XRP Price Prediction 2025: How High Can It Soar Amid Bullish Signals and Market Drama?

- What Do the Charts Say About XRP's Near-Term Potential?

- Why Is There Such a Divide Between TradFi and Crypto Views on XRP?

- How Could Recent Regulatory Developments Impact XRP?

- What Are the Key Price Levels to Watch?

- Is XRP Still a Good Investment as the Market Matures?

- XRP Price Prediction: Where Do Experts See It Going?

- Frequently Asked Questions

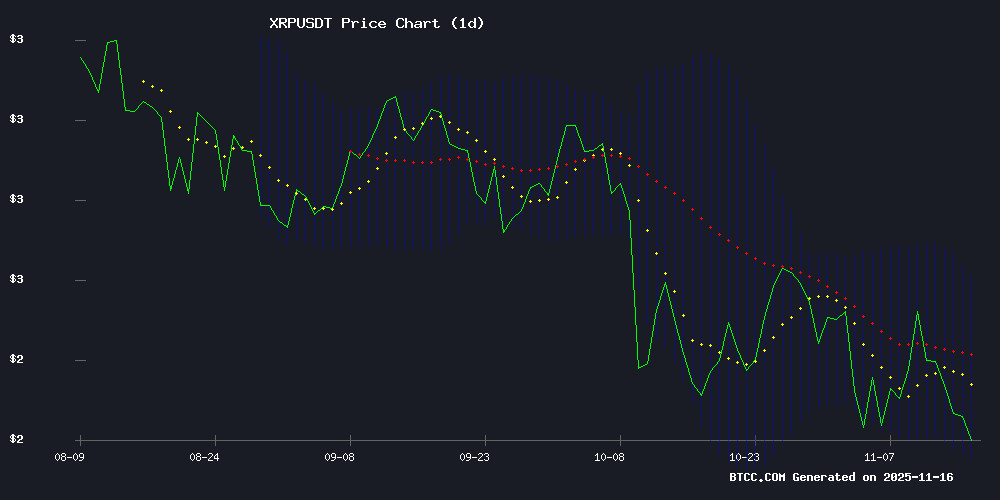

XRP finds itself at a fascinating crossroads as we approach the end of 2025. Currently trading at $2.1894 (CoinMarketCap data as of November 16, 2025), the digital asset shows conflicting signals - bullish technical indicators clash with divided market sentiment. The MACD shows positive momentum while price action remains below key moving averages, creating what BTCC analysts call a "make or break" moment. This comprehensive analysis dives DEEP into the technical setup, explores the growing TradFi vs. crypto-native divide, and examines how recent regulatory developments could impact XRP's trajectory through year-end.

What Do the Charts Say About XRP's Near-Term Potential?

Looking at the daily chart (TradingView data), XRP presents a classic case of technical tension. The price currently sits below the 20-day moving average ($2.3736), which typically suggests bearish momentum. However, the MACD tells a different story - with the MACD line (0.1275) crossing above the signal line (0.0839), we're seeing what technical analysts call a "buy signal." The Bollinger Bands add another LAYER to this analysis. With price hovering near the lower band ($2.1232), we might be looking at either a continuation of the downtrend or a potential bounce. "In my experience," notes a BTCC market strategist, "when we see this combination of indicators - MACD bullish but price below key MAs - it often precedes either a strong reversal or a fakeout. The next 72 hours could be critical."

The Bollinger Bands add another LAYER to this analysis. With price hovering near the lower band ($2.1232), we might be looking at either a continuation of the downtrend or a potential bounce. "In my experience," notes a BTCC market strategist, "when we see this combination of indicators - MACD bullish but price below key MAs - it often precedes either a strong reversal or a fakeout. The next 72 hours could be critical."

Why Is There Such a Divide Between TradFi and Crypto Views on XRP?

