XRP ETFs Bleed $41M in First-Ever Outflows — What Triggered the Sudden Reversal?

XRP's exchange-traded fund honeymoon is officially over. After a steady stream of inflows since launch, the product just recorded its first major capital flight—a cool $41 million heading for the exits in a single week.

The Whispers on the Trading Floor

Market chatter points to a classic cocktail of profit-taking and regulatory jitters. Some early backers are cashing in chips after the post-launch rally, while others are getting skittish about the ever-present regulatory shadow hanging over the asset. It's the age-old finance dance: buy the rumor of legitimacy, sell the news of actual scrutiny.

Not a Panic, But a Pivot

Don't mistake this for a stampede. The outflows represent a tactical shift, not a wholesale abandonment. Big money moves in tides, not ripples. This could simply be institutional portfolios rebalancing or capital rotating into newer, shinier crypto ETF opportunities—because why park money in yesterday's news when you can chase tomorrow's hype?

The Bigger Picture for Crypto ETFs

This moment serves as a stark reminder: crypto ETFs aren't magic. They're just another vessel, subject to the same market winds and investor whims as any other financial product. A $41 million outflow might make headlines, but in the grand scheme, it's a rounding error—and a healthy dose of reality for anyone who thought the path to mainstream adoption would be a straight line up and to the right. Sometimes the market needs to take a breath, even if it costs forty-one million dollars to do so.

XRP ETFs Outflow January 7 Source: SoSoValue

XRP ETFs Outflow January 7 Source: SoSoValue

One ETF Drove the Outflows as the Rest Held Steady

The reversal was driven almost entirely by one product, as the 21Shares XRP ETF, TOXR, saw $47.25 million exit the fund in a single session, equivalent to roughly 21.66 million XRP.

That MOVE pushed its cumulative flows into negative territory at minus $8.18 million, although the product still holds nearly $258 million in net assets.

Other XRP ETFs moved in the opposite direction, with Canary’s XRPC, Bitwise’s XRP fund, and Grayscale’s GXRP each recording modest daily inflows of around $2 million, while Franklin’s XRPZ was flat on the day.

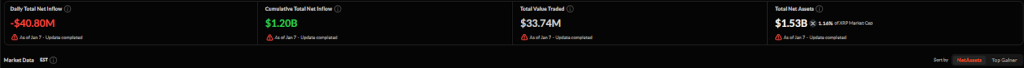

Despite the headline outflow, the broader picture remains intact since launch; XRP ETFs have attracted roughly $1.20 billion in cumulative net inflows and now hold about $1.53 billion in total net assets.

![]() Canary Capital’s XRPC ETF debuted with $58 million in volume, the strongest first-day performance of any ETF launched this year.#XRP #ETFhttps://t.co/27gv7vtyO9

Canary Capital’s XRPC ETF debuted with $58 million in volume, the strongest first-day performance of any ETF launched this year.#XRP #ETFhttps://t.co/27gv7vtyO9

That represents around 1.16% of XRP’s total market capitalization. Trading activity across the products reached $33.74 million on the day, broadly in line with recent averages.

The timing of the outflows appears closely linked to broader market conditions rather than XRP-specific weakness.

XRP’s price fell about 6.4% over the past 24 hours to around $2.10, pulling back from a recent high NEAR $2.25. The move came alongside a sharp drop in trading volume, which fell more than 30% day over day to $4.14 billion, pointing to reduced short-term participation rather than panic selling.

More importantly, XRP ETFs were not alone, with Bitcoin and ethereum ETFs also recording significant outflows on the same day. Spot Bitcoin funds saw $486 million leave, extending a two-day drawdown that has now exceeded $700 million.

Ethereum ETFs posted their first net outflow day of 2026, losing $98.5 million after starting the year with strong inflows. The synchronized nature of the moves suggests portfolio-level repositioning rather than a sudden loss of confidence in XRP products.

XRP ETFs Slow in January, On-Chain Data Points to Stability

The structure of the ETF flows also matters, as November and December accounted for the bulk of that growth, with nearly $1.17 billion added during those two months.

In January, inflows slowed but remained positive overall, even after this week’s outflow, as by the week ending January 7, XRP ETFs had still added $24.4 million on a net basis.

On-chain data adds further context, with CryptoQuant data showing that whale flows of XRP to Binance have declined steadily since peaking in mid-December.

Whale XRP Flows to Binance Decline, Signaling Reduced Selling Pressure

“Decline in whale flows since mid-December, although still at relatively high levels, is a positive sign in the medium term, as it reduces the likelihood of a sudden sell-off.” – By @ArabxChain pic.twitter.com/P646tKZe1u

While whales still account for a majority of exchange flows, their share has fallen from above 70% late last year to about 60%.

Retail behavior has remained relatively stable, with no sign of a broad panic exit.

At the same time, Santiment data points to a surge in large XRP transactions, with transfers above $100,000 hitting a three-month high earlier this week, a sign of heightened positioning rather than a clear directional bet.

Together, the data points to a market digesting gains rather than breaking down. XRP remains up more than 13% over the past seven days and nearly 10% year over year.

The ETF outflows appear to reflect short-term profit-taking, broader ETF rebalancing, and softer volumes across crypto markets, rather than a structural reversal in demand.