Stablecoins Now Fueling $500K-$2.5M Real Estate Transactions Across UK, France, and Malta

Forget wire transfers and bank delays—digital dollars are cutting through the red tape of European property markets.

The New Settlement Layer

High-net-worth buyers and international investors are bypassing traditional finance entirely. They're using dollar-pegged stablecoins to close deals on prime residential and commercial properties. Think London townhouses, French Riviera villas, and Maltese development projects. The process slashes settlement from weeks to minutes and operates 24/7—bankers' hours are officially obsolete.

Why This Isn't a Niche Anymore

The $500,000 to $2.5 million transaction band is significant. It represents the core of the serious investment market, not speculative crypto plays. This shift is driven by pragmatism, not ideology. Stablecoins eliminate currency risk for cross-border deals and provide a transparent, immutable record of payment—something that makes due diligence lawyers breathe a little easier (though they'll never admit it).

The Regulatory Tightrope

Jurisdictions like Malta, with its proactive VFA framework, are leaning in. The UK and France are watching closely, balancing innovation with financial stability concerns. The transactions are happening within existing property law structures; the crypto simply replaces the payment rail. It’s a Trojan horse strategy—adoption by utility, not revolution.

The old guard will call it a fad, right up until their commission checks start getting settled in USDC. The real story isn't the technology; it's the quiet capitulation of a multi-trillion dollar industry to a more efficient system. The future of real estate finance is being built on-chain, one stablecoin mortgage at a time.

Hundreds of wealthy investors are using crypto to purchase property across Europe. Brighty co-founder Nikolay Denisenko reveals the firm has already brokered 100+ real estate deals for HNWIs using crypto. pic.twitter.com/nLARidklwc — Coin Bureau (@coinbureau) January 10, 2026

Brighty’s platform serves between 100 and 150 wealthy customers whose average monthly spending reaches $50,000, with residential property purchases representing the upper end of transaction volumes across European destinations, including Cyprus and Andorra.

