Bitcoin Price Alert: Is a Massive Sell-Off Imminent?

Bitcoin teeters on the edge as warning signals flash across trading desks worldwide. The king of crypto faces its most critical test since the last bull run—and not everyone likes the odds.

The Perfect Storm

Technical indicators scream overbought while whale movements suggest major players are quietly taking profits. Retail investors keep chasing momentum, ignoring the classic signs of distribution that veteran traders spotted weeks ago.

Liquidity Crunch Ahead?

Market depth shrinks as bid support weakens across major exchanges. That thin order book could amplify any downward move into a full-blown cascade—because nothing moves markets like panic selling meets inadequate liquidity.

Institutional Divergence

While crypto Twitter remains euphoric, smart money positions tell a different story. Hedge funds quietly increase short exposure through derivatives while publicly maintaining 'long-term bullish' narratives—because why let consistency interfere with profitable positioning?

The trigger could be anything: regulatory noise, traditional market spillover, or just that timeless market reality that trees don't grow to the sky. Even in crypto.

Bitcoin Price Dips Again

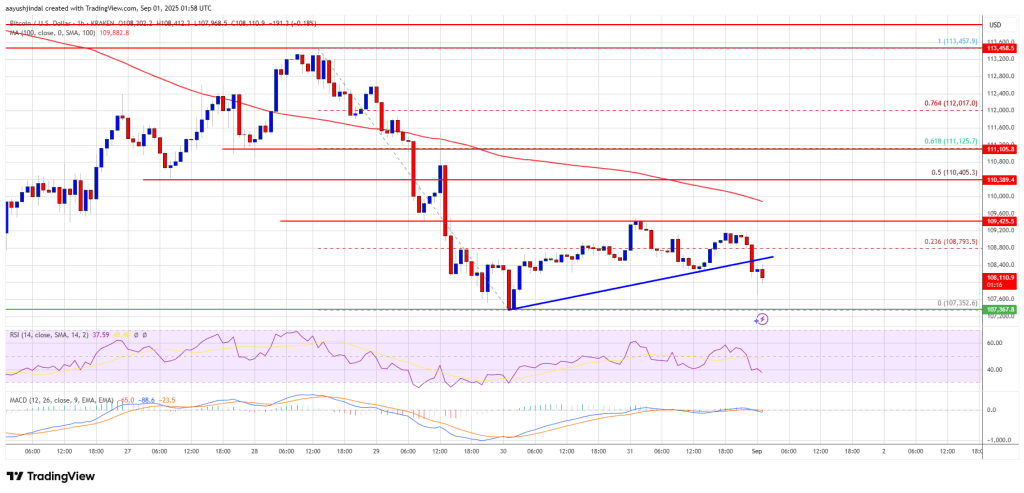

Bitcoin price attempted a fresh recovery wave from the $107,352 low. BTC was able to climb above the $108,000 and $108,500 resistance levels.

The price cleared the 23.6% Fib retracement level of the key drop from the $113,457 swing high to the $107,352 low. However, the bears remained active NEAR $109,500 and prevented more gains. The price is again moving lower below $109,000.

There was a break below a bullish trend line with support at $108,450 on the hourly chart of the BTC/USD pair. Bitcoin is now trading below $109,000 and the 100 hourly Simple moving average.

Immediate resistance on the upside is near the $109,400 level. The first key resistance is near the $110,000 level. The next resistance could be $110,500 or the 50% Fib retracement level of the key drop from the $113,457 swing high to the $107,352 low.

A close above the $110,500 resistance might send the price further higher. In the stated case, the price could rise and test the $112,000 resistance level. Any more gains might send the price toward the $112,500 level. The main target could be $113,500.

More Losses In BTC?

If bitcoin fails to rise above the $110,500 resistance zone, it could start a fresh decline. Immediate support is near the $108,000 level. The first major support is near the $107,400 level.

The next support is now near the $106,500 zone. Any more losses might send the price toward the $105,500 support in the near term. The main support sits at $103,500, below which BTC might decline sharply.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $107,400, followed by $106,500.

Major Resistance Levels – $109,500 and $110,500.