Whale Gobbles $153M Ethereum via Galaxy Digital OTC—Institutional FOMO Hits Overdrive

Another day, another nine-figure crypto power move. While retail traders were busy chasing memecoins, an unnamed whale just parked a $153M bet on Ethereum through Galaxy Digital's OTC desk—no slippage, no fuss. Guess who's not getting rekt by Uniswap fees this time?

OTC: Where whales play (and your portfolio weeps)

The trade screams institutional conviction—Galaxy doesn't roll out the red carpet for pocket change. This isn't some degen apeing into a shitcoin; it's cold, hard capital staking claims on ETH's smart contract empire. Meanwhile, your average crypto bro is still trying to time the market with TA from a 2017 YouTube tutorial.

Ethereum's quiet accumulation phase

No flashy press releases, just a $153M nod to ETH's infrastructure dominance. The OTC route says it all: big money wants in, but not at the cost of moving markets. Pro move—unlike that hedge fund that FOMO'd into the top last cycle (RIP, three-comma club).

So—bullish signal or just rich guys playing hot potato with digital gold? Either way, the institutions aren't waiting for the SEC's blessing. And honestly? Neither should you.

Whale Receives Ethereum From Galaxy OTC As Institutions Double Down

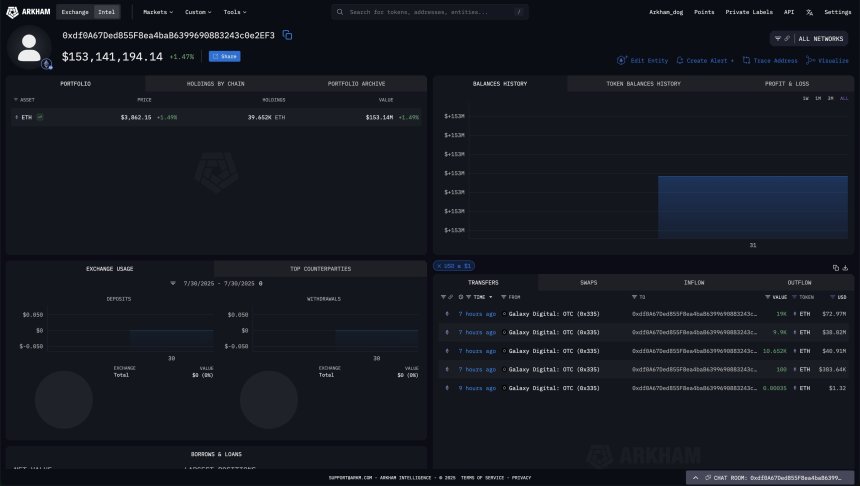

Ethereum’s bullish narrative gained further momentum this week after Arkham disclosed a massive on-chain transaction involving a major institutional player. A fresh wallet address—0xdf0A67Ded855F8ea4baB6399690883243c0e2EF3—just received $153 million worth of ETH, purchased directly through Galaxy Digital’s over-the-counter (OTC) desk. The scale and nature of this transaction suggest growing institutional conviction in Ethereum’s long-term potential.

This isn’t just another whale move. The fact that the ETH was funneled into a new wallet from a regulated OTC provider underscores the strategic accumulation taking place behind the scenes. As traditional finance increasingly integrates with crypto, Ethereum’s utility, programmability, and future role in tokenized finance are making it a high-conviction play among institutional allocators.

This heavy buy comes after a prolonged period of weakness. Earlier this year, ETH suffered persistent selling pressure, with price action sliding lower for months. Retail interest faded, and sentiment turned bearish. But while the public panicked, sophisticated players appear to have taken the other side of the trade—accumulating quietly during the downturn.

ETH Consolidates Below Resistance

Ethereum (ETH) continues to trade in a tight range just below the key resistance level of $3,860.80, as shown in the 4-hour chart. Despite recent price volatility, ETH has remained above its 50- and 100-period moving averages, currently NEAR $3,756 and $3,629, respectively. This suggests that bullish momentum is still intact in the short term.

Volume has picked up slightly, indicating rising interest from traders as ETH tests this critical horizontal resistance. The price has failed to close decisively above this level multiple times since July 25, highlighting its significance. However, the consistent higher lows forming over the past week point to building buying pressure beneath the surface.

A confirmed breakout above $3,860.80 could open the door for a push toward the psychological $4,000 level and beyond. Conversely, failure to break resistance may lead to another retest of the 100-period moving average or even the $3,700 support zone.

Featured image from Dall-E, chart from TradingView