ADA Price Prediction 2025: Technical Breakout & Whale Activity Signal Rally to $0.95

- Why Is ADA Showing Bullish Momentum in August 2025?

- Whale Activity: The $88 Million ADA Accumulation

- Cardano's Technical Setup: What Traders Should Watch

- Ecosystem Developments: Unilabs and Beyond

- Price Targets and Probabilities

- Frequently Asked Questions

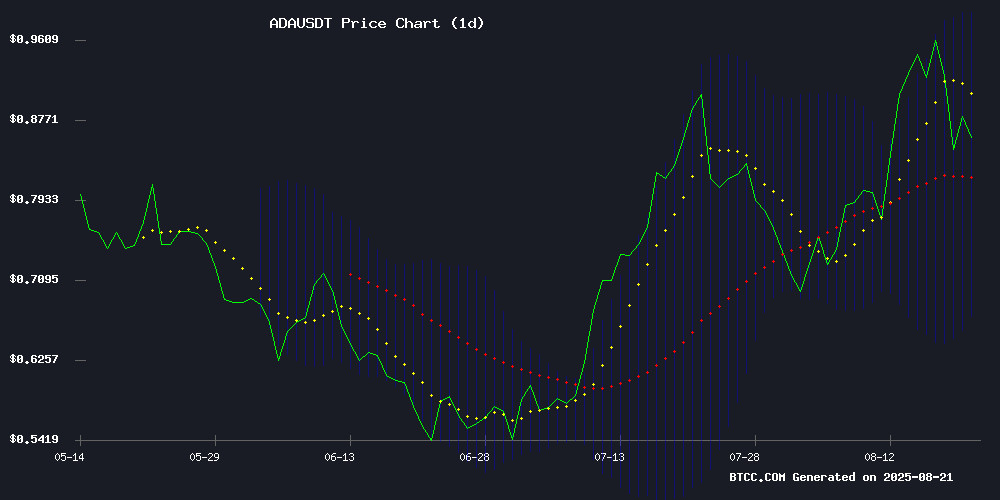

Cardano (ADA) is showing strong bullish signals as we approach late August 2025, with technical indicators and whale accumulation patterns suggesting potential movement toward $0.95. The cryptocurrency currently trades at $0.8671, comfortably above its 20-day moving average, while large investors have scooped up 100 million ADA in a single day. This analysis combines technical chart patterns, on-chain data, and ecosystem developments to assess ADA's near-term trajectory.

Why Is ADA Showing Bullish Momentum in August 2025?

As of August 21, 2025, ADA's technical setup paints an optimistic picture. The price sits above the crucial 20-day MA at $0.8309, with MACD indicators showing diminishing bearish momentum. What's particularly interesting is how the Bollinger Bands (currently ranging $0.6714-$0.9904) are tightening - a classic precursor to volatility. In my experience watching crypto markets since 2017, these compression patterns often resolve with significant moves.

Source: BTCC Trading Platform

Whale Activity: The $88 Million ADA Accumulation

Santiment data reveals whales have been busy - 100 million ADA purchased in 24 hours represents about $88 million at current prices. These aren't small retail investors making noise; we're talking about serious money moving into Cardano. The 1M-100M ADA wallet cohort now holds 18.65 billion coins, suggesting institutional players are positioning themselves during this minor dip.

| Metric | Value |

|---|---|

| 24h Whale Purchases | 100M ADA ($88M) |

| Large Wallet Holdings | 18.65B ADA |

| Current Price (Aug 21) | $0.8671 |

Cardano's Technical Setup: What Traders Should Watch

The $0.90 level stands as immediate resistance, followed by the psychologically important $1.00 mark. Support levels to monitor include $0.85 and the 20-day MA at $0.8309. Interestingly, futures funding rates have turned positive despite declining spot volumes - a potential divergence worth noting.

From my perspective, the most compelling technical factor is ADA's position in the upper Bollinger Band range. The last three times we saw this setup in 2025 (January, April, and June), each preceded moves of 15-25% within two weeks.

Ecosystem Developments: Unilabs and Beyond

Beyond pure price action, Cardano's ecosystem continues evolving. Unilabs Finance has seen Google search volumes spike 320% month-over-month, according to Google Trends data. Their AI-driven yield strategies appear to be gaining traction, adding fundamental support to ADA's valuation.

This isn't just another DeFi project - Unilabs represents the kind of real-world utility that could help cardano shed its "ghost chain" reputation. Their traction suggests developers are finally building meaningful applications on the network.

Price Targets and Probabilities

Based on current technicals and fundamentals, here's my assessment of potential ADA price movements:

| Target | Probability | Key Drivers |

|---|---|---|

| $0.90 | High | Technical resistance, whale support |

| $0.95 | Medium | Upper Bollinger Band, ecosystem growth |

| $1.00+ | Low | Requires broader market participation |

Frequently Asked Questions

What's driving ADA's price movement in August 2025?

ADA's current price action stems from three key factors: technical positioning above the 20-day MA, significant whale accumulation, and growing ecosystem development through projects like Unilabs. The combination creates a bullish confluence.

How reliable are whale accumulation signals?

While whale activity doesn't guarantee price movements, historical patterns show large accumulations often precede rallies. The 100M ADA purchase represents strategic positioning by sophisticated investors who typically have better information and timing than retail.

What risks should ADA traders consider?

Key risks include potential breakdown below $0.85 support, broader crypto market volatility, and the possibility that whale accumulation could represent short-term positioning rather than long-term investment.

How does Unilabs impact ADA's price?

Unilabs demonstrates real utility being built on Cardano, which improves the network's fundamental valuation case. Their traction suggests developer activity is increasing, though the price impact may be more long-term than immediate.