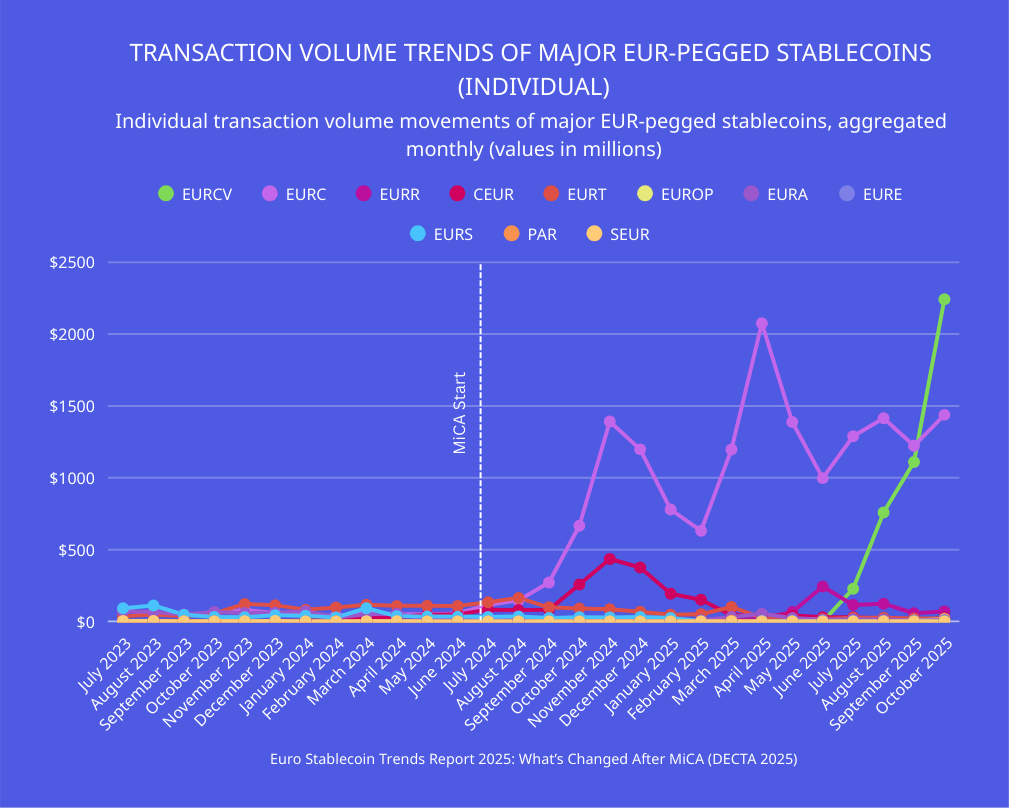

Euro Stablecoins Overtake USDC for European Deals

Nikolay Denisenko, co-founder and CTO at Brighty App, explained that crypto transactions offer significant advantages over traditional methods like SWIFT, the global interbank payment network used by over 11,000 banks.

Converting stablecoins such as USDC into euros eliminates the complexity and delays associated with conventional wire transfers, making the process more efficient for both buyers and sellers.

This notable shift has emerged in stablecoin preferences among wealthy customers.

While Circle’s USDC previously dominated large transfers, buyers now favor euro-pegged stablecoins to avoid conversion costs when purchasing European properties.

Brighty observed average euro-backed transaction sizes surge from €15,785 in Q3 to €59,894 in Q4, as high-net-worth individuals executed major deals in Circle’s EURC rather than USDC.

The preference for euro-denominated stablecoins stems from practical financial considerations.

“Recently, we have started seeing our customers using euro stablecoins where previously they might have used USDC,” Denisenko said.

“Why? Because if you deposit in USDC and you are buying something in Europe, you have a conversion cost. So it’s more convenient to use EURC because you remove any exchange rate.”

Looking ahead, Denisenko said Brighty is engaging in numerous conversations with estate agencies to familiarize them with transparent, legitimately acquired crypto holdings as payment methods.

Real Estate Sector Embraces Crypto Amid Banking Hesitancy

The demand for crypto-powered property deals has intensified as traditional financial institutions continue avoiding such transactions, creating opportunities for specialized platforms.

Denisenko said Brighty is now engaging with estate agencies to familiarize them with transparent, legitimately acquired crypto holdings as payment methods.

“Our wealthy customers are simply looking to de-risk the assets in their portfolio by putting some of their money into real estate,” he said.

Aside from Brighty, luxury brokerage Christie’s International Real Estate launched a dedicated crypto division in July 2025 after completing several high-profile transactions, including a $65 million Beverly Hills property purchased with Bitcoin.

CEO Aaron Kirman told the Times that “crypto is here to stay” and the division WOULD facilitate deals “without banks or fiat.”

Meanwhile, outside of Europe, RAK Properties partnered with UAE fintech Hubpay last September to accept Bitcoin, Ethereum, and Tether for property purchases, opening international markets to digital asset buyers.

Dubai’s government-backed tokenized real estate platform aims to tokenize $16 billion worth of properties by 2033, representing approximately 7% of total projected transactions.

London’s luxury rental market has also adopted crypto payments, with Knightsbridge Prime Property completing a £45,000 weekly bitcoin rental transaction through crypto payments platform Bitcashier in March 2024.

San Francisco-based Opendoor Technologies also announced plans to accept Bitcoin and cryptocurrency for home purchases in October 2025, CEO Kaz Nejatian confirmed.

![]() Real Estate Giant Opendoor to Accept Bitcoin and Crypto for Home Buying, CEO Confirms

Real Estate Giant Opendoor to Accept Bitcoin and Crypto for Home Buying, CEO Confirms

CEO Kaz Nejatian confirms Bitcoin acceptance for the $6.22B real estate platform operating across 44 U.S. markets as company stock jumps to $8.38 following announcement.

The announcement…

The company operates across 44 U.S. markets with a $6.22 billion market cap and generated $1.57 billion in revenue during Q2 2025.

Beyond real estate, private jet company FXAIR has also begun to accept crypto following what its chair described as “tremendous” demand from young Bitcoin entrepreneurs, further demonstrating luxury sector adoption of digital currencies.