🚀 Bitcoin Shatters Records: Soars Past $124K Amid Fed Rate-Cut Frenzy

Bitcoin just rewrote the rulebook—again. The king of crypto blasted past $124,000 as Wall Street bets on Fed dovishness. Here’s why this isn’t just another pump.

The Fed Effect: Liquidity Tsunami Ahead?

Rate-cut whispers became a roar this week. Traders are front-running the Fed like it’s 2021—because nothing says 'sound monetary policy' like chasing yield into volatile digital assets.

Institutional FOMO Hits Ludicrous Speed

BlackRock’s ETF inflows could power a small nation. Meanwhile, crypto skeptics still waiting for 'the big crash' now owe the market another apology letter.

This rally’s got teeth. Whether it’s sustainable or just another speculative bubble depends on who you ask—but try telling that to the degenerates minting new millionaires by the hour.

Trump Support, Rate-Cut Expectations Add Fuel to Bitcoin’s Climb

Bitcoin has now gained nearly 32% in 2025, supported by regulatory wins for the crypto sector following President Donald Trump’s return to the White House. Trump, who calls himself the “crypto president,” and his family have deepened their involvement in the industry over the past year.

Markets are almost fully pricing in a Fed rate cut on Sept. 17, reports show, with a small chance placed on a larger half-point reduction. TRUMP has been openly critical of Fed Chair Jerome Powell for holding rates steady for too long and has even threatened to remove him before his term ends in May.

Adding to the speculation, Treasury Secretary Scott Bessent said on Wednesday that the Fed should deliver a “series of rate cuts” and could begin with a half-point move.

Such policy shifts, analysts say, could provide further tailwinds for risk assets, including cryptocurrencies.

Continued ETF inflows, supportive regulatory signals and strategic corporate moves have reignited the rally, paving the way for Bitcoin’s climb above its previous high of $123,091, registered on July 14, according to data from CoinMarketCap.

Bitcoin ETFs Hold Steady Amid Strong Weekly Inflows

Spot Bitcoin ETFs recorded a daily net inflow of $86.91m on Aug. 13, according to SoSoValue data, bringing cumulative net inflows to $54.76b since launch.

Total net assets for US spot bitcoin ETFs now stand at $156.69b, representing about 6.48% of Bitcoin’s market cap. BlackRock’s iShares Bitcoin Trust leads with $89.11b in net assets, followed by Fidelity’s FBTC at $24.77b.

The rise in inflows for Bitcoin ETFs points to a shift in institutional strategy, with large investors treating the two as complementary assets rather than rivals.

The diversification helps mitigate asset-specific risks while allowing participation in the distinct growth narratives of each network.

Institutional Interest in Bitcoin Remains Strong

Alongside strong demand for Bitcoin ETFs, corporations and institutions are steadily expanding their BTC holdings.

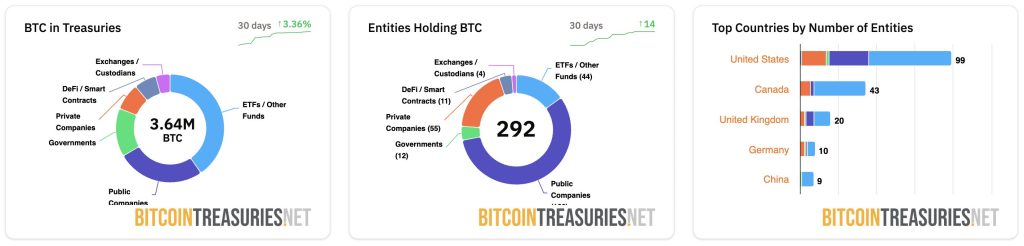

According to data from BitcoinTreasuries.net, a total of 3.65 million BTC is currently held by various entities, with the largest share in ETFs and other funds, followed by public companies, governments, private companies, DeFi/smart contracts, and exchanges/custodians.

The site tracks 291 entities holding Bitcoin, an increase of 16 over the past 30 days.

The United States leads with 99 entities, followed by Canada (43), the United Kingdom (20), Germany (10), and China (9).

Source: BitcoinTreasuries.net

Trump Administration Pushes Pro-Crypto Agenda

The new ATH also comes as the Trump administration advanced its pro-crypto agenda last week with a series of policy and regulatory moves.

President Trump signed an executive order urging regulators to remove barriers that prevent 401(k) plans from including alternative assets such as cryptocurrencies.

If implemented, the reforms could allow millions of Americans to allocate retirement funds to Bitcoin and other digital assets through regulated channels.

Trump also nominated economist Stephen Miran, a digital asset advocate, to the Federal Reserve Board of Governors, signaling continuity in his administration’s pro-crypto stance.

In a separate executive order, Trump moved to end “debanking” practices that target lawful crypto firms.

The Blockchain Association praised the measures as a “historic shift” that WOULD expand consumer choice, empower wealth-building, and reduce operational barriers for blockchain businesses.

The SEC added to the positive momentum by clarifying that certain liquid staking models, such as those involving receipt tokens like stETH, are not securities.

SEC Chair Paul Atkins reinforced his commitment to keeping crypto innovation in the US, pledging a proactive approach to regulation and a shift away from enforcement-led policymaking.

Market Sentiment and Future Outlook

Bitcoin market sentiment remains firmly in “Greed” territory, with the Fear & Greed Index currently at 75, according to data from Alternative.me as of Aug. 14.

This marks a slight uptick from yesterday’s reading of 73 and a notable rise from last week’s 62, though it is up from last month’s “Greed” score of 73.

Source: Alternative.me

The index, which measures investor sentiment on a scale from 0 (Extreme Fear) to 100 (Extreme Greed), suggests continued Optimism among traders despite recent market fluctuations.

The index’s upward momentum over the past week reflects sustained buying interest and confidence in the broader crypto market, likely fueled by strong ETF inflows and institutional participation.

While sentiment is not yet in the “Extreme Greed” zone, the current level signals that investors remain bullish, potentially increasing the risk of overbought conditions if the rally accelerates further.