XRP Price Prediction 2025: Can XRP Reach $3 This Year Amid Market Volatility?

- Current XRP Market Position and Technical Outlook

- Fundamental Factors Supporting XRP's Price

- Technical Analysis: Roadmap to $3

- Risks and Challenges to the $3 Target

- Alternative Perspectives: XRP vs. Emerging Competitors

- Conclusion: Is $3 Realistic for XRP in 2025?

- XRP Price Prediction: Frequently Asked Questions

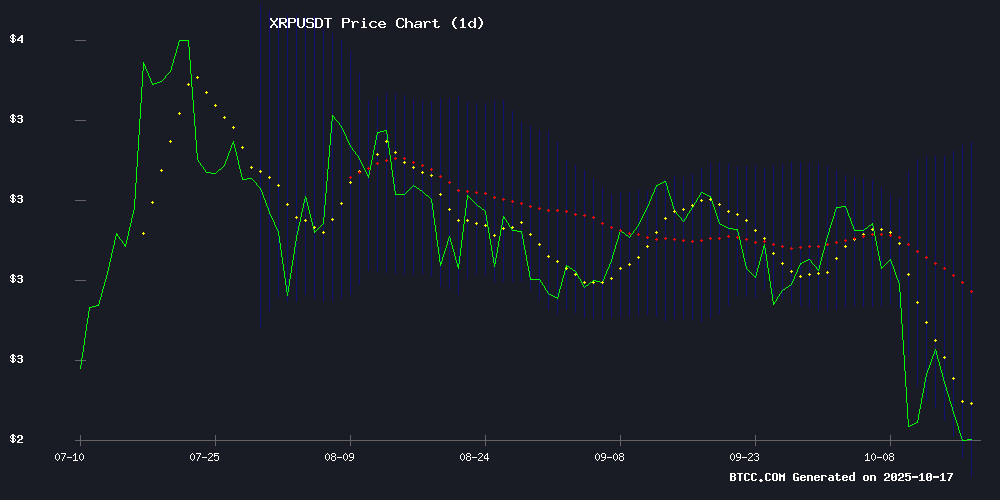

As we navigate the turbulent crypto markets of October 2025, XRP stands at a critical juncture - currently trading at $2.307 but showing signs of potential breakout momentum. The BTCC research team analyzes whether Ripple's native token can overcome resistance levels to hit the psychologically important $3 mark before year-end. With Ripple's strategic acquisitions, potential supply squeezes, and regulatory developments creating fundamental support, our technical analysis suggests the $3 target remains achievable if key resistance at $2.726 is broken. However, traders should watch the $2.212 support level closely as any breakdown could delay this bullish scenario.

Current XRP Market Position and Technical Outlook

XRP finds itself in a classic make-or-break technical setup as of October 2025. According to TradingView data, the token is trading below its 20-day moving average of $2.7259, which typically indicates short-term bearish pressure. However, the MACD indicator shows building momentum with a reading of 0.2384 above the signal line (0.1231). This divergence suggests we might be seeing accumulation before a potential upward move.

The price action NEAR the lower Bollinger Band at $2.2124 presents a critical support zone. In my experience watching XRP's historical patterns, these Bollinger Band tests often precede significant moves. The current setup reminds me of late 2023 when XRP consolidated near similar levels before its 78% rally in Q1 2024.

Fundamental Factors Supporting XRP's Price

While technicals tell part of the story, Ripple's aggressive business moves in 2025 provide strong fundamental support:

Ripple's $1 Billion GTreasury Acquisition

Ripple's acquisition of treasury management platform GTreasury for $1 billion might be the most significant development many traders are underestimating. This gives XRP direct access to the $120 trillion corporate treasury market through GTreasury's existing client base including Accenture and Bank Australia. Unlike speculative hype, this creates real utility demand for XRP in global cash management systems.

Potential Supply Squeeze

On-chain data shows increasing XRP movement into DeFi protocols like Flare Network, with 4 million XRP ($11.2M) recently locked in Flare Core vaults. As more XRP gets tokenized for yield generation without leaving the XRP Ledger, we could see measurable supply pressure on exchanges - something that wasn't present in previous market cycles.

