Ethereum Price Prediction: Big Money Exodus From Bitcoin – Are Institutions Quietly Flipping Bullish on ETH in 2026?

Smart money moves. While retail traders chase Bitcoin's daily volatility, institutional flows tell a different story—a quiet but accelerating pivot toward Ethereum's programmable future.

The Rotational Trade Nobody's Talking About

Forget the headlines. The real action isn't in spot price swings; it's in the capital migration happening under the hood. Major funds aren't just diversifying—they're reallocating. Bitcoin, the digital gold narrative, faces its first real competition for institutional mindshare. Ethereum's utility stack—DeFi rails, tokenization bedrock, and a sprawling dApp ecosystem—is finally being priced in as a core holding, not just a speculative bet.

Ethereum's Infrastructure Edge

It's about the network effect. Developers build where the users are, and users go where the applications work. Ethereum's lead isn't shrinking; it's solidifying. The merge is old news. The focus now is on scaling solutions that actually work at scale and the gradual but steady burn of ETH through its fee mechanism—a built-in economic flywheel that Bitcoin can't replicate. It's a value accrual story that's starting to resonate in boardrooms tired of 'store of value' as the only thesis.

The Bullish Case Beyond the Hype

This isn't about flipping Bitcoin tomorrow. It's about recognizing a multi-chain future where Ethereum operates as the foundational settlement layer. Institutional interest is a lagging indicator, but when it moves, it moves in size. The due diligence cycles that started years ago are culminating in real treasury allocations. They're not betting against Bitcoin; they're betting on a broader crypto economy—and Ethereum is its central bank, stock exchange, and internet protocol rolled into one. Of course, this all assumes the 'finance professionals' can look past their quarterly bonus cycles long enough to see a five-year trend.

The narrative is shifting. The money is moving. The only question left is who's paying attention.

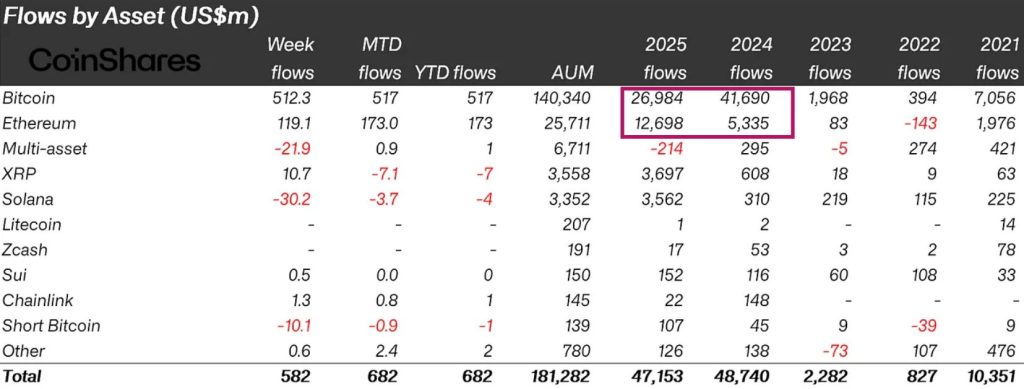

Netflows by asset year-over-year (US$m). Source: Coinshares.

Netflows by asset year-over-year (US$m). Source: Coinshares.

Decentralized finance is usually the core driver that separates Bitcoin from leading smart-contract ecosystems, yet DeFi activity itself stalled through much of 2025.

Total value locked across DeFi protocols surged 121% in 2024, from $52 billion to $115 billion, but grew just 1.73% the following year to around $117 billion.

What makes this cycle different is the source of demand. Rather than organic DeFi usage, institutional participation has taken the lead.

The ETF narrative has broadened regulated digital asset exposure in U.S. TradFi markets, creating institutional-grade demand with a clear preference for ETH.

Ethereum Price Predicition: Why Are Institutions Bullish on ETH?

This capital rotation may have also been strategic, with ethereum reaching the bottom of a potential 20-month bullish head-and-shoulders breakout over 2025.

The Ethereum price has confirmed a local bottom at $2,750, forming higher lows in a fresh uptrend that solidifies the right shoulder.

Momentum indicators add validity to the trend. The RSI is pressing against the 50 neutral line after several higher lows, suggesting strength beneath the surface.

The MACD has also reversed towards the signal line in a potential golden cross setup, a sign that buyers may soon control the prevailing trend.

A fully realised pattern breakout could see the neckline tested, reclaiming past all-time highs and entering new price discovery in a.

But as the bull market matures, broader institutional participation alongside traction in DeFi as mainstream use cases are realised could extend the move.

Traders should watch historical psychological levels around $3,500 and $4000 all-time highs as interim resistance to the move.

Bitcoin Hyper: Solana Technology Being Used for Bitcoin

Institutions that chose Ethereum as their TradFi bet may soon need to reconsider, as the Bitcoin ecosystem finally tackles its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

Just as Layer-2s like Ondo did for Ethereum, Bitcoin Hyper could bring Bitcoin deeper into the DeFi conversation.

The project has already raised over $30 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send $HYPER significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website Here