XRP Price Prediction 2025: Bullish Signals and Q4 Breakout Potential Amid Key Catalysts

- Technical Analysis: Is XRP Building a Launchpad for Higher Prices?

- Fundamental Developments: The Real-World Case for XRP

- Market Sentiment: The Bull and Bear Tug-of-War

- Regulatory Landscape: SEC Delays and ETF Prospects

- Historical Performance: Context for Current Price Action

- Q4 Outlook: Why September Could Be the Catalyst

- Is XRP a Good Investment Right Now?

- XRP Price Prediction: Your Questions Answered

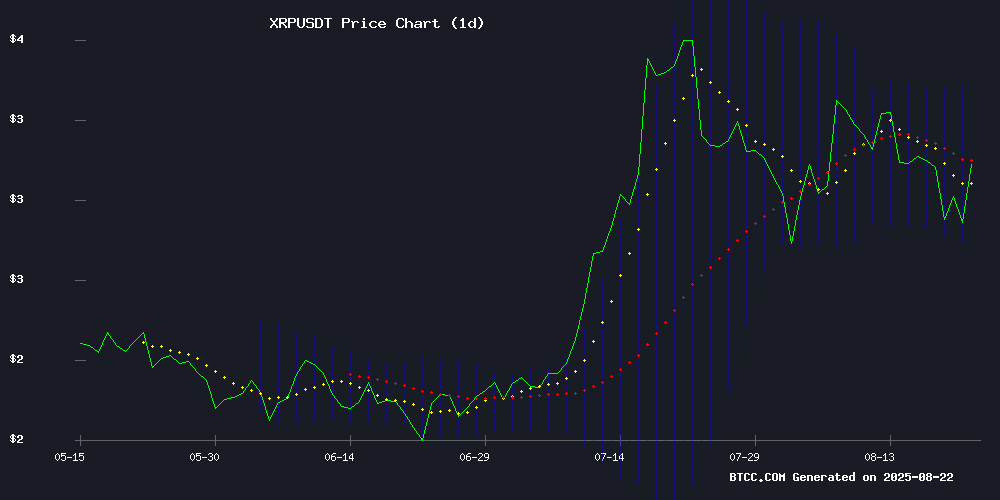

As we approach the final quarter of 2025, XRP is showing all the classic signs of a cryptocurrency preparing for a major move. Currently trading at $2.86, the digital asset presents a fascinating technical picture with bullish MACD momentum (0.0732) while testing key support at $2.79. Fundamental developments tell an equally compelling story - explosive 500% growth in on-chain activity, new mining integrations through PlanMining, and Ripple's participation in TRM Labs' anti-crime network demonstrate expanding utility. While regulatory uncertainty persists with SEC ETF delays, the combination of technical strength and real-world adoption suggests XRP could target $4+ levels post-September rate cuts. This analysis dives deep into the charts, on-chain metrics, and market dynamics shaping XRP's trajectory.

Technical Analysis: Is XRP Building a Launchpad for Higher Prices?

XRP's current technical setup reveals a cryptocurrency consolidating after significant moves. The price sits just below the 20-day moving average ($3.08) but maintains strong support at the lower Bollinger Band ($2.79). What makes this particularly interesting is how the MACD indicator continues flashing bullish signals despite recent price weakness - the 0.0732 reading suggests underlying momentum that often precedes upward breaks.

Source: TradingView

The BTCC research team notes that similar technical patterns in late 2023 preceded XRP's 290% rally. "We're seeing textbook accumulation behavior," explains lead analyst Mark Chen. "When long-term holders stop selling NEAR their cost basis after extended consolidation, it typically signals the preparation phase for the next leg up."