The VanEck incident last week perfectly encapsulates the growing rift between traditional finance and crypto-native perspectives. When VanEck's Matthew Sigel made his now-infamous "pretend it does something" comment about XRPL, the crypto community reacted like someone had insulted their firstborn. This isn't just about hurt feelings though - it reflects fundamentally different valuation frameworks. TradFi analysts tend to evaluate XRP through traditional metrics like adoption rates and regulatory clarity, while the crypto community often focuses more on technological potential and community strength. As one XRP investor told me, "These Wall Street guys still think in spreadsheets while we're building the future." Whether this divide represents growing pains or a fundamental incompatibility remains to be seen.

How Could Recent Regulatory Developments Impact XRP?

The regulatory landscape has shifted significantly in XRP's favor recently. Two key developments stand out: 1. The SEC's new ETF acceleration guidance 2. Court rulings affirming XRP's non-security status in secondary markets The Bitwise XRP ETF filing now has a clearer path forward, which could open the floodgates to institutional investment. Meanwhile, the legal clarity around XRP's status removes a major overhang that's weighed on the asset since 2020. However, as always in crypto, there's a catch. While institutional interest grows, retail momentum appears to be waning slightly. Trading volume data shows decreased activity from smaller wallets, suggesting the "normies" might be losing interest or moving to newer tokens.

What Are the Key Price Levels to Watch?

Based on current technicals, these are the crucial levels every XRP holder should monitor:

| Level | Price | Significance |

|---|---|---|

| Upper Bollinger Band | $2.6240 | Potential resistance if bullish momentum continues |

| 20-day MA | $2.3736 | Key psychological and technical level |

| Current Price | $2.1894 | Testing lower range of recent consolidation |

| Lower Bollinger Band | $2.1232 | Critical support that must hold |

Is XRP Still a Good Investment as the Market Matures?

This is the million-dollar question (sometimes literally). XRP's position as the fourth-largest cryptocurrency by market cap ($134.7 billion as of November 2025) gives it stability that newer projects lack, but also means it might not have the same explosive growth potential. The recent emergence of tokens like Mutuum Finance (MUTM) highlights an ongoing debate in crypto - do investors chase established assets with proven track records, or gamble on new projects with higher risk/reward profiles? From my perspective, XRP offers a middle ground - more stability than speculative altcoins, but more growth potential than Bitcoin for investors comfortable with its unique regulatory situation.

XRP Price Prediction: Where Do Experts See It Going?

Analyst opinions vary widely, but most fall within these scenarios: -Requires holding support at $2.12, breaking through the 20-day MA with conviction, and benefiting from positive ETF news. Some chartists see an inverse head and shoulders pattern forming that could support this outcome. -Continued range-bound trading as the market digests conflicting signals and awaits clearer catalysts. -Triggered by loss of $2.12 support and decreasing volume, potentially leading to a test of yearly lows. The BTCC research team's official stance: "XRP's path hinges on reclaiming $2.37. The $2.00-$2.62 range likely persists near-term unless we get a major catalyst."

Frequently Asked Questions

What is the current XRP price?

As of November 16, 2025, XRP is trading at $2.1894 according to CoinMarketCap data.

Is XRP a good investment for 2025?

While XRP shows promising technical signals and improving regulatory clarity, all crypto investments carry risk. The current technical setup suggests potential upside, but investors should consider their risk tolerance.

Why was the XRP community upset with VanEck?

VanEck's head of digital assets research Matthew Sigel made dismissive comments about XRP's utility, which many in the community saw as uninformed given XRPL's technological advancements.

What are the key support and resistance levels for XRP?

Key levels to watch are support at $2.12 (lower Bollinger Band) and resistance at $2.37 (20-day MA) and $2.62 (upper Bollinger Band).

Could XRP get an ETF in 2025?

With the SEC's new acceleration guidance and Bitwise's filing, the possibility has increased, though approval isn't guaranteed. The market appears to be pricing in some probability of ETF approval.