Riot’s $162M Bitcoin Fire Sale: Hashprice Crisis Triggers Record Miner Exodus

Bitcoin miners are bleeding—and they're selling the furniture to stay alive.

Riot Platforms just unloaded a staggering $162 million worth of BTC in a single month, marking the largest forced selloff in the company's history. The culprit? A hashprice crisis squeezing the entire industry. With mining rewards plummeting and operational costs soaring, even the giants are cashing out their core assets.

The Great Miner Liquidation

This isn't a strategic rebalance—it's a distress signal. When the cost to produce a single bitcoin exceeds its market value, miners face a brutal choice: shut down rigs or sell treasuries. Riot chose the latter, converting a massive chunk of its mined bitcoin directly into fiat to keep the lights on. It's a classic case of selling your gold reserves to pay the electric bill.

Hashprice: The Industry's Pulse

Hashprice—the estimated daily revenue per unit of mining power—has collapsed. Network difficulty keeps hitting new highs while transaction fees remain subdued, crushing profit margins. The math has flipped: operations that were printing money last cycle are now burning cash. When your business model depends on volatile crypto rewards and relentless energy consumption, sustainability becomes a daily gamble.

Contagion or Cleansing?

Riot's move signals deeper industry stress. Smaller miners without large BTC treasuries face existential threats—expect more consolidation and bankruptcies. Yet, this forced selling creates a fascinating paradox: massive miner selloffs historically coincide with market bottoms. Weak hands get shaken out, inefficient operations fold, and the network emerges leaner. It's Darwinism with ASICs.

One cynical take? Wall Street would call this 'strategic liquidity management.' In crypto, we call it survival. The miners who built this ecosystem are now cannibalizing it to survive—proving once again that in finance, even the most revolutionary tech eventually bows to basic cash flow. The hash rate may secure the network, but fiat pays the power bill.

Riot Steps Up Bitcoin Sales as Hashprice Slumps to Five-Year Lows

The US-listed miner sold 1,818 bitcoin during the month at an average net price of $88,870, according to its latest production and operations update released on January 6.

That marked a 375% increase from November sales and pushed Riot’s bitcoin holdings down to 18,005 BTC, compared with more than 19,300 a month earlier. t

Riot Announces December 2025 Production and Operations Updates.

Riot mined 460 #bitcoin in December, averaging 14.8 Bitcoin per day. The Company maintained an efficient all-in power cost of 3.9¢/kWh.

Read the full press release here: https://t.co/FFOIqhG1Wo. pic.twitter.com/fg2s3tLIW8

Despite producing 460 bitcoin in December, the company liquidated nearly four times that amount, underlining the severity of the current profitability squeeze.

Average daily production ROSE slightly to 14.8 BTC, while deployed hash rate climbed to 38.5 exahash per second in December, up 22% year-on-year, while average operating hashrate rose to 34.9 EH/s.

The selloff comes as hashprice, a key measure of miner revenue per unit of computing power, continues to hover NEAR $37 per petahash per second, close to a five-year low.

While Bitcoin reached new all-time highs in 2025, rising network difficulty and relentless hashrate growth eroded margins across the industry.

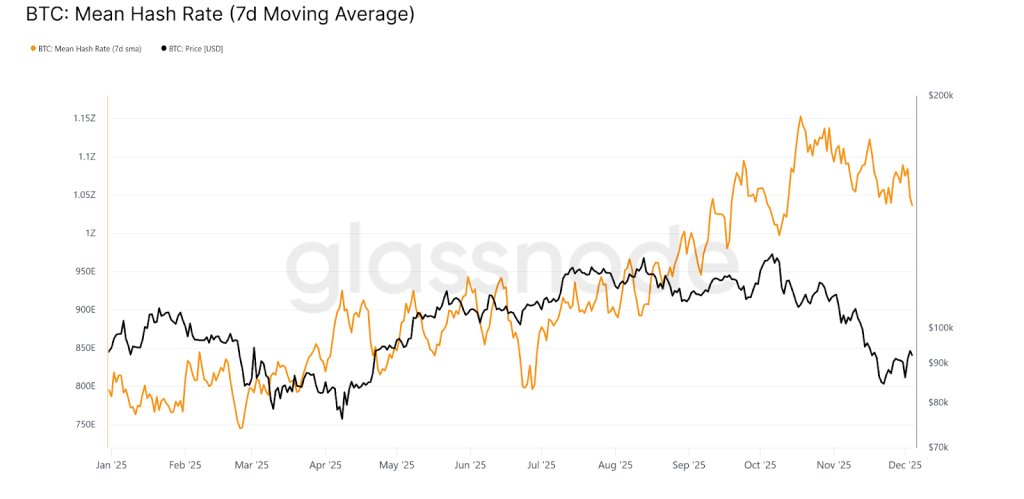

Glassnode data shows total network hashrate has slipped from around 1.1 zettahash per second to just above 1 ZH/s, showing that some miners are already capitulating or curtailing operations.

Fleet efficiency improved to 20.2 joules per terahash, down from 21.9 J/TH a year earlier. Power costs remained competitive at 3.9 cents per kilowatt hour, supported by $6.2 million in power and demand response credits.

That WOULD offer limited short-term relief, but the broader trend remains challenging. Following the April 2024 halving, block rewards dropped to 3.125 BTC per block, or roughly 450 BTC per day across the network.

Transaction fees contributed less than 1% of revenue for much of 2025, leaving operators highly exposed to difficulty increases.

As Mining Costs Soar, Bitcoin Miners Rethink Their Playbook

Bitcoin difficulty reached a record 155.98 trillion in October and currently sits near 148.2 trillion, with only a modest 3% decline expected in the next adjustment.

Data from CoinShares shows that in the second quarter of 2025, the average direct cash cost to mine one bitcoin for public miners was about $74,600.

When non-cash expenses such as depreciation are included, total costs rise above $137,000. By late 2025, median “hash cost” estimates suggested many miners were operating at or below breakeven, even with efficient fleets and favorable power contracts.

Riot’s decision to sell more bitcoin rather than hold mirrors a broader shift among large miners.

Throughout 2025, firms responded to pressure by expanding hashrate, tightening costs, and increasingly diversifying into artificial intelligence and high-performance computing.

Firms like CleanSpark, TeraWulf, Cipher Mining, and Bitfarms have signed multi-year, multi-billion-dollar AI infrastructure deals, while others are repurposing entire mining sites.

![]() @Bitfarms_io shares dropped 18% as it announced a wind-down in $BTC operations to pivot to AI infrastructure after a $46M Q3 loss. #Bitcoin #AI https://t.co/3Q7tsldFzS

@Bitfarms_io shares dropped 18% as it announced a wind-down in $BTC operations to pivot to AI infrastructure after a $46M Q3 loss. #Bitcoin #AI https://t.co/3Q7tsldFzS

Riot executives have previously said the company now views mining as a way to monetize power access rather than an end in itself.

That logic is widely shared across the sector, even as aggregate miner debt has surged, rising from about $2.1 billion to $12.7 billion over the past year as companies financed expansion and diversification.

Riot also announced that December will be its final monthly production report. Going forward, the company plans to provide quarterly updates focused on broader business performance, data center strategy, and mining operations.