Morgan Stanley Files for Spot Bitcoin ETF: Is Wall Street Finally Going All In on Bitcoin?

Wall Street's slow dance with Bitcoin just got a lot less awkward. Banking giant Morgan Stanley—yes, the same institution that once treated crypto like a contagious disease—has officially filed for a spot Bitcoin ETF. This isn't just another fund application; it's a seismic shift in institutional posture.

Why This Filing Feels Different

Forget the niche crypto shops. When a legacy titan with trillions in assets under management knocks on the SEC's door, the whole neighborhood hears it. This move signals a critical pivot: Bitcoin is no longer a speculative sideshow for hedge funds, but a potential core holding for the everyday wealth management client. It’s the ultimate validation play, wrapped in the boring, familiar packaging of an ETF.

The Mainstream Floodgate Theory

The logic is brutally simple. A spot Bitcoin ETF from a name like Morgan Stanley demolishes the last major barrier to entry for conservative capital. No more wrestling with private keys or sketchy exchanges. Just a ticker symbol in a retirement account. This could unlock a tidal wave of institutional and retail money that has been sitting on the sidelines, waiting for a 'safe' way in. It turns Bitcoin from a tech experiment into just another asset class—albeit a volatile one.

A Cynical Take on Wall Street's 'Innovation'

Let's be real for a second. This is classic Wall Street: spend a decade dismissing an asset, then rush to build the toll booth once it's clear people are going there anyway. The real innovation here isn't in blockchain tech—it's in fee extraction. They’re not betting on Bitcoin's decentralization; they're betting they can centralize the profits.

So, is the traditional finance world about to go all in? The filing is a definitive 'maybe.' It shows intent, not commitment. But in the high-stakes game of financial legitimacy, Morgan Stanley just placed a very public, very expensive bet. The rest of the street is now forced to look at their cards.

Morgan Stanley’s ETF Filing Signals Shift

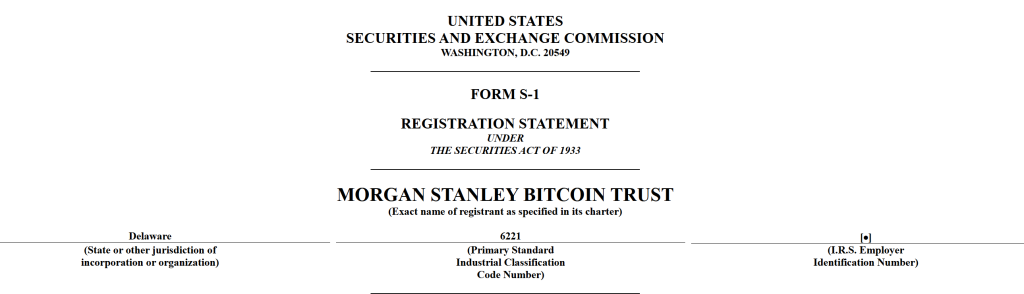

The filing, submitted to the U.S. Securities and Exchange Commission, outlines the proposed Morgan Stanley bitcoin Trust, designed to track bitcoin’s spot price, net of fees. Unlike futures-based products, the fund would hold bitcoin directly, aligning it with spot ETFs approved in early 2024.

Spot bitcoin ETFs now manage more than $120 bn in assets, accounting for a meaningful share of bitcoin’s total market value. Until recently, banks limited exposure to custody and brokerage services. That stance has shifted as regulators clarified how banks can engage with digital assets.

For Morgan Stanley, issuing a proprietary ETF allows tighter integration into client portfolios and captures management fees that previously flowed to firms like BlackRock and Fidelity.

Why Institutions Still Favor Bitcoin

Institutional demand remains heavily concentrated in bitcoin-linked products. While Morgan Stanley also filed paperwork for a Solana-based fund, most inflows across U.S. crypto ETFs continue to favor bitcoin due to its liquidity, regulatory clarity, and derivatives depth.

Key drivers supporting institutional interest include:

- Spot ETFs holding bitcoin directly rather than futures

- Regulatory guidance reducing compliance uncertainty

- Bitcoin’s dominance in crypto ETF inflows

- Growing adoption across wealth-management platforms

Bitcoin (BTC/USD) Technical Outlook Remains Tense

On the 4-hour chart, Bitcoin price prediction seems neutral as BTC is consolidating near $92,000 inside a descending channel drawn from the $107,700 peak. Price continues to respect the 38.2% Fibonacci retracement at $90,900, while repeated rejection near $94,100 has formed a visible triple-top resistance zone.

Candlestick behavior supports this view. Recent sessions show long upper wicks, spinning tops, and small-bodied candles, suggesting hesitation and fading momentum near resistance. No convincing bullish engulfing or three WHITE soldiers pattern has appeared to confirm a breakout.

Structurally, Bitcoin is still printing higher lows from the November bottom, which keeps the medium-term recovery intact. However, without a clean close above $94,200, the move remains corrective within a broader downward slope. A breakdown below $90,900 WOULD expose $86,970, followed by the $80,500–$82,000 demand zone.

Sell NEAR $94,000 resistance, target $87,000, stop above $100,800.

Maxi Doge: A Meme Coin Built Around Community and Competition

Maxi Doge is gaining traction as one of the more active meme coin presales this year, combining bold branding with community-driven incentives. The project has already raised more than $4.4 million, placing it among the stronger early performers in the meme token category.

Unlike typical dog-themed tokens that rely purely on social buzz, Maxi DOGE leans into engagement. The project runs regular ROI competitions, community challenges, and events designed to keep participation high throughout the presale phase. Its leverage-inspired mascot and fitness-themed branding have helped it stand out in a crowded meme market.

The $MAXI token also includes a staking mechanism that allows holders to earn daily smart-contract rewards. Stakers gain access to exclusive competitions and partner events, adding a passive earning component while encouraging long-term participation rather than short-term speculation.

Currently priced at $0.000277, $MAXI is approaching its next scheduled presale increase. With momentum building and community activity remaining strong, Maxi Doge is positioning itself as a meme coin focused on sustained engagement rather than one-off hype.

Click Here to Participate in the Presale