Optimism Proposes Using Half Its Revenue to Buy Back OP Tokens

Layer-2 giant Optimism just dropped a bombshell proposal—and it's aimed directly at token holders.

The Buyback Gambit

Forget vague promises about ecosystem growth. The core mechanism is brutally simple: divert half of all protocol revenue straight into repurchasing OP tokens from the open market. No intermediaries, no complex vesting schedules—just a direct capital injection designed to tighten supply.

Why This Changes the Game

This isn't just another governance vote. It's a fundamental shift in how a major L2 values its own success. Revenue, often funneled back into grants or treasury reserves, gets weaponized for tokenomics. Every transaction, every fee paid on the chain, could now translate into buy-side pressure for OP.

The Fine Print & The Skeptic's View

The proposal hinges on a clear definition of "protocol revenue"—a term that can be as flexible as an accountant's imagination. Critics will watch closely to see what gets counted. Is it pure net profit, or a more generous gross figure? It's the kind of financial engineering that would make a legacy bank CEO blush—turning user fees into a perpetual motion machine for token demand.

The Bottom Line

If passed, this sets a new precedent for L2 value capture. It directly ties the chain's financial performance to token holder rewards, moving beyond speculative utility to hard, recurring buybacks. Other chains will now face pressure to answer a simple question: if Optimism is willing to put half its money where its mouth is, what are you doing with yours?

The Optimism Foundation is putting forward a proposal to align the OP token with growing Superchain demand by directing 50% of incoming Superchain revenue to regular OP buybacks https://t.co/VSDazlbRdX pic.twitter.com/jBQoJyxDCF — Optimism (@Optimism) January 8, 2026

Revenue-Driven Token Evolution

The Foundation plans to partner with an OTC provider to execute monthly conversions of ETH to OP, beginning with January’s revenue in February.

Conversions will occur within predetermined windows regardless of price, though the program pauses if monthly revenue falls below $200,000 or if the OTC provider cannot execute under the maximum allowable fee spreads.

Purchased tokens will FLOW back into the collective treasury, where they may eventually be burned, distributed as staking rewards, or deployed for ecosystem expansion as the platform evolves.

The mechanism starts small but scales with Superchain expansion, where every transaction across participating chains expands the buyback base and creates structural demand for OP tokens.

The proposal also grants the Foundation discretion to manage the remaining ETH treasury assets to generate yield and support ecosystem growth, thereby reducing governance overhead that historically limited active treasury management.

While governance retains oversight over capital allocation parameters, this flexibility seeks to keep the Superchain competitive with peers that deploy capital more adaptively.

Superchain Dominance Fuels Growth Strategy

The buyback initiative comes as the Layer-2 landscape consolidates dramatically around Base, Arbitrum, and Optimism, which together process nearly 90% of all L2 transactions.

Base alone surpassed 60% market share by late 2025, while activity across smaller rollups dropped 61% since June, with many operating as “” with minimal user activity.

Despite aggressive fee wars triggered by the Dencun upgrade’s 90% fee reduction, pushing most rollups into losses, Base generated approximately $55 million in profit during 2025.

![]() Most ethereum L2s are at risk of collapse in 2026 as activity concentrates overwhelmingly on Base, Arbitrum, and Optimism.#Ethereum #L2shttps://t.co/luFyL8YWFB

Most ethereum L2s are at risk of collapse in 2026 as activity concentrates overwhelmingly on Base, Arbitrum, and Optimism.#Ethereum #L2shttps://t.co/luFyL8YWFB

The Superchain model leverages this concentration, where member chains contribute portions of sequencer revenue back to Optimism, creating a flywheel where usage generates revenue, revenue funds development, and development drives additional usage.

Meanwhile, Optimism continues building infrastructure for long-term sustainability, having selected Ether.fi as its strategic liquid staking partner on OP Mainnet in December, following a comprehensive RFP process.

The collective has earned 80.03 ETH in yield through staking operations, with the partnership designed to strengthen OP Mainnet’s position as a secure, liquid, and institutionally trusted DeFi environment.

