Ethereum Price Prediction 2025: Can ETH Shatter $5,000 After Recent All-Time High?

- Why Ethereum's Technical Setup Looks Bullish

- Institutional Demand Reaches Fever Pitch

- Tokenized Assets: Ethereum's $400 Trillion Opportunity

- Potential Headwinds to Consider

- Market Sentiment and Price Predictions

- Ethereum Investment FAQ

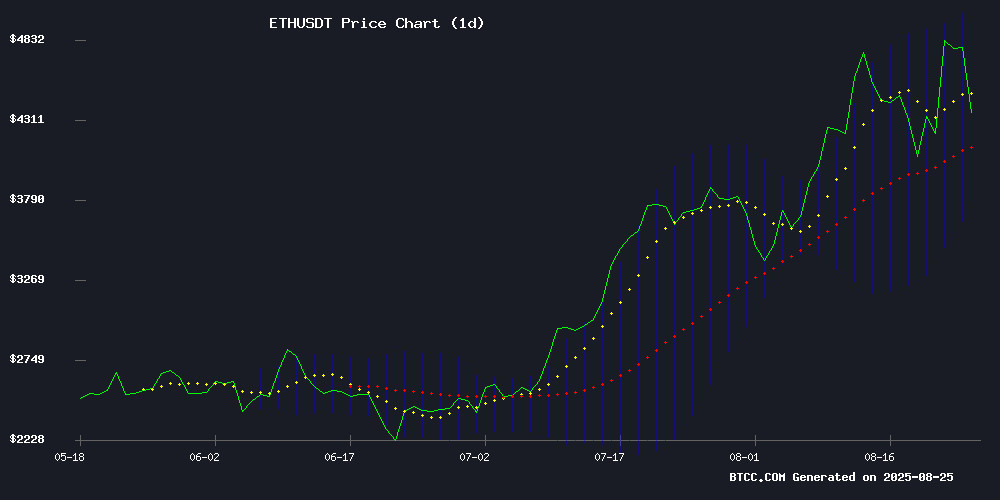

Ethereum (ETH) is making waves in the crypto market, recently hitting an all-time high of $4,957 and currently trading around $4,603.67 as of August 25, 2025. With strong technical indicators, massive institutional inflows, and growing adoption in tokenized assets, analysts are debating whether ETH can break the psychological $5,000 barrier. This in-depth analysis examines the bullish case for ethereum while acknowledging potential headwinds, providing traders with a comprehensive look at ETH's market dynamics.

Why Ethereum's Technical Setup Looks Bullish

Ethereum's current price action paints an encouraging picture for bulls. The cryptocurrency is trading comfortably above its 20-day moving average of $4,375.12, which often serves as dynamic support during uptrends. The MACD histogram has turned positive at +28.38 despite the overall MACD reading remaining negative at -316.52, suggesting weakening selling pressure.

According to TradingView data, ETH is trading within its Bollinger Band range with upper resistance at $4,977.94 and support at $3,772.29. The current position NEAR the middle band indicates room for upward movement. "We're seeing textbook bullish momentum here," notes a BTCC market analyst. "The key will be whether ETH can maintain above $4,400 on any pullbacks."

Institutional Demand Reaches Fever Pitch

The institutional story for Ethereum has become increasingly compelling in recent weeks. BlackRock-led ETH ETFs have seen $287 million in inflows, with $233 million coming from BlackRock alone. Fidelity contributed another $28 million, signaling growing confidence from traditional finance heavyweights.

Perhaps more telling is the massive withdrawal of 200,000 ETH from exchanges within just 48 hours this week. "When you see this scale of movement off exchanges, it typically indicates accumulation by large players," explains a crypto market strategist. "These coins are likely going into cold storage or being staked, reducing available supply."

Tokenized Assets: Ethereum's $400 Trillion Opportunity

New research from Animoca Brands highlights Ethereum's leading position in the tokenization of real-world assets (RWAs), a sector that's grown 70% since January 2025 to reach $26.5 billion. Ethereum currently commands 55% of this market, expanding to 76% when including layer-2 solutions.

"The estimated $400 trillion addressable traditional finance market represents an enormous growth runway," wrote Animoca researchers Andrew Ho and Ming Ruan. Private credit and U.S. Treasurys dominate current tokenization efforts, accounting for nearly 90% of tokenized value.

Potential Headwinds to Consider

While the overall picture appears bullish, several factors could challenge ETH's upward momentum:

- September Seasonality: Historical data shows ETH has declined in September after strong August performances in 2017, 2020, and 2021.

- ETF Outflows: U.S.-listed ETFs saw $241 million in outflows during the week of August 22, breaking a 15-week inflow streak.

- Security Concerns: Phishing scams exploiting EIP-7702 have resulted in $1.5 million in losses this month.

Market Sentiment and Price Predictions

The crypto community appears divided on ETH's near-term prospects. Some traders point to bearish divergences on daily and 4-hour RSI indicators as signs of potential exhaustion. Others emphasize the strong accumulation by large holders (1-10 million ETH wallets added 210,000 ETH worth $1 billion since August 19).

"We're at a critical inflection point," observes a BTCC technical analyst. "A clean break above $4,900 could quickly send ETH to $5,500, while failure to hold $4,400 might trigger a deeper correction to $4,100."

Ethereum Investment FAQ

Is Ethereum a good investment in 2025?

Ethereum presents a compelling case with strong fundamentals, though investors should be prepared for volatility. The combination of institutional adoption, technological developments, and growing use cases in decentralized finance makes ETH a cornerstone crypto asset.

What price can Ethereum reach in 2025?

Based on current technicals and market structure, analysts see potential for ETH to reach $5,000-$5,500 if bullish momentum continues. However, this depends on maintaining key support levels and continued institutional interest.

Why is Ethereum price rising?

The rally is driven by multiple factors: institutional ETF inflows, exchange withdrawals reducing supply, positive developments in tokenization, and overall crypto market recovery. Fed Chair Powell's recent dovish comments also provided tailwinds.

What are the risks of investing in Ethereum?

Key risks include regulatory uncertainty, potential September seasonality, smart contract vulnerabilities, and competition from other smart contract platforms. Investors should only allocate what they can afford to lose.

Should I buy Ethereum now or wait for a dip?

Market timing is notoriously difficult. Dollar-cost averaging can help mitigate volatility risk. For those waiting for a pullback, $4,100-$4,400 appears to be a potential accumulation zone based on technical analysis.