Pi Network Price Forecast: PI token risks new record low amid bearish outlook

Pi Network's native token teeters on the edge of catastrophe as bearish momentum builds. The once-hyped project now faces its toughest test yet—potential new all-time lows loom large.

Technical breakdown accelerates

PI's chart structure resembles a freefall more than a cryptocurrency. Support levels crumble faster than crypto bros' promises during a bull run. Each bounce gets weaker, each drop more severe.

Market sentiment turns toxic

Traders flee PI positions like rats from a sinking ship. The 'mainnet when?' crowd grows quieter by the day—nothing kills hype like relentless downward pressure. Even the most devoted community members start questioning their bags.

Volume tells the real story

Liquidity evaporates faster than a meme coin's utility. Bid support barely exists—market makers apparently took one look at the charts and went on permanent vacation. Thin order books amplify every move downward.

Broader context offers no salvation

While major cryptos battle their own demons, PI gets special punishment. It's the kid picked last in gym class while Bitcoin and Ethereum choose teams. The project's delayed mainnet and unclear utility make institutional investors laugh—then short.

Potential bottom? More like bottomless pit

Previous support zones now act as resistance. Technical analysts wave white flags—chart patterns suggest more pain ahead. Fibonacci retracements look like wishful thinking rather than actual analysis.

Only the brave—or foolish—dip buy here. Everyone else remembers the oldest rule in crypto: never catch a falling knife. Especially when that knife keeps getting sharper on the way down.