Governance Debate and Implementation Timeline

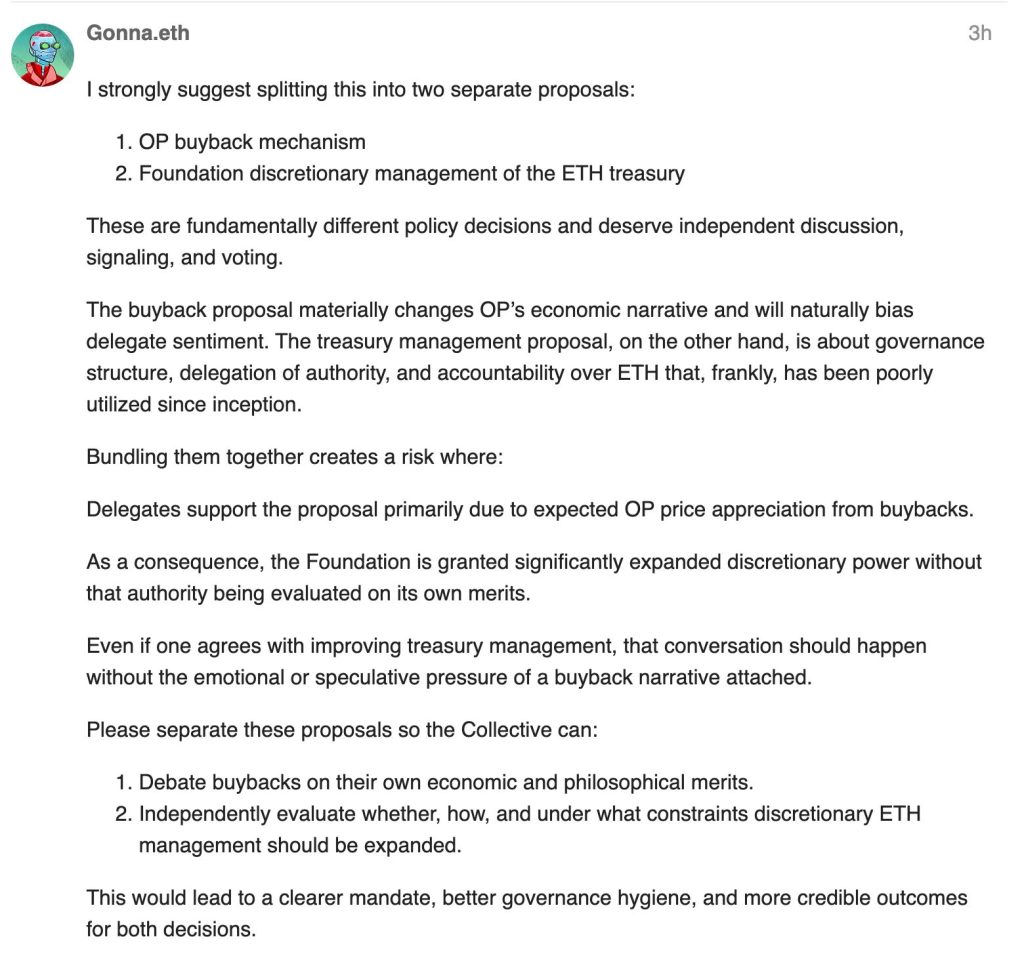

The proposal is facing some scrutiny from delegates concerned about bundling two distinct policy decisions into a single vote.

Community member Gonna.eth urged splitting the buyback mechanism from Foundation treasury discretion, arguing that bundling creates risks in which delegates approve expanded discretionary power primarily because of expected OP price appreciation rather than evaluating treasury management authority on its own merits.

The governance proposal moves to vote in Special Voting Cycle, requiring Joint House approval at a 60% threshold.

If approved, the Foundation will promptly enter into agreements with an OTC provider and publish an execution dashboard tracking fills, pacing, pricing, and balances for monthly conversions.

The program will continue for twelve months before re-evaluation, with initial operations executed by the Foundation under predetermined parameters, eliminating discretion.

Over time, the mechanism may MOVE increasingly on-chain through Protocol Upgrade 18, which ensures all sequencer revenue from OP Chains gets collected on-chain without Foundation involvement.

At the time of publication,trades at $0.31, down 1% in the past 24 hours.