Solana ETF Filing by Morgan Stanley Sparks Wall Street Frenzy: Is SOL the Next Institutional Crypto Obsession?

Morgan Stanley just dropped a regulatory bomb—a Solana ETF filing that could reshape crypto's institutional landscape.

The move signals a seismic shift: Wall Street isn't just watching crypto anymore; it's building the infrastructure to own it directly. Forget dipping toes—this is a cannonball into the deep end of digital assets.

Why Solana? The Institutional Calculus

Speed and scale. Solana's architecture handles thousands of transactions per second at a fraction of Ethereum's cost—a practical allure for firms allergic to network congestion and gas fee volatility. It's the high-throughput blockchain that doesn't just promise efficiency; it delivers it consistently.

The ETF Effect: Mainstream On-Ramp or Speculative Frenzy?

An approved ETF transforms SOL from a crypto-native asset into a regulated, brokerage-account-friendly security. It bypasses the complexities of direct custody, offering financial advisors a familiar wrapper for client portfolios. Translation: billions in dormant capital could flood in from investors who'd never touch a crypto exchange.

But let's be cynical for a second—Wall Street excels at repackaging volatility and selling it as 'innovation.' A SOL ETF might just be the perfect vehicle to commoditize blockchain's risk while collecting fat management fees.

Market Ripples and Competitive Dynamics

This filing pressures the SEC to clarify its stance beyond Bitcoin and Ethereum. It also throws a gauntlet at other asset managers—watch for a scramble of 'me-too' filings if momentum builds. The race to list the third major crypto ETF is officially on.

Solana's ecosystem braces for unprecedented scrutiny. Every outage, every network performance tick will now play on a Bloomberg terminal. Institutional adoption brings a magnifying glass—and merciless accountability.

The Bottom Line: A New Phase Begins

Morgan Stanley's move isn't a prediction; it's a declaration. Traditional finance is drafting the blueprints for crypto's next chapter—one where legacy players help set the rules, control the flows, and capture the value. Whether this legitimizes the asset class or just professionalizes the speculation, the game changed today.

Buckle up. The wall between crypto and conventional finance just got a whole lot thinner.

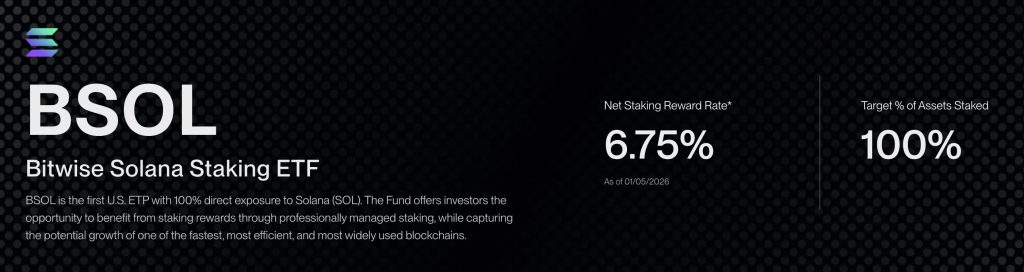

The largest of these ETFs in terms of assets under management (AUM) continues to be Bitwise’s BSOL ETF with $730 million.

Staking rewards are an attractive feature for investors. At the time of writing, BSOL’s staking yield sits at 6.75%. These rewards are added to the fund’s assets daily and should boost the price of the ETF in the long run.

Solana Price Prediction: SOL Eyes $230 as Positive Momentum Accelerates

Morgan Stanley’s decision to launch a solana ETF gives this altcoin a strong credibility boost. It also provides further confirmation of Wall Street’s strong interest in tokens beyond Bitcoin.

In the past week, SOL has gained 9% and currently sits at $138. Meanwhile, trading volumes stand at $5.5 billion, accounting for 7% of the asset’s market cap.

The daily price action shows that SOL broke out of a falling wedge pattern. This is a bullish setup that, once broken, commonly confirms a trend reversal.

The near-term target for the token WOULD be the $160 level, as the market will likely retest the 200-day exponential moving average (EMA).

Meanwhile, if SOL surpasses its 200-day EMA, it may reach $200 quickly, aided by growing institutional demand on Wall Street.

As interest in the Solana ecosystem keeps growing, top crypto presales like bitcoin Hyper ($HYPER) could eventually draw Wall Street’s attention as well. This is a powerful Solana-based Bitcoin L2 that will make it easier for BTC investors to earn passive income on their assets.

Bitcoin Hyper ($HYPER) Leverages Solana’s Efficiency to Boost Bitcoin’s DeFi Ecosystem

Bitcoin Hyper ($HYPER) brings real utility to Bitcoin by unlocking fast, low-cost DeFi through Solana’s high-speed infrastructure.

With the, BTC holders can tap into the Hyper LAYER 2 directly from the Bitcoin network, without ever giving up custody.

That means lending, staking, and earning yield on BTC for the first time.

As more Bitcoin flows into the Hyper L2, demand for $HYPER is set to surge.

Investors have already poured in over $30 million, spotting the potential to revive Bitcoin’s ecosystem and open the door to true on-chain utility.

To buy $HYPER before its presale ends, simply head to the official Bitcoin Hyper website and LINK up a compatible wallet like Best Wallet.

You can either swap USDT or SOL for this token or use a traditional bank card to complete your purchase.

Visit the Official Bitcoin Hyper Website Here