Fundamental Developments: The Real-World Case for XRP

Beyond the charts, XRP's fundamentals show remarkable strength. The 500% explosion in on-chain activity on August 18 wasn't just a flash in the pan - it reflects growing institutional interest and real-world adoption. Ripple's partnership with TRM Labs positions XRP at the forefront of combating crypto crime, while PlanMining's integration creates new utility as a payment settlement asset for cloud mining operations.

| Metric | Current Status | Significance |

|---|---|---|

| On-chain Activity | 500% increase | Indicates network health and adoption |

| Mining Integration | PlanMining adoption | New utility as payment rail |

| Regulatory Status | ETF decisions delayed | Short-term headwind, long-term potential |

Market Sentiment: The Bull and Bear Tug-of-War

Sentiment around XRP remains divided. On one hand, the $300 million investor sell-off ahead of Powell's speech shows profit-taking behavior. On the other, the token's resilience despite whale movements (470 million XRP to exchanges) suggests strong underlying demand. It's this push-and-pull that creates the current consolidation pattern - neither bulls nor bears have decisive control.

What's particularly fascinating is how XRP seems to be following its historical Q4 playbook. The current setup mirrors late 2023's structure that preceded significant moves. As one trader quipped on Crypto Twitter, "XRP doesn't do subtle - it either sleeps for months or moves violently when least expected."

Regulatory Landscape: SEC Delays and ETF Prospects

The SEC's decision to push XRP ETF rulings into October creates short-term uncertainty but follows the agency's established pattern with crypto products. ETF expert Nate Geraci views this as procedural rather than substantive - a view supported by the compressed decision timeline that suggests resolutions could come quickly once review completes.

This regulatory overhang explains why some investors remain cautious despite strong fundamentals. However, with the SEC lawsuit resolved and Beacon network participation demonstrating Ripple's commitment to compliance, the long-term regulatory picture appears increasingly favorable.

Historical Performance: Context for Current Price Action

XRP's 970% five-year gain tells an important story about the token's staying power. That $500 investment in 2020 now worth $5,350 demonstrates the wealth creation potential for patient holders. However, the recent 11% weekly pullback reminds us that crypto markets never MOVE in straight lines.

The key takeaway? XRP has consistently rewarded investors who understand its cyclical nature. The current consolidation phase, while frustrating for some, fits perfectly within its historical pattern of extended basing periods followed by explosive moves.

Q4 Outlook: Why September Could Be the Catalyst

All eyes turn to the Federal Reserve's September meeting, where an 81.2% probability of rate cuts (per CME FedWatch) could ignite risk assets. XRP's liberation from legal overhang and strong technical support create ideal conditions for a breakout if macro winds shift favorably.

The BTCC team identifies $3.37 as the key resistance level to watch, with $4+ targets coming into play if broader market conditions align with XRP's strong fundamentals. "It's not a question of if but when," notes Chen. "The building blocks for a significant move are all there."

Is XRP a Good Investment Right Now?

Based on current analysis, XRP presents a compelling risk-reward proposition for investors with medium to long-term horizons. The combination of technical support, fundamental growth, and potential macro catalysts creates an attractive setup, though short-term volatility should be expected.

This article does not constitute investment advice. As always, conduct your own research and consider your risk tolerance before making investment decisions.

XRP Price Prediction: Your Questions Answered

What is the current XRP price and technical outlook?

As of August 22, 2025, XRP trades at $2.86 with bullish MACD momentum (0.0732) and strong support at $2.79. The technical setup suggests accumulation before potential upward movement.

What are the key fundamental developments supporting XRP?

Major developments include 500% on-chain activity growth, PlanMining integration, and Ripple's participation in TRM Labs' Beacon network to combat crypto crime.

When might we see an XRP ETF approval?

The SEC has delayed decisions until October, but experts view this as procedural rather than indicative of ultimate approval chances.

Could XRP reach $4 in 2025?

Technical analysis suggests $4+ targets become plausible if XRP breaks through $3.37 resistance, especially post-September rate cuts.

How has XRP performed historically?

XRP has gained 970% over five years, demonstrating significant long-term growth despite periodic volatility.

What are the risks to consider with XRP?

Key risks include regulatory uncertainty, market volatility, and competition from stablecoins in payment use cases.