Pi Coin Price Prediction: On-Chain Data Reveals Mysterious Trading Volume Surge – Are Whales Accumulating in Stealth Mode?

On-chain metrics flash a cryptic signal—trading volume spikes without clear retail catalyst. The data whispers what headlines won't shout.

The Whale-Watching Conundrum

Large, fragmented transactions pepper the ledger. They mimic retail flow but carry the digital fingerprint of coordinated capital. Exchanges see deposits from unfamiliar wallets, withdrawals to cold storage vaults. The classic accumulation playbook, executed in plain sight yet disguised as market noise.

Liquidity's Telltale Heartbeat

Order books thin at key levels, then refill from shadow pools. Price action defies typical retail sentiment swings, holding support with unnatural precision. It's the market equivalent of a stage magician's misdirection—everyone watches the price chart while the real action happens in the depth charts.

The Narrative Machine Kicks In

Predictions surge alongside the volume. Analyst reports materialize, citing 'technical breakouts' and 'fundamental re-ratings'—the usual financial fanfare that follows smart money, not leads it. A cynic might note the timing is always perfect for those holding the right bags.

So, is a major revaluation imminent, or just another round of wealthy investors playing musical chairs with retail hopes? The chain knows, but it isn't talking. Watch the wallets, not the words. After all, in crypto, the 'fundamental analysis' is often just a compelling story told by the last person to buy.

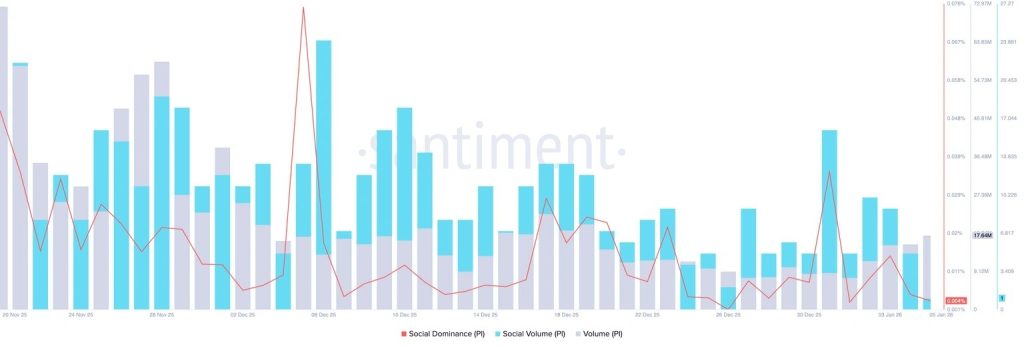

Pi Network social dominance and volume. Source: Santiment.

Pi Network social dominance and volume. Source: Santiment.

Retail participation remains subdued, pointing to whale-driven activity behind the high-volume move, potential early positioning before broader market participation returns.

PI Coin Price Prediction: What Do Whales Know?

This potential whale positioning comes as Pi Network approaches the apex of a potential ascending triangle pattern.

The last retest of its lower resistance unfolded as a launchpad, putting focus back on a breakout of its upper resistance at $0.215.

Still, momentum indicators remain on the fence.

The MACD maintains a narrow but growing lead on the signal line, suggesting the uptrend is gaining momentum. Yet, the RSI has stalled shortly after breaching neutral territory for the first time since November, suggesting it may lack the strength to break out.

Fully realised, the triangle eyes a potential, though this likely hinges on broader retail participation.

This reversal opens the door for a more sustained reversal, eying resistance that capped upside over the past quarter around– a.

PepeNode: An Easier Way to Accumulate

While wider market momentum remains on the fence, entrants on tokens like PI coin face a difficult decision: sit out and miss out on the next leg up, or enter and risk exposure to potential heavy losses.

PepeNode ($PEPENODE) takes the stress out of the market by giving investors a smarter way to earn crypto, without having to guess the perfect entry point.

It’s a plug-and-play mine-to-earn (M2E) game, no hardware or technical setup required.

Just log in, collect VIRTUAL nodes, stack your rigs, and start generating meme coins passivemely.

Simple, fun, and built for those who want exposure without the headache.

And thanks to a built-in deflationary model, where 70% of all $PEPENODE spent on nodes and rigs is burned, scarcity supports long-term token value.

PepeNode offers a more measured way to capture high-upside market exposure — without relying on perfect entries.

There are justto join the presale; starting post-launch could come at a higher cost.

Visit the Official Pepenode Website Here