CryptoQuant CEO Warns: Bitcoin Capital Inflows Hit a Standstill – What’s Next?

Bitcoin’s liquidity pipeline is running dry. CryptoQuant’s CEO drops the hammer: capital inflows into BTC have flatlined. No sugarcoating—just cold, hard on-chain data.

Where did the money go? The usual suspects: risk-off sentiment, institutional cold feet, or maybe just Wall Street’s latest shiny distraction. (Remember when they swore Bitcoin was 'digital gold'? Pepperidge Farm remembers.)

Key takeaways:

- No new buyers stepping up

- Exchange reserves bleeding out

- Macro headwinds squeezing crypto’s oxygen supply

Bottom line? The market’s playing chicken—waiting for either a catalyst or a carcass. Meanwhile, Bitcoin hodlers keep stacking sats like nothing happened. Because in crypto, patience isn’t a virtue—it’s the only strategy that survives contact with hedge funds.

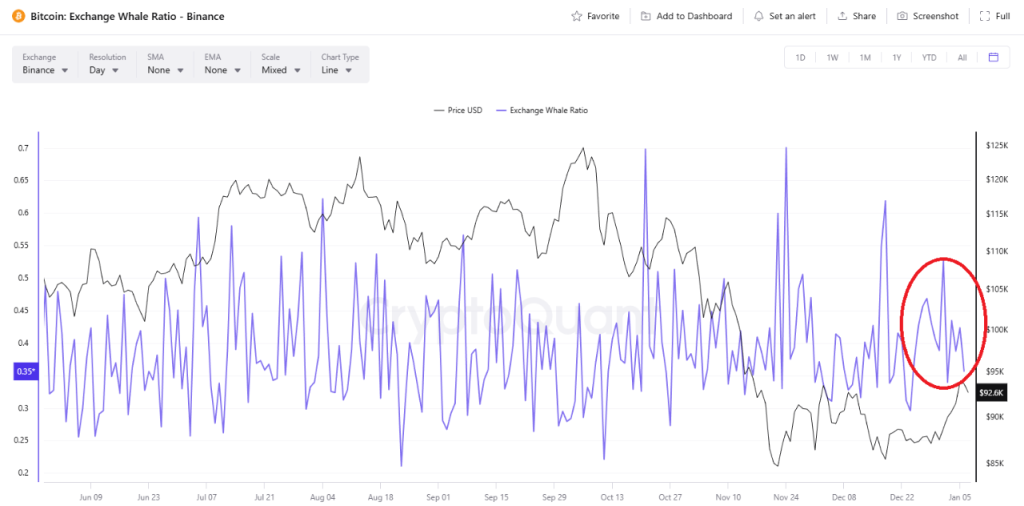

Whale Behavior Signals Market Health Despite Price Volatility

Despite Bitcoin’s recent rebound from lower levels, whale exchange activity has declined rather than increased, defying historical patterns where heightened large-holder interaction with exchanges preceded selling pressure.

CryptoQuant data shows whale engagement remains relatively low even after the price recovery.

This suggests limited distribution pressure from major holders, consistent with analysts’ characterization of a “” market environment.

Retail investors also remain notably absent from the current recovery phase, with Bitcoin’s 30-day change in retail investor demand remaining deeply negative according to CryptoQuant analyst Maartunn.

“,” Maartunn noted, emphasizing that the crowd hasn’t returned to markets despite recent price stabilization.

With little participation from the broader crowd and no clear push from whales, the market is stuck in an unusual state where both retail and large holders appear hesitant.

In the middle of all this, bitcoin recently dipped below $90,000 and filled its first CME gap, adding to uncertainty over whether prices could slide further toward the $88,000 area.

Institutional Positioning Shows Early Recovery Signs

Looking deeper, Glassnode reports Bitcoin entering 2026 following decisive drawdown and consolidation phases, with on-chain metrics pointing to reduced profit-taking pressure and structural stabilization around current range lows.

“In late December 2025, Realized Profit (7D-SMA) declined sharply to $183.8M per day, down from the elevated levels above $1B per day observed through much of Q4,” the analytics firm stated, noting this deceleration in realized gains signaled exhaustion of distribution-side pressure.

US spot ETF flows have also re-emerged following late-2025 outflows, while futures open interest has stabilized and begun turning higher after contracting from cycle highs above $50 billion.

“Positive impulses are becoming more frequent, indicating that ETF participants are once again transitioning from net distributors into marginal accumulators,” Glassnode observed, describing the shift as institutional spot demand re-establishing itself as a constructive tailwind.

Notably, the largest options open interest reset on record cleared more than 45% of outstanding positioning following the December 26 expiry, removing structural hedging constraints.

“Open interest fell from 579,258 BTC on December 25 to 316,472 BTC following the December 26 expiry,” Glassnode noted, explaining the reset offers “a cleaner read on sentiment, as new positions now reflect fresh premium being bought or sold rather than inherited exposure.“

Glassnode analysts also noted that dealer gamma has flipped short between $95,000 and $104,000, with new-year options flows tilting increasingly toward calls rather than defensive puts.

They concluded that corporate treasury demand continues to provide stabilizing support beneath the price for now.

However, it remains episodic rather than persistently structural, with accumulation bursts clustering around local pullbacks.

Capital Rotation and Long-Term Outlook

Speaking with Cryptonews, VALR CEO Farzam Ehsani attributes Bitcoin’s consolidation to capital flowing into precious metals, with Gold and silver rising 69% and 161% respectively over the past year.

“Bitcoin and ETH will see capital inflows once the rally in precious metals comes to an end,” Ehsani stated, projecting base-case targets of $130,000 for Bitcoin and $4,500 for ethereum in Q1 2026 once precious metals momentum fades.

In contrast, early Bitcoin investor Michael Terpin offers a different outlook, suggesting 2026 could mirror down years like 2014, 2018, and 2022.

“If the price follows historical patterns, we should bottom out around $60,000 in the early fall,” Terpin noted, though acknowledging roughly 20% probability of an extended bull cycle reaching new highs before final correction.

However, Ju offered a long-term perspective on patience, comparing Bitcoin investment to aging whiskey.

Investing in Bitcoin is like aging whiskey.

You need at least 4 years to get the depth. Open a bottle under a year old and you’ll never get that flavor. Age it as long as you can.

Aren’t you curious what 16-year Bitcoin tastes like? Start aging now and open it in 2042![]() pic.twitter.com/xUqsnKGLYN

pic.twitter.com/xUqsnKGLYN

“You need at least four years to get the depth,” he stated, encouraging investors to consider 16-year holding periods extending to 2042 rather than focusing on short-term volatility.