Treasury Secretary Demands More Rate Cuts—Even as Jobs Data Roars

Treasury's top official just lobbed a monetary policy grenade. The call? Slash rates further, and do it now. This isn't a whisper—it's a full-throated demand that cuts against the grain of what the economic data seems to scream.

The Contradiction in the Numbers

Strong jobs reports typically signal a hot economy—the kind that makes central bankers sweat and think twice about cheap money. Yet here we are, with the Treasury Secretary pushing for more stimulus anyway. It's a bold play that bypasses conventional wisdom, betting that preemptive easing trumps reactive tightening.

Reading Between the Policy Lines

This move isn't just about employment figures. It's a signal—a bet that other headwinds, perhaps unseen in the headline data, justify an aggressive cushion. Think of it as financial airbags being deployed before the crash everyone feels is coming, but nobody can quite point to on the map. It’s the kind of forward guidance that either looks prescient or panicked in hindsight.

Markets are left to decode the intent. Is this deep strategic insight, or just another case of political pressure dressed up as economic theory? After all, in the hallowed halls of finance, the line between visionary policy and convenient narrative is often drawn with disappearing ink.

The bottom line? When the data says 'hold' but the Treasury says 'cut,' strap in. You're witnessing a high-stakes gamble with the entire economy on the table—and the house always has its own reasons for changing the rules mid-game.

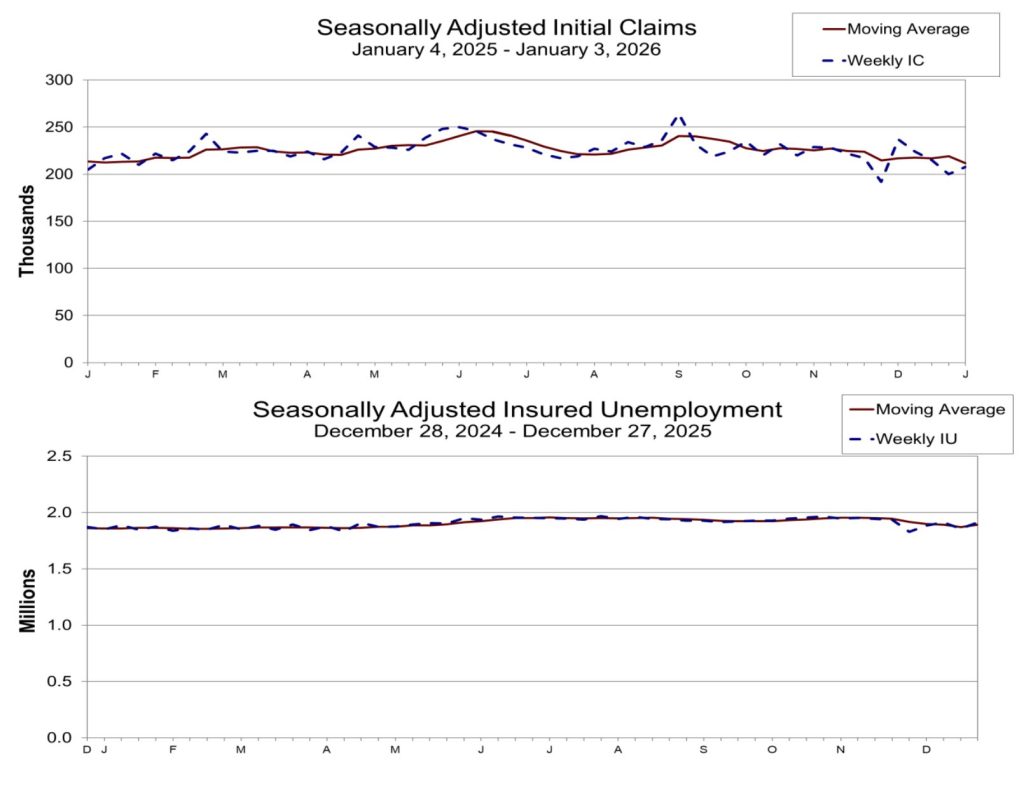

Source: DOL

Source: DOL

While the Fed implemented three consecutive rate cuts in late 2025 totaling 75 basis points, bringing the benchmark rate to a range of 3.5 to 3.75%, markets now expect substantially fewer reductions in 2026.

Fed officials’ most recent projections point to just one cut this year, despite the Treasury’s call for more aggressive action.

However, Jerome Powell’s term as Fed chair expires in May, and Bessent is already overseeing the selection process, which has narrowed to five candidates.

Policy Tensions MountMinneapolis Fed President Neel Kashkari indicated on Monday that monetary policy is NEAR neutral, suggesting limited room for additional cuts.

“My guess is we’re pretty close to neutral right now,” Kashkari told CNBC. “We just need to get more data to see which is the bigger force. Is it inflation or is it the labor market?“

Kashkari, a voting member on the Federal Open Market Committee this year, emphasized that inflation risks remain elevated despite unemployment drifting to 4.6%.

“Inflation risk is one of persistence, that these tariff effects take multiple years to work their way all the way through the system,” he said, though acknowledging unemployment could spike quickly from current levels.

He also noted artificial intelligence adoption among large companies was creating hiring slowdowns while generating productivity gains.

“AI is really a big company story,” Kashkari said, adding that businesses previously skeptical are now seeing tangible benefits from the technology.

Fed Governor Stephen Miran, whose term ends January 31, offered a contrasting view in a Fox Business interview Tuesday, calling for aggressive rate cuts of more than 100 basis points this year.

“I think policy is clearly restrictive and holding the economy back,” Miran said, arguing that underlying inflation has reached the Fed’s 2% target. His dissent in favor of a 50-basis-point cut at December’s meeting pointed out growing divisions within the central bank.

Bessent framed his own case for rate cuts within Trump’s broader economic strategy, noting that 2025’s “” passage, trade realignment deals, and deregulation agenda created foundations for robust growth.

“Now, in 2026, we will reap the rewards of President Trump’s America First agenda,” he said in the prepared remarks scheduled for delivery at 12:45 PM ET.

Crypto Markets React to Rate Policy Uncertainty

slipped toward $90,000 today as traders digested tensions over rate policy and stronger-than-expected employment figures.

The crypto market dropped nearly 2% while gold rose.

Investor RAY Dalio touched on the broader economic outlook in his recent market analysis, noting that currency devaluation distorts return perceptions.

“When one’s own currency goes down, it makes it look like the things measured in it went up,” Dalio wrote, adding that Gold returned 65% in dollar terms last year while the S&P gained just 18%, making gold “the best major investment of the year.”

Speaking with Cryptonews, Kurt Hemecker, CEO of Gold Token S.A., noted the evolving relationship between the assets.

“Bitcoin and gold responding differently to macro stresses isn’t new. This is what we’re seeing play out today, as again gold is strengthening as Bitcoin pulls back,” he said.