Bitcoin Open Interest Tops $40 Billion—Longs Pile In, Setting Stage for Potential Squeeze

Bitcoin's derivatives market hits a fever pitch as open interest surges past the $40 billion mark—fueled by an aggressive wave of long positions betting on further gains.

Leveraged Longs Dominate

Traders are stacking bullish bets, pushing open interest to historic levels. That much leverage in one direction often signals either explosive upside or a painful flush-out.

High Stakes, Higher Volatility

When this many players crowd the long side, even a minor dip can trigger cascading liquidations. It’s a classic setup—greedy, optimistic, and primed for a reality check from the market’s cold mechanics.

Remember what they say on Wall Street? When everyone’s already in the pool, the only thing left to do is drain it. Crypto just does it faster and with more leverage.

Bitcoin To Fall More? Crowded Long Trade Gives Hint

According to a CryptoQuant Quicktake post by contributor XWIN Research Japan, Bitcoin open interest across all exchanges has surged past $40 billion, nearing ATH territory. This rise shows both whales and short-term traders are piling into Leveraged positions.

The chart below highlights the recent spike in BTC open interest, now hovering at $40.6 billion. Compared to August 2024 levels of $15 billion, open interest has grown by more than 150%.

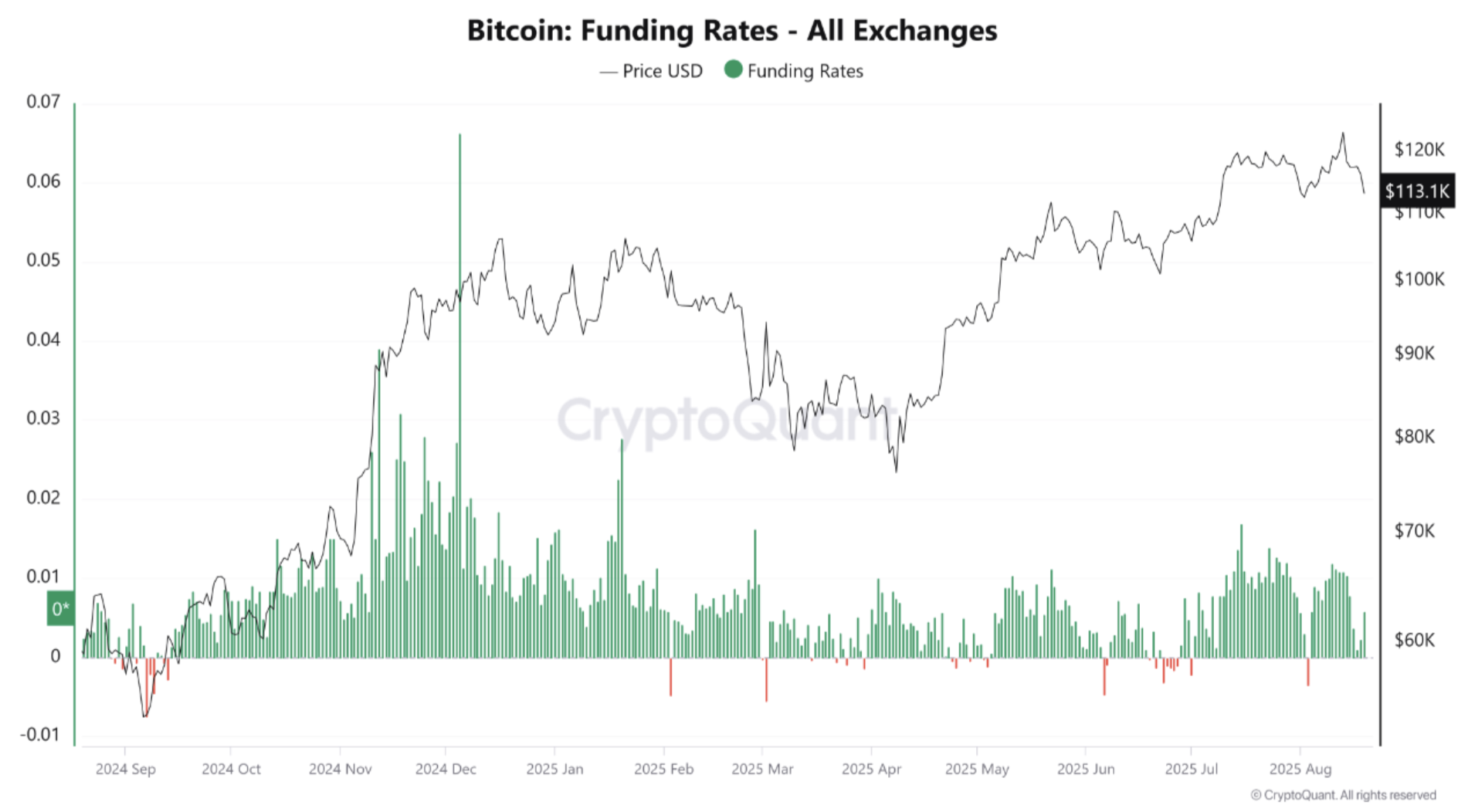

The CryptoQuant contributor added that despite this surge, the funding rate has remained positive, showing a strong long bias. While this reflects market optimism, it also signals a crowded trade, with most participants betting on further BTC appreciation.

