Bitcoin New Investor Surge Defies Expectations – Where Are the Paper Hands?

Bitcoin's latest rally isn't just hodlers doubling down—fresh money floods in as retail FOMO meets institutional FOMO. No mass exits, no panic sells... yet.

The new breed of investors

They're buying the hype, not the dip. These aren't your 2017 'lambo dreamers' or 2021 'NFT degens'—these entrants arrive with direct deposit set up and tax forms pre-filled. The suits finally got what they wanted: boring crypto.

Profit-taking? What profit-taking?

Zero signs of major sell pressure despite 300% gains since last cycle's lows. Either everyone suddenly believes in 'number go up' theology, or we're witnessing the greatest HODL experiment since Mt. Gox wallets went cold.

Wall Street's worst nightmare: an asset that won't let them front-run retail. The irony? This 'decentralized' revolution now depends on SEC filings and BlackRock's quarterly reports. Wake us when the ETFs start trading 24/7.

Bitcoin Enters Healthy Late Bull Phase as New Investor Activity Grows

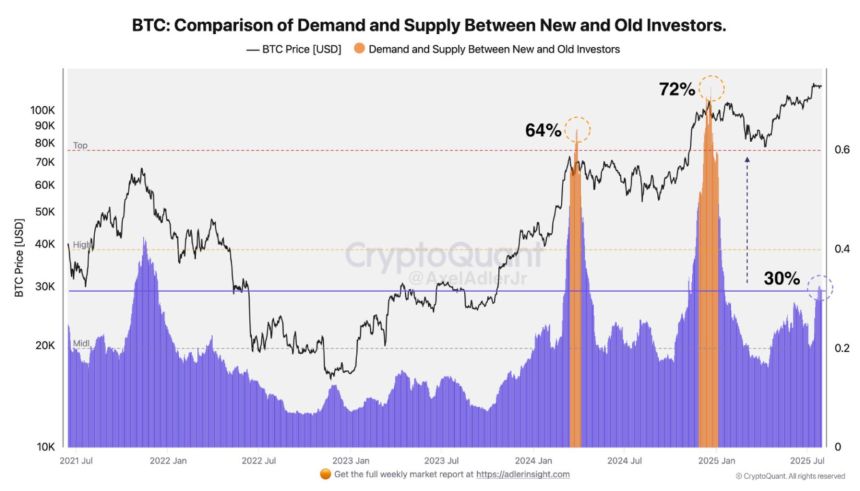

Top analyst Axel Adler recently shared detailed insights into Bitcoin’s market structure, focusing on the balance between new and old investor behavior. According to Adler, previous peaks in new investor dominance—64% in March 2024 and 72% in December 2024—aligned precisely with local BTC price tops. At those points, new liquidity began to wane, and experienced holders ramped up profit-taking.

Currently, new investor dominance stands at 30%, which is still far from those overheated extremes. However, the trend is upward. The purple fill on the chart, which reflects cumulative activity from younger coins, has been climbing steadily since July 2024. This indicates that a fresh wave of buyers continues to enter the market, while selling pressure from old hands remains limited.

This dynamic creates room for further bullish continuation before the typical euphoria zone—above 60–70% dominance—takes hold. Old holders are still distributing coins, but only moderately. A coefficient of 0.3 means that three-year-old coins are absorbing demand without triggering major volatility. This balance suggests that the market remains structurally sound.

Bitcoin Forms A Tight Consolidation Range

Bitcoin is currently trading at $118,413, consolidating in a narrow range between $115,724 and $122,077, as seen in the 8-hour chart. This sideways movement has persisted for over two weeks, indicating indecision in the market. The key support sits at $115,724, which has been tested multiple times but held firmly, while the $122,077 level acts as immediate resistance after a strong rejection earlier in July.

The price remains above the 50, 100, and 200-period moving averages, which now align in bullish order—another sign that the underlying trend is still intact despite short-term consolidation. Volume remains relatively low, suggesting that neither bulls nor bears are aggressively positioning at the moment. However, such tight ranges often precede large directional moves.

If bulls manage to break above the $122K resistance with strong volume, it could trigger a continuation toward new highs. On the other hand, a breakdown below the $115.7K support WOULD expose downside risk. Potentially leading to a retest of the 100-period moving average around $114,490 or even the 200-period average near $110,188.

Featured image from Dall-E, chart from TradingView