Analyst Predicts XRP Will Lead The Next Major Upswing — Here’s The Bull Case

XRP poised to spearhead crypto's next major rally according to market analysts—fueled by regulatory clarity and institutional adoption momentum.

Breaking Through Resistance

Technical indicators suggest XRP has consolidated at key support levels, creating ideal conditions for explosive upward movement. The asset demonstrates stronger fundamentals than during previous cycles.

Institutional Tailwinds

Growing enterprise adoption and settlement volume growth provide concrete utility backing—unlike projects relying purely on speculative narratives. Real-world use cases finally translating to price action.

Market Positioning

While other cryptocurrencies face regulatory uncertainty, XRP's relative clarity becomes its ultimate advantage. Sometimes the safest bet in crypto is the one that already survived the regulators' wrath.

Timing The Breakout

Analysts point to historical patterns suggesting imminent movement. The setup mirrors previous pre-bull market conditions—because in crypto, history doesn't repeat but it often rhymes. Just ask anyone who's ever tried to explain their portfolio to traditional finance friends.

Why XRP Could Outperform BTC And ETH

The Core of his case is a comparative liquidity mapping across BTC, ETH, and XRP. On Bitcoin, he notes that downside pools around “about 106K” have been a persistent magnet on intraday timeframes, but the daily heatmap still shows heavier clusters above spot. “Now we’re down at these levels, it’s more likely than not that we do continue to take this liquidity here for Bitcoin,” he says.

The analyst adds that on the daily timeframe “to the upside there could be a push into this liquidity about $126K–$128K and then we’re starting to see orange liquidity now at $141,000.” He frames any reversal as fast and reflexive: “When we get this MOVE back to the upside… it’s going to be pretty aggressive and people are going to be caught on the wrong side of the trade.”

Ethereum’s setup, by contrast, is described as tactically softer after already tapping significant overhead liquidity during its prior pop. On his hourly mapping, the denser pools sit below recent lows, implying a non-trivial risk of mean reversion. “We actually have come back to this sort of area as well and we can see this more dense liquidity again below us sitting at around $4,050ish… the dense liquidity sits about $4,000 to $4,450,” he explains, characterizing ETH as “a bit hands off” for now—while also flagging that today’s US market closure for a public holiday can distort intraday reads.

The crux of the bullish divergence is on XRP. On the hourly basis, he shows that XRP has already swept and “taken the red liquidity below,” leaving the “main liquidity… above,” a configuration he views as conducive to an upside reversal if bid momentum emerges.

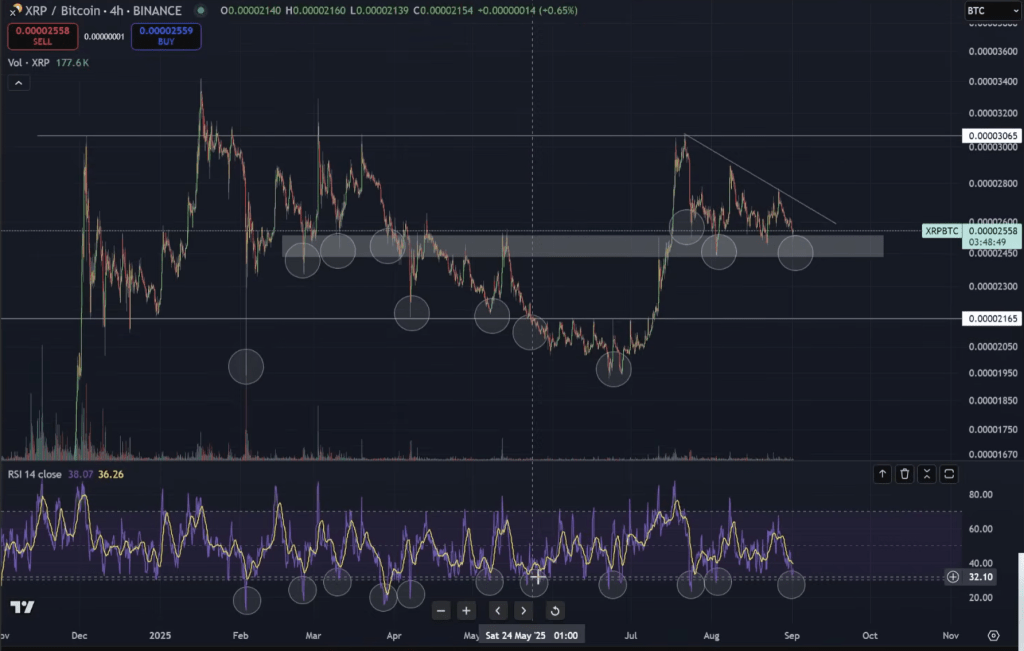

“Is XRP front-running here? Is it going to front-run altcoins?” he asks, pointing to the token’s different placement on the liquidity map relative to BTC and ETH. Extending the lens to relative performance, he highlights the XRP/BTC pair on the four-hour chart, where a prior resistance box has been flipped to support and momentum has repeatedly wicked into oversold territory with constructive reactions.

“When we’re at this level, we want to flip this resistance into support. Currently, we are holding that support,” he says, adding that while such oversold prints do not perfectly call bottoms, “more often than not, they have had a decent reaction, especially when we’re in an area of support like this.”

On higher timeframes, he reiterates that XRP’s heavier liquidity sits overhead—interpreting that as dry powder for continuation if spot can reclaim momentum—while BTC still has an attractive path to vacuum upper pools once immediate downside pockets are cleaned. Ethereum, having already consumed much of its near-term upside liquidity, could underperform tactically until its lower clusters are tested or rebalanced. The analyst ties the mosaic together with a cycle view that remains incomplete: “That’s one of the reasons I really don’t think the top is in yet for crypto.”

He stresses that the work is descriptive, not prescriptive. “This doesn’t mean that this is my opinion specifically. I’m just showing you charts here,” he says, before reiterating the cycle-long thesis: “I’ve said for the whole cycle, I think XRP is leading.” The coming weeks, he adds, should clarify whether the structural divergence he outlines translates into XRP leadership on the tape as broader market euphoria returns and sidelined traders chase.

At press time, XRP traded at $2.77.