As a result, the risk of a long squeeze – forced liquidations of long positions due to aggressive leverage – has risen. XWIN Research Japan explained in their analysis:

A sudden price drop can trigger a cascade of forced selling, amplifying volatility. In other words, Bitcoin’s short-term moves remain at the mercy of speculative flows.

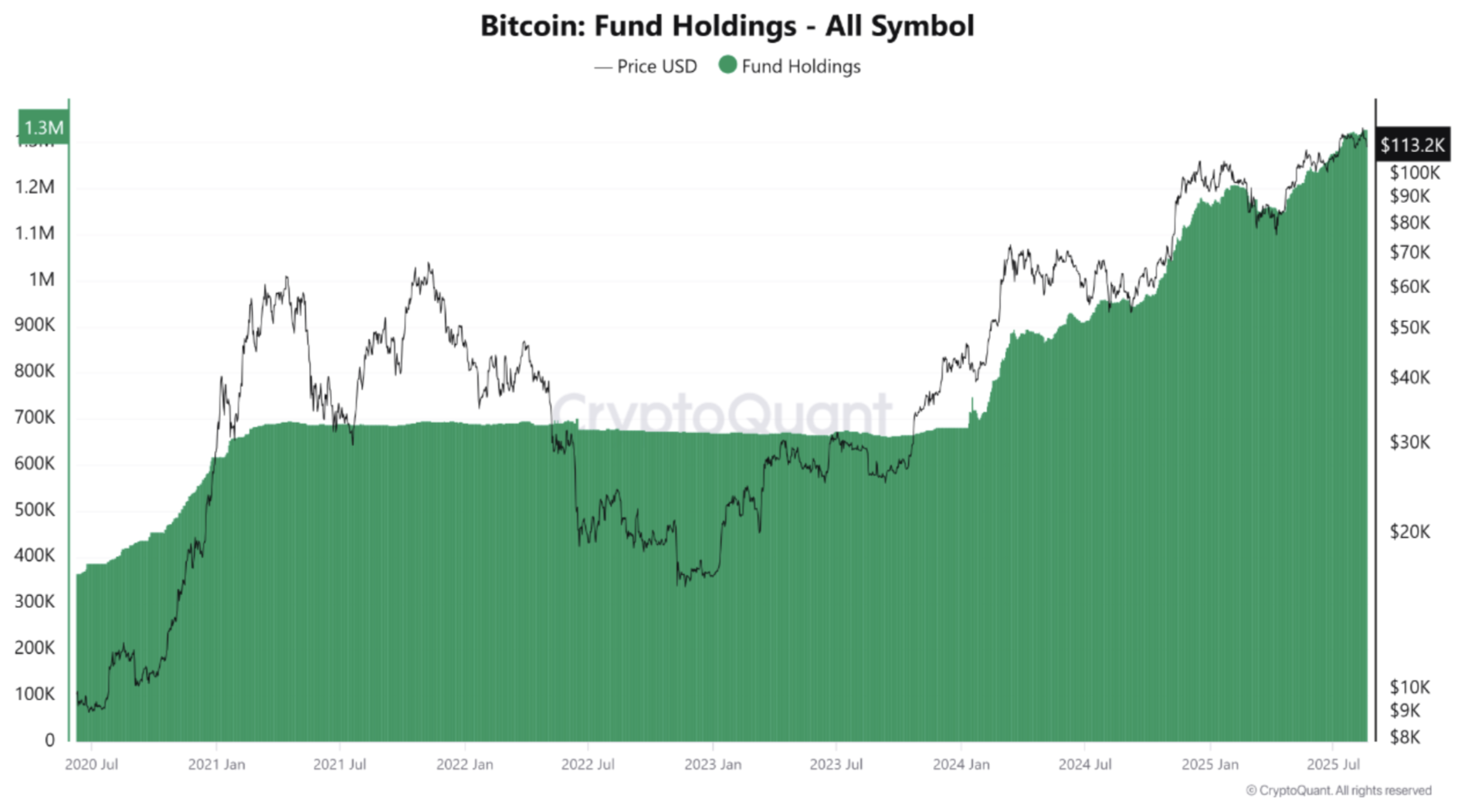

BTC Fund Holding By Institutions Rises

Despite speculative froth from excessive leverage in the market, BTC fund holdings by bitcoin exchange-traded funds (ETFs) and institutional investors continue to surge, exceeding 1.3 million according to latest data.

Spot ETFs and corporate treasuries absorbing BTC provides the digital asset a structural bid that steadily reduces its available supply. According to data from SoSoValue, US-based spot Bitcoin ETFs currently hold $146 billion in net assets – representing 6.47% of BTC’s market cap.

That said, this week alone has seen more than $645 million in outflows from spot Bitcoin ETFs, following two consecutive weeks of inflows totaling nearly $800 million. Among the ETFs, BlackRock’s IBIT leads with $84.78 billion in net assets as of August 19.

Still, not all signals are bearish. For instance, while BTC slipped below $115,000, its spot trading volume surged past $6 billion, giving bulls hope for a potential rebound.

Similarly, technical analyst AO recently suggested that BTC could be mirroring gold’s trajectory, with an ambitious target of $600,000 by early 2026. At press time, BTC trades at $113,845, down 1.5% in the past 24 hours.