Large deposits to CEXs signal increased selling pressure

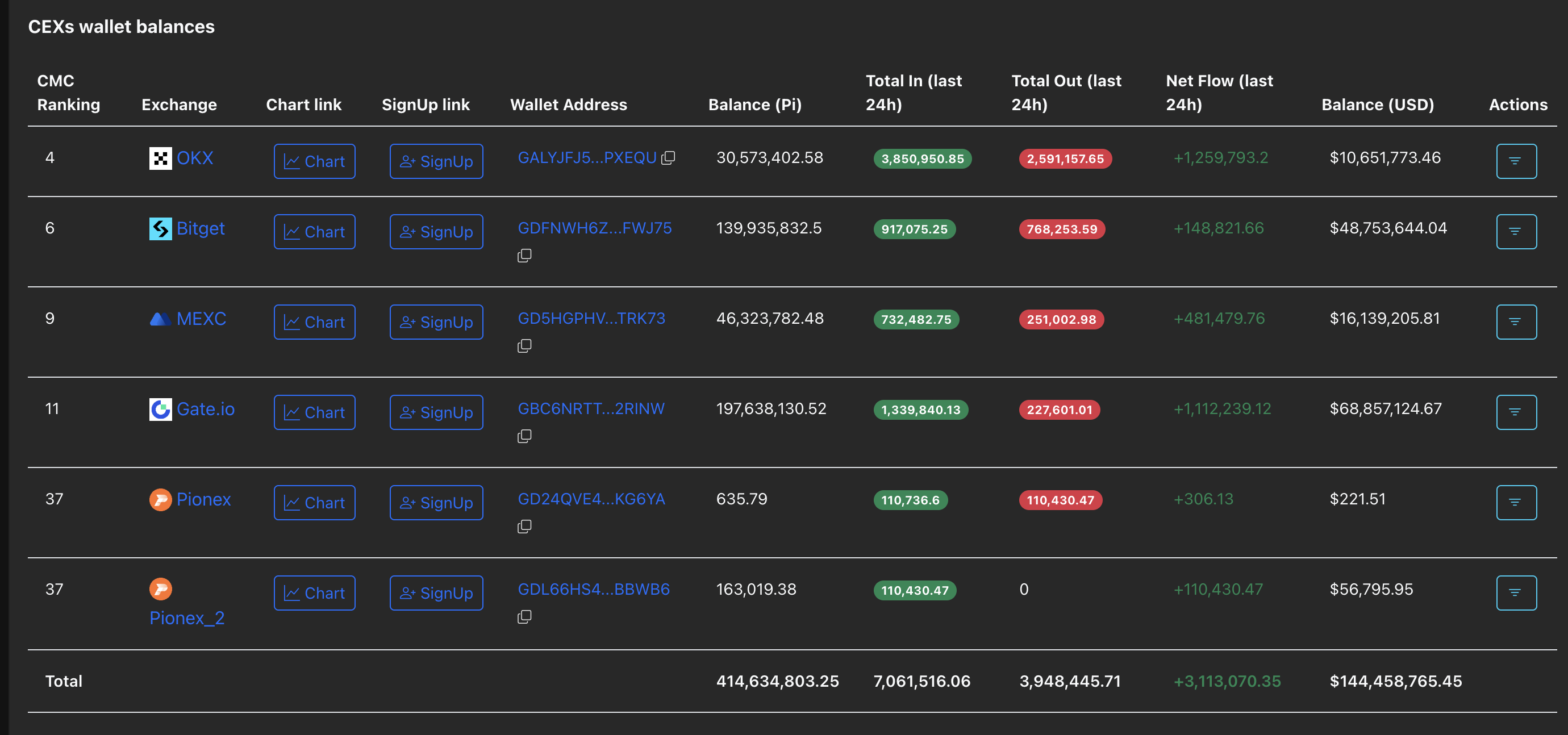

PiScan data shows that the 7.06 million PI token inflows to the CEXs' wallet balances outpaced the 3.94 million PI outflow, resulting in a net inflow of 3.11 million PI tokens, which is worth nearly $1.08 million at the current price. The 3.11 million net PI token inflow results in a 0.75% increase in the CEXs' wallet balances, rising to 414.63 million PI tokens.

CEXs Wallet Balances. Source: Coinglass

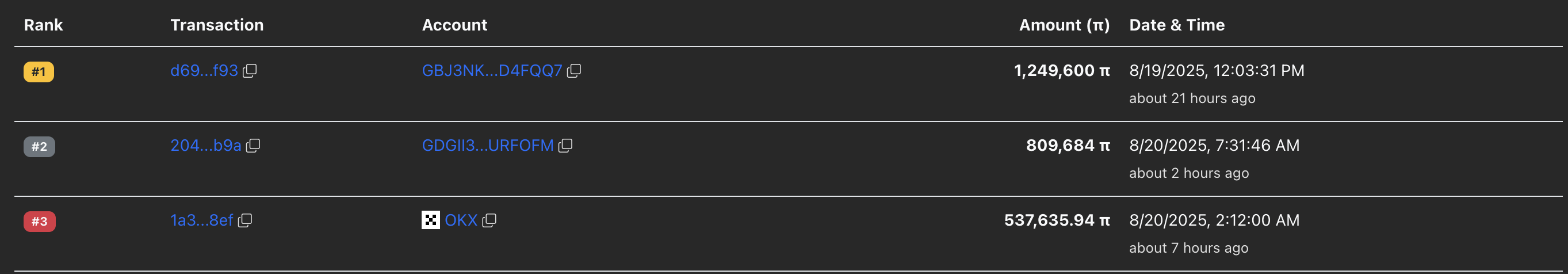

It is worth noting that two out of the three largest transactions on the Pi Network over the last 24 hours are large deposits to the OKX exchange. The transactions refer to 1.24 million and 809,684 PI tokens. Typically, an increase in exchange reserves driven by large deposits signals a risk-off sentiment among investors, fueling the correction phase.

Large transactions. Source: Coinglass

Pi Network risks further losses in a falling channel

PI trades at $0.3481 at press time on Wednesday, with bulls attempting to halt the third consecutive bearish candle on the daily chart. Still, price action on the same chart highlights a pullback phase in a falling channel pattern, with bears targeting $0.3220, the all-time low recorded on August 1.

A decisive push below this level could retest the falling channel’s lower boundary level NEAR $0.2700 for a fresh record low.

The Relative Strength Index (RSI) reads 42 on the daily chart as it hovers above the oversold boundary line. This suggests a bearish momentum, with further room for correction.

The Moving Average Convergence Divergence (MACD) crosses below its signal line, signalling a bearish turnaround in trend momentum.

PI/USDT daily price chart.

Looking up, the PI token should reclaim the $0.4000 level to retest the overhead trendline at $0.4342.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.