Bitcoin’s Weakness vs. Ethereum’s Strength: On-Chain Data Exposes Stark Divergence

Digital asset markets reveal a tale of two cryptocurrencies—one struggling, one surging.

On-chain metrics paint a clear picture: Ethereum's network activity screams bullish while Bitcoin's chain signals caution. Transaction volumes, active addresses, and network utilization all tell the same story—ETH's ecosystem thrives as BTC faces headwinds.

Ethereum's defi ecosystem continues eating traditional finance's lunch—because why wait three days for settlement when you can do it in seconds? Meanwhile, Bitcoin's hodlers watch from the sidelines as institutional flows favor the smarter contract platform.

The divergence isn't just technical—it's fundamental. One network evolves, the other hesitates. In crypto, standing still is the fastest way to move backward.

Bitcoin Shows Correction Risks – Is ETH Safe?

According to a CryptoQuant Quicktake post by contributor XWIN Research Japan, on-chain data reveals underlying weakness in BTC price action. By contrast, ETH is displaying notable resilience even as broader crypto market momentum fades.

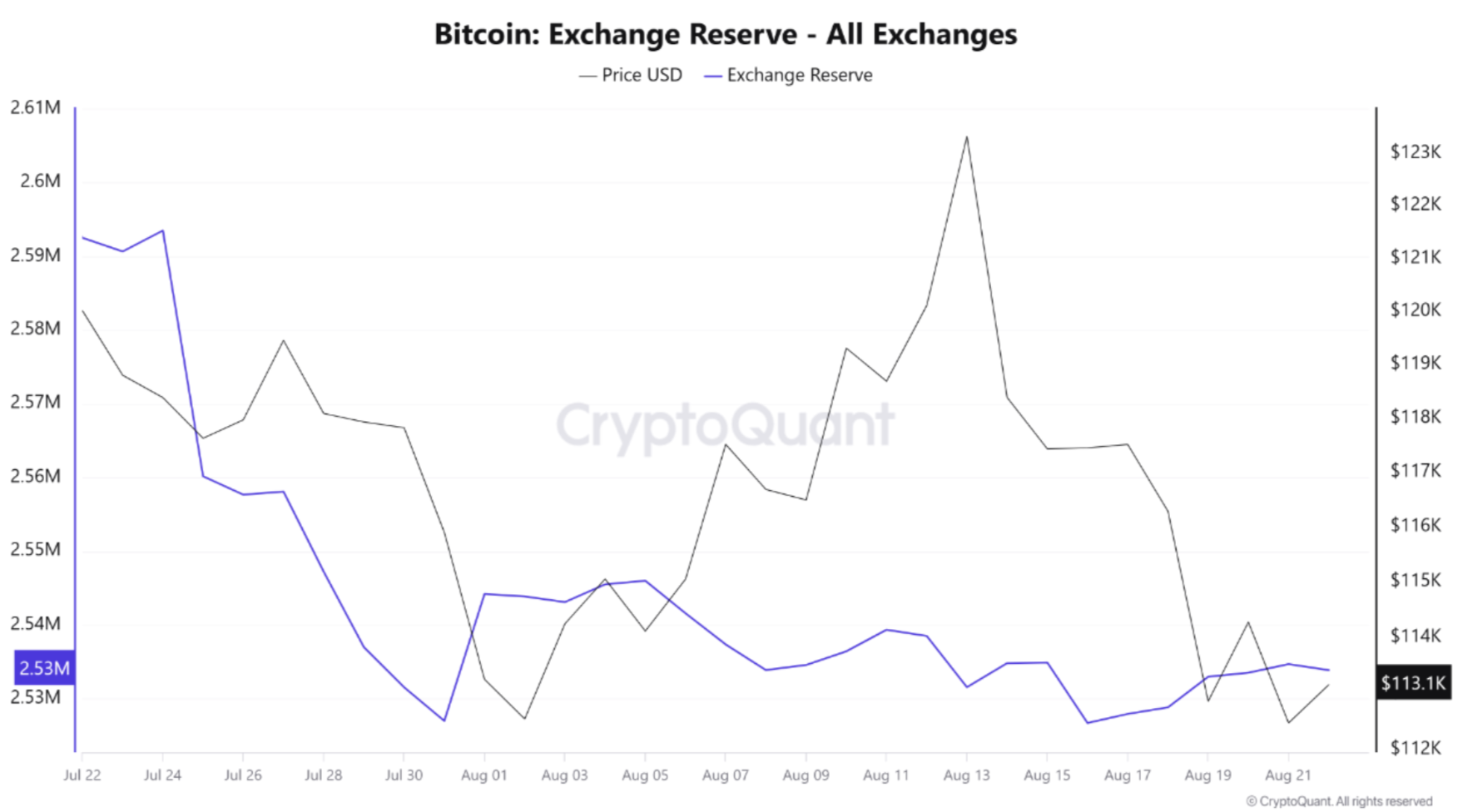

Currently, Bitcoin’s exchange reserves are hovering around 2.53 million BTC, showing little sign of declining despite recent volatility. For context, BTC has fallen 5.4% over the past week.

Historically, shrinking exchange reserves have indicated BTC moving off exchanges for long-term holding, which reduces near-term sell pressure. This time, however, reserves remain flat, suggesting that a significant portion of BTC supply is still liquid and available for selling.

