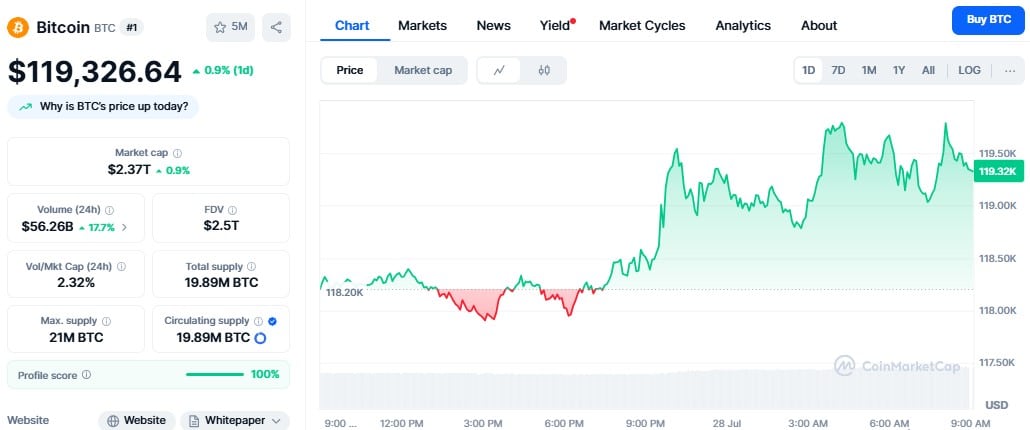

Bitcoin Soars to $119,700 Amid Renewed US-China Tariff Negotiations

Bitcoin rockets past $119k as geopolitical tensions thaw—because nothing fuels crypto like traditional finance's dysfunction.

Tariff talks trigger volatility play

Digital gold's latest surge coincides with US and China reopening trade discussions. Traders pile into BTC as a hedge against potential market chaos—proving again that crypto thrives on uncertainty.

Wall Street's loss is crypto's gain

While legacy markets wobble over tariff headlines, Bitcoin charts its own course. The decentralized asset continues eating fiat currencies' lunch—with institutional investors now leading the charge.

Another ATH before 2026?

With macro winds at its back, Bitcoin's momentum suggests this rally has legs. The real question isn't if it'll break $120k, but when—and how many bankers will still call it a 'bubble' afterward.

Bitcoin Price Chart – Source: CoinMarketCap

Bitcoin Price Chart – Source: CoinMarketCap

Fueling the rally is news of renewed Optimism in the trade talks between the US and China. As per the South China Morning Post, both countries plan to meet in Stockholm to finalize an agreement that would freeze tariffs for another 90 days. This pause could help ease global market tensions, giving risk assets like crypto room to climb.

Adding to the bullish sentiment, MicroStrategy (Strategy) issued a bitcoin buy signal early Sunday, which appears to have triggered more institutional interest. Bitcoin’s hashrate also reached a record 932 EH/s, with difficulty sitting at 127.62T.

The rally isn’t limited to Bitcoin. ethereum crossed $3,825, and CME futures for ETH hit a record $7.85 billion in open interest. BNB hit a new all-time high of $825.

The total crypto market cap is now $3.94 trillion, just shy of the $4 trillion milestone as Bitcoin continues to lead the charge.

Also Read: Citi Analyst Predicts Bitcoin Could Surge to $199K by Year-End