Ethereum Price Forecast: ETH Plunges Below $4,200 as Investors Brace for Powell’s Speech - What’s Next for Crypto?

Ethereum takes a nosedive below critical support as traders position for Fed volatility.

The $4,200 Breakdown

ETH sliced through the $4,200 level like a hot knife through butter—no hesitation, no looking back. Traders scrambled to adjust positions ahead of Powell's keynote, creating a classic risk-off cascade across crypto markets. The move caught leveraged longs completely off guard, triggering a series of liquidations that accelerated the downward momentum.

Powell's Shadow Looms Large

Every word from the Fed chair now carries trillion-dollar consequences. Market makers priced in potential hawkish rhetoric, dumping speculative assets faster than you can say 'quantitative tightening.' Crypto's correlation with traditional risk assets remains stubbornly high—proving once again that decentralized finance still kneels before central bank pronouncements.

Where From Here?

Watch the $4,000 psychological level like a hawk. A break below could trigger another 15-20% slide as algorithmic traders pile on. Conversely, any dovish surprise from Powell might spark a violent squeeze back toward $4,500. Either way—volatility's back on the menu, and the only certainty is that someone's getting rekt. Typical finance: where macroeconomic theater dictates digital asset prices more than actual utility.

Ethereum investors brace for volatility as Powell's speech draws closer

Ethereum dropped below $4,200 on Tuesday, stretching its decline to over 10% since the US Producer Price Index (PPI) inflation data for July rocked the market last Thursday. During the period, ethereum has seen long liquidations of over $1.1 billion, per CryptoQuant's data, a demonstration of de-risking ahead of Powell's speech on Friday.

"Traders are bracing for a volatile end to August, with all eyes on Jackson Hole," noted Nick Forster, founder of crypto options platform Derive, in a Tuesday note.

He highlighted that near-term (7-day) ETH implied volatility (IV) on Derive ROSE from 68% to 73% on Monday, while that of the 30-day IV remains fairly muted. "[It's a] sign that markets expect heightened volatility in the immediate term," Forster added.

-1755633276366-1755633276367.png)

ETH 7-day IV (Red) vs 30-day IV (Blue). Source: Derive, Amberdata

The higher-than-expected inflation data last week sent market participants' expectations of a rate cut at the next Federal Open Market Committee (FOMC) meeting in September plunging below 90% and falling to 82% on Tuesday, according to the CME FedWatch Tool. While investors still lean toward a rate cut, the drop signifies cautious sentiment is gradually setting in.

"If Powell signals a continued hawkish stance, we could see a rapid correction in digital assets, particularly for BTC and ETH," said Forster. On the other hand, a dovish stance could lift the market. The probability of ETH declining to $4,000 by the end of September has spiked from 45% to 60% on Derive, he added.

A similar sentiment is evident on-chain, where Ethereum's validator exit queue has surged to a record high of 927,000 ETH, per data from Validatorqueue.com. Validator exit queue shows the number of coins waiting to leave transaction validation responsibilities. While some of these coins may not go toward profit-taking, high exits during a price correction often negatively affect market sentiment.

Meanwhile, US spot Ethereum exchange-traded funds (ETFs) registered net outflows of $196.6 million on Monday — its second largest since launching last July, per SoSoValue data.

Ethereum Price Forecast: ETH technical indicators on verge of flipping bearish

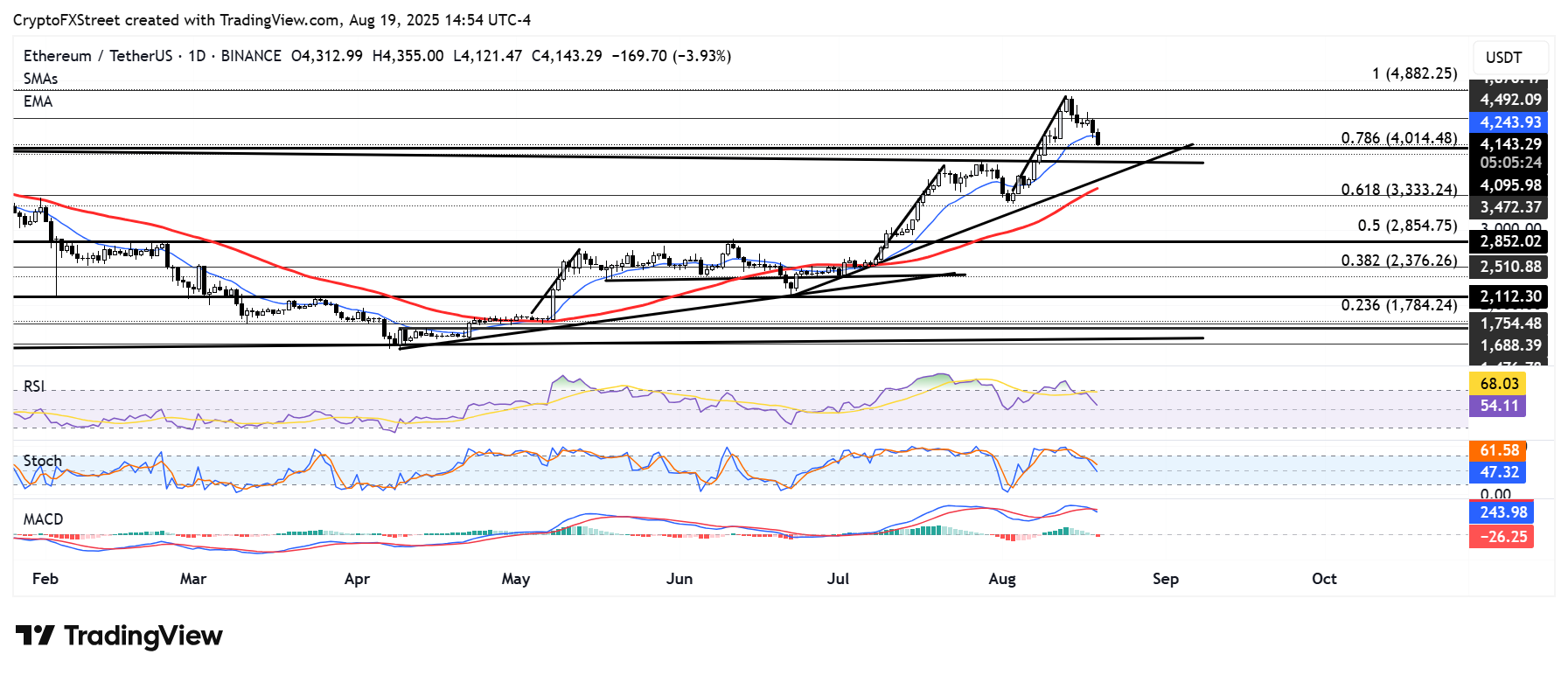

Ethereum is testing the $4,100 support after declining below the 14-day Exponential Moving Average (EMA), marking a sharp turnaround from its uptrend over a week ago.

ETH/USDT daily chart

If ETH declines below $4,100, it could find support at the 78.6% Fibonacci Retracement level NEAR $4,000, just above a key descending trendline. A failure to hold the $4,000 psychological level and the descending trendline could send ETH toward $3,500.

However, a bounce off these support levels could see ETH tackle the $4,500 resistance.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are on the verge of declining below their neutral levels, a MOVE that could accelerate bearish momentum. The Moving Average Convergence Divergence (MACD) also highlights a potential trend shift toward the bearish side, after crossing below its signal line, with its histogram bars flipping to red.

A daily candlestick above $4,500 will invalidate the bearish outlook and potentially send ETH to test its all-time high resistance at $4,868.