Trump Tariffs Make a Comeback — How Bitcoin and Crypto Could Defy Trade Wars in 2025

Trade barriers are back on the menu—just as crypto markets hit their stride. Former President Trump’s latest tariff push rattles traditional markets, but Bitcoin? It’s busy doing its best 'uncorrelated asset' impression.

Here’s the twist: tariffs could accelerate crypto adoption. When cross-border commerce gets messy, decentralized finance doesn’t ask for permission—it just routes around the damage. Stablecoins already grease $9T+ in annual transactions; add trade friction and watch that number spike.

Gold bugs will argue their shiny rock thrives in chaos too. But try smuggling a gold bar through customs versus a seed phrase. Exactly.

The real play? Watch for tariff-driven inflation fears pushing more institutional money into BTC as a hedge. Because nothing says 'store of value' like an asset that’s up 1,200% since politicians last tried this protectionist stunt.

Of course, Wall Street will still find a way to lose money on it—probably via leveraged ETF decay while pretending they 'understand the macro.'

Some of the world’s biggest economies have managed to draw up trade deals with Trump over this timeframe — covering billions of consumers — including the European Union, the United Kingdom, Japan and South Korea.

But late on Thursday night, a barrage of breaking news lines started to emerge from the White House, revealing what dozens of countries — many of them poor — will now end up paying when their goods are shipped to the States.

The most headline-grabbing announcement concerns neighboring Canada, where tariffs on some goods have now jumped up to 35%. But Mexico, on the other side of the border, has managed to secure another 90-day reprieve.

About 90 countries are going to end up facing elevated costs, with the BBC having a breakdown of some of the nations affected:

As the graphic above makes clear, even countries that aren’t explicitly named in this new executive order will still face a baseline tariff of 10%. This elevated trade war is going to cost everybody something.

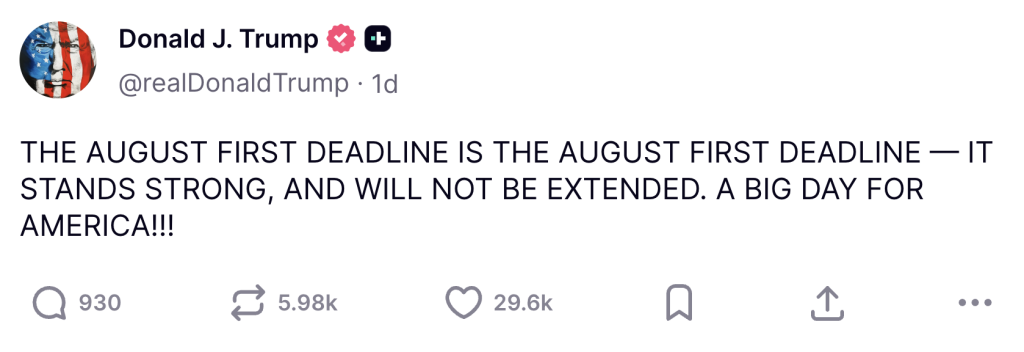

It is worth noting that some of these tariffs won’t come into force immediately. In most cases, they’ll only apply from 7 August — meaning that there’s theoretically a small window of time for last-minute negotiations. The levies also won’t apply to goods arriving by sea until the beginning of October, which could help prevent dramatic price hikes when consumers are shopping for Christmas presents.

Asian stocks took a battering early on Friday as investors there digested the news — suffering their worst week since “Liberation Day” — and it’s likely that this will be followed by more of the same across Europe and the Americas later on Friday. Many experts argue that hiking levies to their highest level since World War Two is needless and an act of economic self-harm.

24h7d30d1yAll timeBitcoin, which trades 24/7, wasn’t immune to this latest bout of uncertainty. At the time of writing, it had fallen by 2.3% over 24 hours, but was continuing to trade above $115,000.

Altcoins have been faring far worse. Ether’s dropped by about 5%, with XRP’s losses closer to 6%. And as often happens during crypto corrections, it’s meme coins that are faring the worst — with pump.fun shedding 20% of its value and Pudgy Penguins plunging by 11%.

BTC could find itself in a vulnerable position if developments prompt institutional investors to start pulling their capital out of exchange-traded funds — exacerbating selling pressure. The resurgence of tariff talk also takes the shine out of the White House crypto report that was released just a day earlier.

A big problem for crypto and equity investors alike is the lack of certainty that this latest bout of tariffs creates. While there have been a flurry of high-profile earnings reports in recent days, many are yet to fully illustrate the impact that these trade tensions are having on bottom lines. Most retailers will have little choice but to pass on some of the elevated costs onto customers, which could feed through into lower levels of spending.

There are also further clouds on the horizon. We’re yet to find out whether the U.S. will be able to reach a deal with China — by far the world’s biggest exporter of products — by a separate deadline of August 12. At one point in April, Trump had been suggesting that tariffs on Chinese goods could surge to a jaw-dropping 145%.

A fresh flurry of erratic announcements from Trump, complete with lower levels of trading during the summer months, may well mean that Bitcoin struggles to find its footing for a while.