Bitcoin Price Forecast 2025: Can BTC Realistically Reach $200,000 This Cycle?

- BTC Technical Analysis: Bullish Indicators vs. Reality Check

- Institutional Adoption: The Double-Edged Sword

- The $200,000 Question: Capital Requirements

- Regulatory Tailwinds From El Salvador

- Macroeconomic Wildcards

- Security Concerns in a Bull Market

- FAQ: Your Bitcoin Price Questions Answered

As bitcoin hovers around $121,000 in August 2025, the crypto community is buzzing about whether we'll see a push to $200,000 before year-end. The BTCC research team analyzes technical indicators, institutional adoption trends, and macroeconomic factors shaping Bitcoin's trajectory. While bullish signals abound - from El Salvador's progressive regulations to MicroStrategy's massive bets - significant capital inflows remain the critical factor for reaching that coveted $200k milestone.

BTC Technical Analysis: Bullish Indicators vs. Reality Check

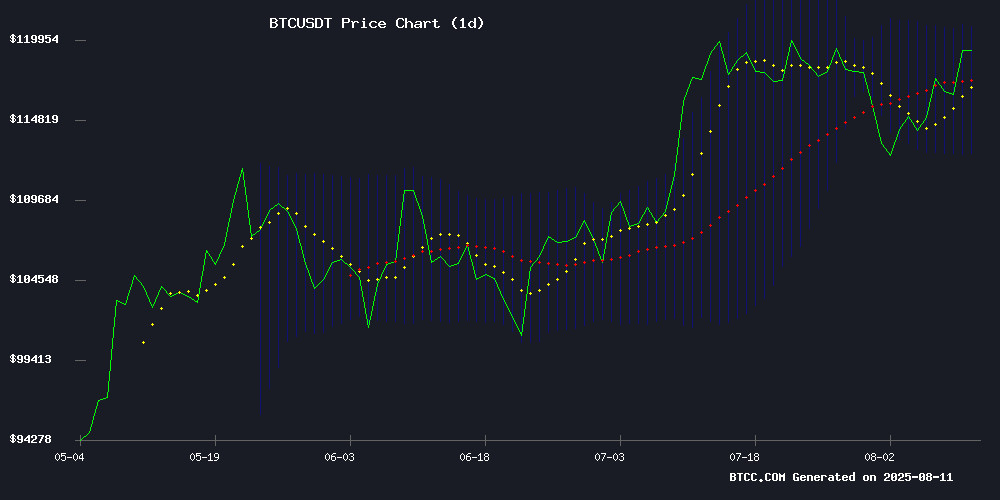

According to TradingView data, Bitcoin currently trades at $121,253.95, comfortably above its 20-day moving average of $116,852.57. The MACD histogram shows positive momentum at 198.52, while the price flirts with the upper Bollinger Band at $121,260.09.

Source: BTCC Exchange

"These technicals suggest continued upside potential," notes William from BTCC's analytics team. "But traders should watch for potential resistance at $125,000 - a psychological barrier that's rejected price advances twice this quarter."

Institutional Adoption: The Double-Edged Sword

The corporate Bitcoin treasury movement has reached staggering proportions in 2025. MicroStrategy alone holds $74 billion in BTC, while the top 100 corporate holders collectively own nearly 1 million coins. This institutional accumulation challenges Bitcoin's traditional four-year cycle theory.

Jason Williams, author of "The Bitcoin Standard for Institutions," declares: "The halving cycle is dead. Corporate buying now drives price discovery more than mining rewards." However, Bitwise's Matthew Hougan cautions that we won't know for certain until 2026 data confirms whether the pattern has truly broken.

The $200,000 Question: Capital Requirements

For Bitcoin to reach $200,000, its market cap WOULD need to grow by approximately 65% from current levels. Analyst Willy Woo puts this into perspective: "Bitcoin's $2.4 trillion valuation remains dwarfed by gold's $23 trillion. We're talking about attracting trillions more in institutional money."

| Metric | Current Value | Required for $200k BTC |

|---|---|---|

| Market Cap | $2.4 trillion | ~$4 trillion |

| Daily Volume | $85 billion | $120+ billion |

Regulatory Tailwinds From El Salvador

Bitcoin's recent 2.8% surge to $121,823 coincided with El Salvador's groundbreaking banking legislation. The new law allows regulated banks to offer digital asset services with $50 million minimum capital requirements. "This creates legitimate on-ramps for institutional money," explains a BTCC market strategist. "When banks can custody crypto for clients, it removes a major adoption barrier."

Macroeconomic Wildcards

This week's US economic data could make or break Bitcoin's rally. The July CPI report (forecast at 2.8% YoY) and PPI numbers will influence Fed rate decisions. Historically, Bitcoin has shown inverse correlation with dollar strength - so hotter inflation could pressure BTC prices.

Goldman Sachs analysts note: "Tariff implementations are contributing to price pressures. If inflation surprises to the upside, risk assets including crypto could see pullbacks."

Security Concerns in a Bull Market

Alena Vranova of SatoshiLabs warns about the dark side of rising prices: "Wrench attacks targeting crypto holders now occur weekly globally." These violent crimes - aimed at extracting private keys - have surged alongside Bitcoin's price appreciation. Centralized exchange data breaches have exposed over 80 million user identities, creating hunting grounds for criminals.

FAQ: Your Bitcoin Price Questions Answered

What are the key technical levels to watch for BTC?

The $125,000 level represents immediate resistance, while $116,000 serves as crucial support. A daily close above $125k could signal momentum toward $140,000.

How does institutional adoption affect Bitcoin's price?

Corporate buying reduces available supply, creating upward pressure. However, concentrated holdings also introduce new risks if these entities face financial stress.

What's the most realistic timeline for $200,000 Bitcoin?

Most analysts see late 2025 or early 2026 as plausible if current adoption trends accelerate. However, macroeconomic conditions could delay this projection.

How does Bitcoin's current rally compare to previous cycles?

This cycle differs fundamentally due to institutional participation. Retail-driven volatility has decreased while larger, more sustained moves characterize the current market structure.

What are the main risks to Bitcoin's price growth?

Regulatory crackdowns, macroeconomic shocks, security breaches, and over-leveraged institutional positions could all derail the rally.