Morgan Stanley SEC Filing Ignites $BTC Trust Frenzy — Wall Street’s Trillion-Dollar Onramp Just Opened

Wall Street's crypto dam just cracked. Morgan Stanley's S-1 filing for a spot Bitcoin trust isn't just paperwork—it's a signal flare to the institutional herd.

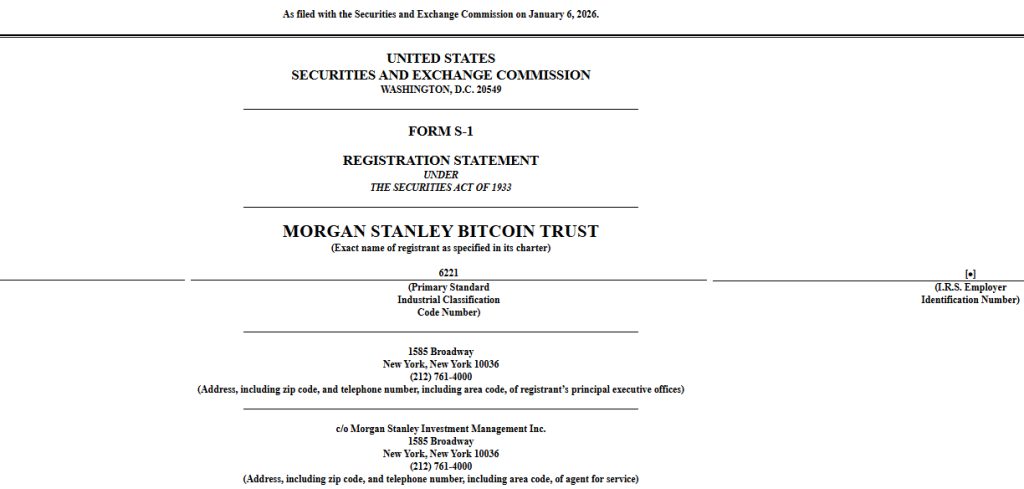

The Filing That Changes Everything

Forget the niche crypto funds. This is America's wealth management titan building a regulated on-ramp for its high-net-worth clients. The S-1 is the boring, bureaucratic key that unlocks pension funds, endowments, and Main Street retirement accounts. It transforms Bitcoin from a speculative asset into a portfolio allocation.

Why This Time Is Different

Previous ETF approvals opened the door. Morgan Stanley's move shows who's walking through it. They're not chasing volatility; they're constructing infrastructure. This is about custody, compliance, and fitting digital gold into legacy financial frameworks. It’s the ultimate validation—not from a crypto evangelist, but from a firm that measures risk for a living.

The Domino Effect Begins

Watch the other mega-banks scramble. Goldman Sachs, JPMorgan—they can't afford to be left behind when their biggest competitor starts vacuuming up assets under management with a shiny new product. The filing creates its own gravity, pulling more capital and legitimacy into the space. It’s a self-fulfilling prophecy of adoption.

The Cynical Take

Of course, Wall Street only embraces an asset class after figuring out how to layer on fees and wrap it in enough complexity to justify their cut. They spent years dismissing the technology, only to now become its most expensive middlemen.

The gates are open. The slow, deliberate trillions are coming. The question isn't if Wall Street piles in, but how fast the pile becomes a mountain.

Morgan Stanley Targets Simple, Price-Tracking Bitcoin ETF

The filing shows that the trust is structured as a passive ETF designed to mirror Bitcoin’s price performance in U.S. dollars, minus fees and expenses. It will hold bitcoin directly rather than using leverage, derivatives, or active trading strategies.

Net asset value will be calculated daily using a pricing benchmark derived from aggregated activity across major spot bitcoin exchanges.

Shares are expected to list on a national securities exchange under a ticker that has not yet been disclosed, subject to SEC approval.

Morgan Stanley Investment Management will sponsor the trust, while custody and operational oversight will be handled by designated service providers. Shares will be created and redeemed only in large blocks by authorized participants, either in cash or in kind.

For cash creations and redemptions, third-party bitcoin counterparties will execute trades on behalf of the trust, with trading costs borne by the authorized participants.

Retail investors will not be able to redeem shares directly and will instead trade them on the secondary market through brokerage accounts, where prices may deviate slightly from net asset value depending on market conditions.

The filing comes as spot bitcoin ETFs continue to expand rapidly in the U.S. market. Data shows these products now hold more than $123 billion in net assets, representing about 6.6% of Bitcoin’s total market capitalization.

Net inflows have exceeded $1.1 billion since the start of the year, with Bitcoin trading NEAR $93,800 as of Jan. 5.

BlackRock’s spot bitcoin ETF has emerged as one of the firm’s largest revenue drivers, with allocations nearing $100 billion, showing the fee potential of these products.

![]() @BlackRock has placed its spot Bitcoin exchange-traded fund among its three biggest investment themes for 2025.#ETF #Bitcoinhttps://t.co/k1zRml0omY

@BlackRock has placed its spot Bitcoin exchange-traded fund among its three biggest investment themes for 2025.#ETF #Bitcoinhttps://t.co/k1zRml0omY

Morgan Stanley Pushes Crypto Further Into Mainstream Portfolios

Morgan Stanley’s move also follows its filing for a Solana-tracking trust, showing a broader push into crypto-linked investment vehicles. solana trusts have already grown past $1 billion in total net assets after attracting nearly $800 million in cumulative inflows.

Together, the filings point to a strategy aimed at capturing more of the economics of crypto investing rather than outsourcing exposure to competitors.

Unlike asset managers that focus primarily on fund distribution, Morgan Stanley operates the world’s largest wealth management business, overseeing roughly $8.2 trillion in client assets.

The timing of the S-1 filing aligns with a broader regulatory and commercial shift. Morgan Stanley is also preparing to roll out direct crypto trading for Bitcoin, Ether, and Solana through its E-Trade platform, pending regulatory approval from the Federal Reserve.

![]() American investment bank @MorganStanley sets sights on crypto trading via E-Trade, banking on potential Trump-era regulatory ease. #MorganStanley #CryptoTrading https://t.co/H7YtyYCJkA

American investment bank @MorganStanley sets sights on crypto trading via E-Trade, banking on potential Trump-era regulatory ease. #MorganStanley #CryptoTrading https://t.co/H7YtyYCJkA

The bank has cited a more permissive U.S. regulatory stance as a factor behind expanding its digital asset offerings.

For investors, the proposed trust WOULD provide regulated bitcoin exposure through familiar brokerage infrastructure, avoiding the operational complexities of self-custody.

As with other spot ETFs, the structure is designed to keep share prices closely aligned with the underlying asset through daily creation and redemption mechanisms, addressing issues that plagued earlier trust models that traded at persistent premiums or discounts.