Ethereum Exchange Balance Plunges Into Negative Territory For First Time Ever - Here’s Why Prices Could Skyrocket

Ethereum just hit a historic milestone that's sending shockwaves through crypto markets.

Exchange balances officially flipped negative for the first time in Ethereum's history. That means more ETH is leaving exchanges than entering them - a massive supply squeeze that typically precedes explosive price movements.

The Great ETH Exodus

Investors are yanking their Ethereum off trading platforms at unprecedented rates. Why? They're not looking to sell - they're moving into long-term storage, staking protocols, and decentralized finance applications. This mass migration from exchanges creates artificial scarcity that could send prices parabolic.

Supply Shock Mechanics

Fewer coins on exchanges means less selling pressure and thinner order books. When demand inevitably picks up - whether from institutional adoption or the next bull market frenzy - buyers will encounter dramatically reduced available supply. Basic economics takes over from there.

Traditional finance analysts might dismiss this as 'digital voodoo' while simultaneously wondering why their bond yields can't keep up with crypto's fundamental supply dynamics. The market doesn't care about skepticism - it cares about math.

This isn't just technical analysis - it's the market voting with its wallet. And right now, it's betting big on Ethereum's future.

Ethereum Exchange Balance = Negative

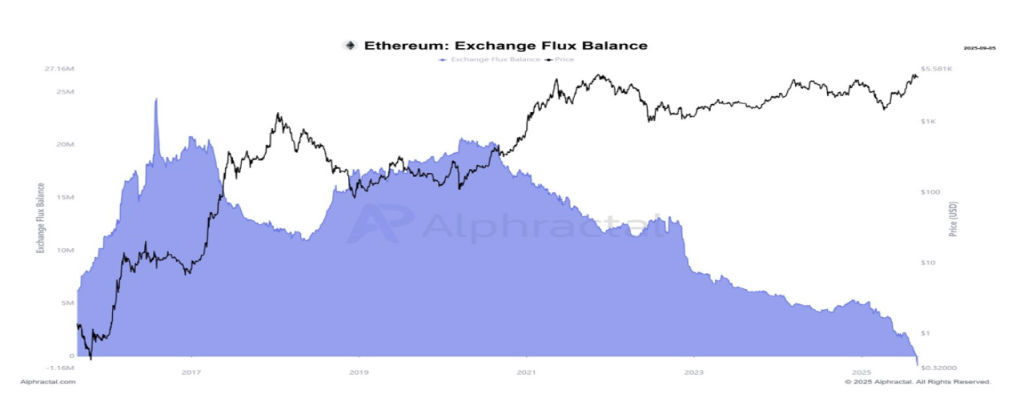

Crypto market expert Cas Abbe shared a new report showing that Ethereum’s exchange flux has slipped into the negative territory for the first time on record. He suggests that the latest development could be bullish for ETH, as it signals reduced selling pressure and growing investor confidence.

Historically, the exchange balance metric has served as one of the clearest indicators of investor behavior. When balances rise, it typically signals mounting selling pressure, as traders MOVE coins for liquidation purposes. Conversely, when they fall, it indicates that coins are being withdrawn into private wallets, which are less likely to be sold.

The analyst’s chart illustrates a sharp and accelerating drop in Ethereum’s exchange balances over the past few years, culminating in this historic low. Billions worth of ETH have been removed from centralized platforms, coinciding with the asset’s advance toward a target above $5,500. This indicates a clear reduction in liquid supply during already heightened demand.

According to Abbe, the importance of this decline cannot be overstated. He noted that market tops in crypto generally occur after inflows spike back into these centralized platforms, not when balances are draining to new lows. In other words, Ethereum may not be positioned for a sell-off but for accumulation.

As selling pressure subsides, long-term holders exert greater control over supply, creating conditions for potentially strong upward price momentum. If history is any guide, Abbe suggests that the shrinking exchange balance could set the stage for Ethereum’s next leg up.

Analyst Sets $7,000 As ETH’s Next Target

While Ethereum’s exchange supply hits uncharted lows, technical analysts like crypto Goos are increasingly bullish on its price. The market expert announced in a post on X that ETH has officially broken out of a long-term wedge pattern, which has constrained price action since 2021.

The accompanying chart illustrates ETH finally piercing through resistance after years of sideways trading. Crypto Goos points to the breakout level around $3,600, and with Ethereum now trading significantly above it, the move appears confirmed.

Although Ethereum has experienced a number of price swings in the past few weeks, Crypto Goos remains confident that it can reach a new all-time high soon. The analyst’s projection from the wedge breakout targets the $7,000 region, representing a potential upside of about 62% from current price levels above $4,300. Should momentum persist, the cryptocurrency could extend even beyond the $7,000 milestone.

Featured image from Unsplash, chart from TradingView