Flat exchange reserves – combined with BTC’s recent drop from $123,000 to $113,000 – have raised red flags for a possible short-term correction. Meanwhile, ETH’s on-chain dynamics tell a very different story.

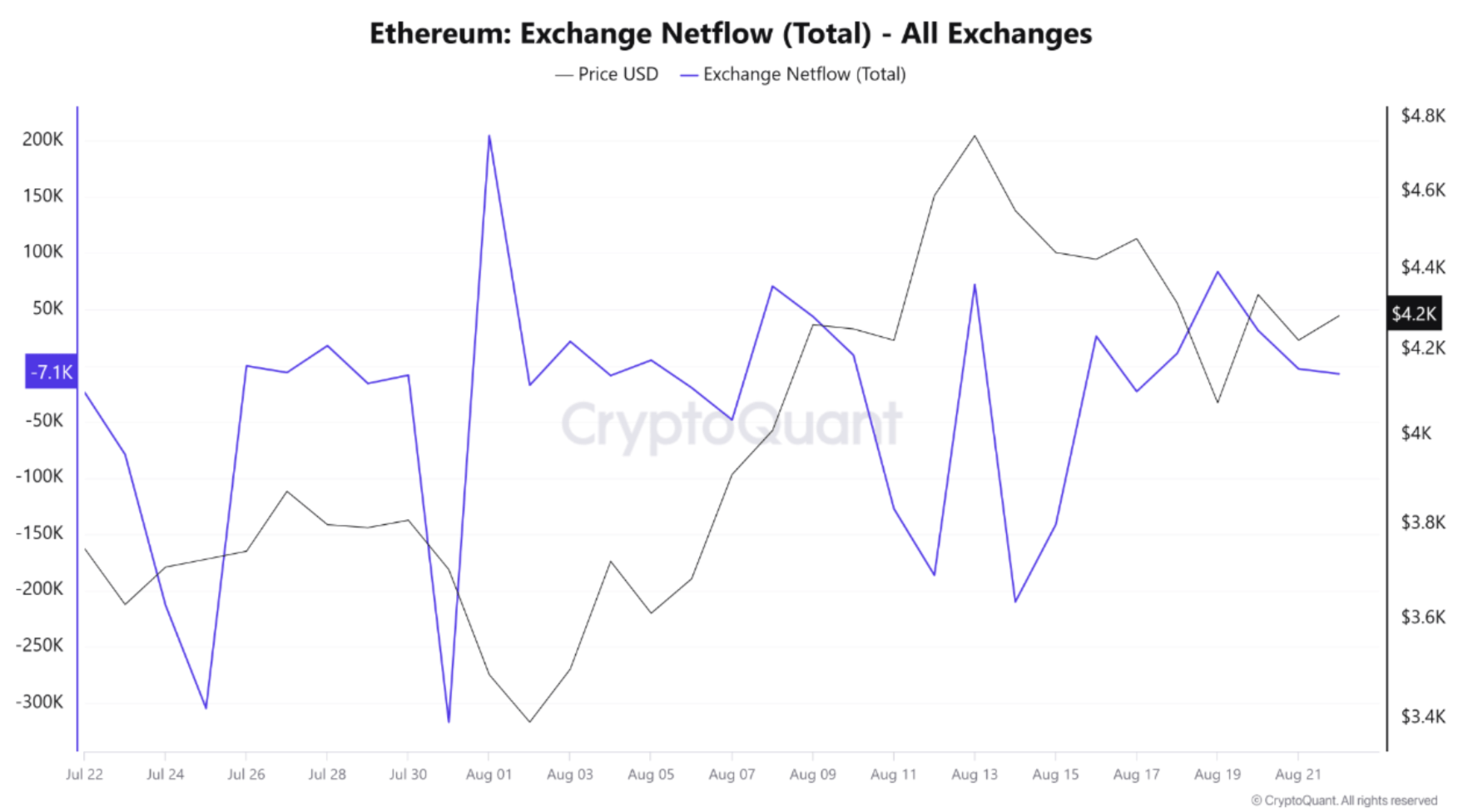

Unlike BTC, ETH has consistently recorded large net outflows from exchanges, with multiple spikes exceeding 300,000 ETH in late July and mid-August. XWIN Research Japan explained:

Outflows usually reflect coins moving into cold storage, staking, or institutional custody, tightening the available supply on the open market. ETH’s price has been between $4.150 to $4,400, aligning with the outflow trend and reinforcing a bullish narrative of a potential supply shock.

In short, while BTC is consolidating with lingering sell-side liquidity, ETH’s declining exchange balances signal rising institutional demand. These opposing dynamics suggest capital may be rotating from BTC to ETH.

Different Dynamics Between BTC And ETH

Beyond exchange reserves, other indicators also highlight further downside risk for BTC and growing institutional interest in ETH, reinforcing the market’s preference for Ethereum over Bitcoin.

For instance, noted crypto analyst Xanrox recently offered a dramatic price prediction for BTC, stating that it may crash all the way down to $60,000 – almost a 50% fall from its current market price.

Meanwhile, whales continue to increase their exposure to ETH, growing their holdings at a rapid pace as ETH’s relative strength compared to BTC improves. Yesterday, an Ethereum whale went long on $300 million worth of ETH on-chain.

From a technical perspective as well, things look positive for ETH, with a potential recovery to $4,788 on the cards. At press time, BTC trades at $112,283, down 0.7% in the past 24 hours.