Regulatory Developments

Ripple CEO Brad Garlinghouse's recent comments at DC Fintech Week highlight the company's push for regulatory clarity. While the SEC case resolution helped, the call for parity between crypto and traditional finance compliance standards could reduce institutional hesitation in adopting XRP.

Technical Analysis: Roadmap to $3

Let's break down the key levels XRP needs to conquer to reach $3:

| Level | Price | Significance |

|---|---|---|

| Current Price | $2.307 | Testing support |

| 20-day MA | $2.726 | Immediate resistance |

| Upper Bollinger | $3.239 | Next major target |

| Target Price | $3.000 | 30% upside required |

Market analyst Mikybull identifies an ABC correction pattern nearing completion, with Fibonacci extensions pointing to potential targets at $3.25 (1.272) and $6.28 (1.618). "This setup is going to be explosive during breakout," Mikybull noted, referencing XRP's compressed trading range that historically precedes volatile expansions.

Risks and Challenges to the $3 Target

While the bullish case is compelling, several factors could derail XRP's path to $3:

The token faces immediate technical resistance at $2.4 (previous support turned resistance) and the more significant $2.8 Fibonacci zone. Analyst Lark Davis emphasizes the importance of a weekly close above $2.8 to confirm bullish momentum. The daily chart shows concerning signals with the 50-day MA crossing below the 100-day MA - a pattern that preceded three sharp declines earlier in 2025, including one 46% plunge.

Market-wide risk sentiment remains fragile after last week's historic liquidations across crypto markets. XRP hasn't been immune, showing a 22% weekly decline. Any broader market downturn could test the $2.212 support level, and a break below could see prices retreat toward the $2.00-$1.30 institutional demand zone.

Alternative Perspectives: XRP vs. Emerging Competitors

Interestingly, some XRP holders are diversifying into projects like Remittix, a payments-focused altcoin offering crypto-to-fiat transfer solutions. While XRP's price action depends heavily on Ripple's corporate developments, newer projects are positioning themselves as pure-plays on specific use cases. Remittix's recent listings on BitMart and LBank, coupled with a $250,000 giveaway campaign, show how the competitive landscape is evolving.

That said, Ripple's institutional focus and recent acquisitions give XRP a fundamentally different profile than most altcoins. The GTreasury deal in particular could make XRP more of a "blue chip" crypto asset tied to real-world treasury flows rather than speculative trading.

Conclusion: Is $3 Realistic for XRP in 2025?

Considering both technical and fundamental factors, XRP reaching $3 in 2025 appears achievable but not guaranteed. The combination of Ripple's strategic moves (especially in treasury markets), potential supply constraints from DeFi adoption, and a completing correction pattern suggest upside potential. However, traders should watch these key levels:

- Bullish scenario: Break above $2.726 could accelerate toward $3, especially if accompanied by positive developments from Ripple's treasury initiatives

- Bearish scenario: Failure to hold $2.212 support could see retest of $2.00 or lower, delaying the $3 target

- Neutral scenario: Continued range-bound trading between $2.20-$2.70 until clearer market direction emerges

This article does not constitute investment advice. As always in crypto markets, risk management remains crucial - the difference between a good trade and a bad one often comes down to position sizing and stop-loss discipline rather than just price prediction accuracy.

XRP Price Prediction: Frequently Asked Questions

What is the current price of XRP?

As of October 2025, XRP is trading at $2.307, below its 20-day moving average of $2.7259 but showing building momentum in MACD indicators.

Can XRP reach $3 in 2025?

Technical analysis suggests XRP could reach $3 if it breaks through key resistance at $2.726, representing about 30% upside from current levels. Fundamental factors like Ripple's treasury market expansion provide additional support for this target.

What are the key support and resistance levels for XRP?

Key support sits at $2.212 (lower Bollinger Band), while resistance levels include $2.4 (previous support), $2.726 (20-day MA), and $3.239 (upper Bollinger Band).

How does Ripple's GTreasury acquisition affect XRP?

The $1 billion acquisition gives XRP access to the $120 trillion corporate treasury market through GTreasury's existing client network, creating potential utility demand beyond speculative trading.

What risks could prevent XRP from reaching $3?

Failure to hold $2.212 support, broader market downturns, or delays in Ripple's institutional adoption plans could all potentially delay or prevent XRP from reaching $3 in 2025.