Breaking: Ethereum (ETH) Primed for Explosive Move—Here’s Why

Ethereum's coiled-spring moment approaches as technical indicators flash bullish signals across trading platforms.

Market momentum builds behind the world's second-largest cryptocurrency, with analysts pointing to converging factors that could trigger significant price action. The network's upcoming protocol upgrades continue drawing institutional interest—because nothing says 'mature asset class' like betting on unproven tech that could revolutionize finance or evaporate your retirement fund.

Trading volumes spike while volatility compression suggests pent-up energy. Key resistance levels loom overhead, but breaking through could unleash cascading buy orders from both retail and algorithmic traders.

On-chain metrics reveal strengthening fundamentals beneath surface price movements. Active addresses hit multi-month highs while exchange outflows indicate accumulation patterns emerging among large holders.

The smart contract platform faces its moment of truth—will it deliver the breakout believers anticipate or become another 'should've bought Bitcoin' story for finance bros to cry about over champagne?

The Calm Before the Storm?

While ethereum (ETH) has been trading in a tight range between $4,300 and $4,500 in the past week, the technical analysis tool Bollinger Bands suggests that a major price move could be just around the corner.

The metric, developed by John Bollinger in the 1980s, helps traders spot oversold or overbought conditions. When the bands squeeze, it usually indicates a period of low volatility, which could be a precursor of a significant resurgence or a considerable correction.

Earlier this week, the popular X user Ali Martinez revealed that the bands have tightened, warning the crypto community to “expect a big move.”

Expect a big move for Ethereum $ETH soon as the Bollinger Bands squeeze! pic.twitter.com/5KgYzuF3Vb

— Ali (@ali_charts) September 10, 2025

The majority of users commenting on the post predicted that the potential swing will be to the upside. Still, a handful remain bearish, alerting of a possible drop to $3,500.

Recent Price Predictions

According to X user Ted, ETH is “exactly mirroring” the bull cycle of BTC in 2020-2021. That said, he expects the price of the second-largest cryptocurrency to explode to $8,000-$10,000 in the next three to four months. However, he sees potential for a short-term correction that will “liquidate high-leveraged longs before reversal and a new ATH.”

Crypto General and Max Crypto outlined similar forecasts. The former believes ETH could reach $8,000 before the end of 2025.

“I am all in on this trade. Millions (of) profits or homeless,” they added.

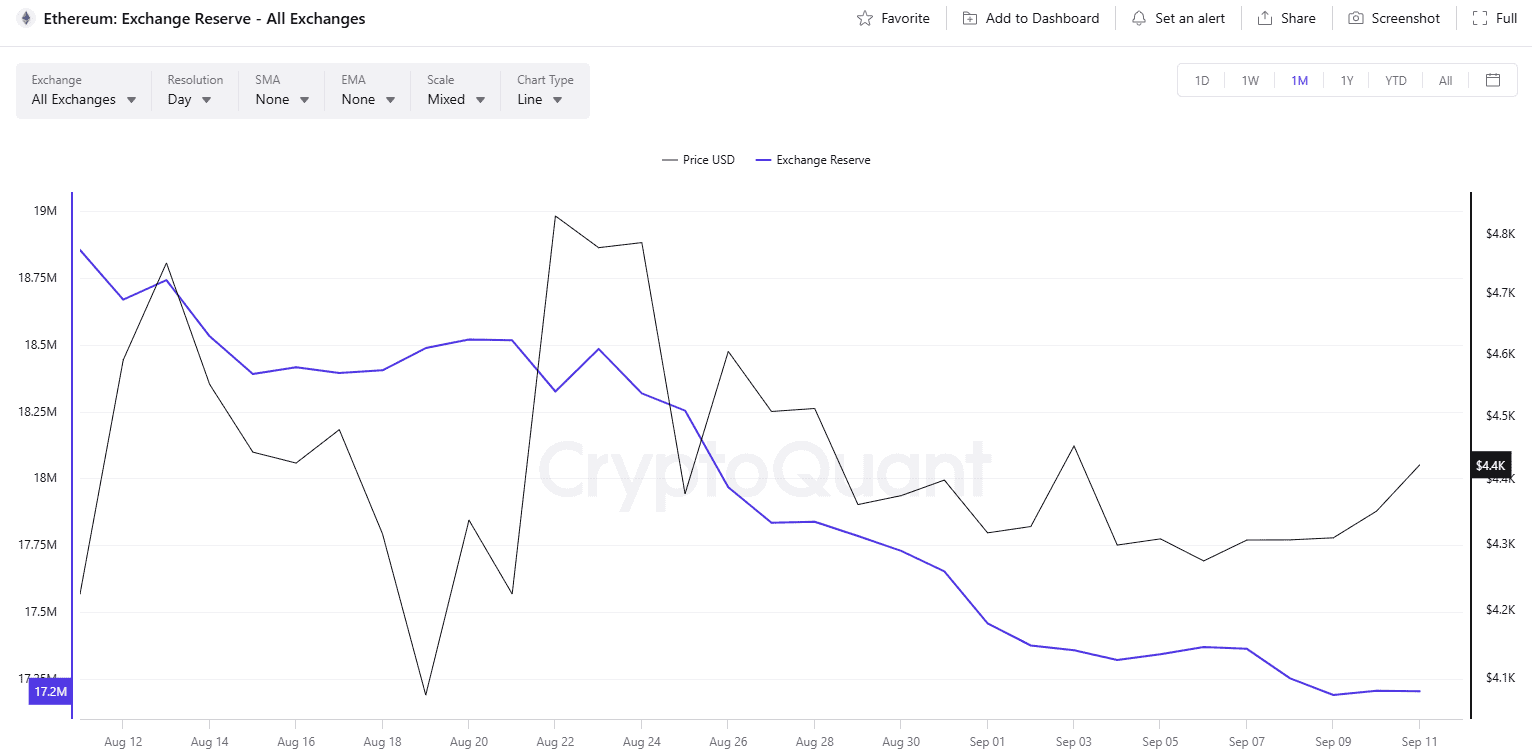

The decreasing amount of ETH stored on crypto exchanges supports the bullish thesis. CryptoQuant’s data shows that recently the figure dropped to a fresh nine-year low of around 17.1 million tokens. This means investors continue to MOVE holdings from centralized platforms toward self-custody methods, thus reducing the immediate selling pressure.