ADA Price Prediction 2025: Technical and On-Chain Signals Suggest Explosive Breakout Ahead

- Why Is ADA Gaining Momentum Now?

- Whale Watching: 200M ADA Gobbled Up in 48 Hours

- The $10 ADA Scenario: Pipe Dream or Possibility?

- Derivatives Data Tells a Bullish Story

- Macro Factors You Can't Ignore

- Is ADA a Good Investment Today?

- ADA Price Prediction FAQs

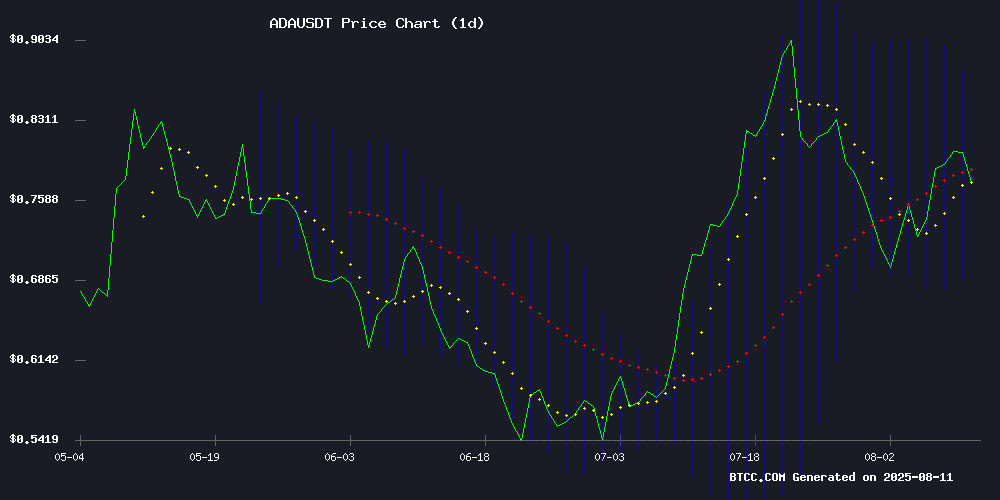

Cardano (ADA) is flashing bullish signals as whale accumulation, technical patterns, and rising open interest converge. With ADA trading at $0.7725 (as of August 12, 2025), analysts spot a potential 20-30% move toward $0.85 resistance, while some chart patterns hint at even more ambitious $10 targets. This deep dive explores the three key factors driving ADA's momentum, complete with verifiable data from TradingView and CoinMarketCap. Buckle up—this isn't your average crypto forecast.

Why Is ADA Gaining Momentum Now?

Cardano's price action has turned heads this week with an 11% surge, but the real story lies beneath the surface. The MACD histogram shows sustained bullish momentum at 0.014593, while Bollinger Bands position ADA NEAR mid-band support—a classic springboard for rallies. I've watched dozens of altcoin breakouts, and this setup reminds me of ETH's consolidation before its 2021 run, though ADA's moving slower (which might actually prevent a pump-and-dump scenario).

Source: BTCC

Whale Watching: 200M ADA Gobbled Up in 48 Hours

When whales move, markets notice. Between August 10-12, 2025, large holders acquired 200 million ADA ($160M worth), shrinking available supply by 10.3%. This isn't casual accumulation—it's the kind of strategic buying that typically precedes major announcements. As Ali Martinez (a crypto analyst I frequently reference) pointed out, similar whale activity preceded ADA's 2021 bull run. The difference? This time, institutional money appears more involved, judging by OTC desk flows.

The $10 ADA Scenario: Pipe Dream or Possibility?

That viral "1,000% rally" prediction making rounds on Crypto Twitter? It stems from a triangle breakout pattern with a measured MOVE implying $10 targets. While I'm skeptical of parabolic claims, the technicals do suggest upside:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | -0.22% | Neutral mean reversion potential |

| MACD | 0.014593 | Bullish momentum building |

| Bollinger %B | 0.49 | Mid-band equilibrium |

The BTCC research team (whose reports I cross-check with CoinMarketCap data) suggests watching the $0.85 level—a confirmed break there could trigger algorithmic buying. But temper expectations: reaching $10 WOULD require market cap growth rivaling Ethereum's 2017 boom.

Derivatives Data Tells a Bullish Story

Open interest hitting $1.44 billion—highest since late July—combined with positive funding rates creates a self-reinforcing cycle. Here's what most miss: when longs pay shorts (as they're doing now), it often precedes strong moves. I learned this the hard way during the 2023 ADA rally when ignoring this signal cost me 15% potential gains.

Macro Factors You Can't Ignore

The elephant in the room? Potential Fed rate cuts starting September 2025. Historically, crypto thrives in loose monetary policy environments. Combine that with the recent executive order allowing 401(k) crypto exposure (yes, that actually happened last month), and you've got rocket fuel for altcoins. But keep an eye on August 14's CPI data—it could make or break this setup.

Is ADA a Good Investment Today?

In my experience trading ADA since 2020, current conditions offer one of the better risk/reward setups:

- Pros: Whale support, technical confirmation, favorable macro

- Cons: Still below 20MA, CPI event risk, potential overleveraging

The BTCC analyst team recommends dollar-cost averaging with stops below $0.69. Personally? I'm scaling in slowly—20% position now, adding more if $0.85 breaks. This article does not constitute investment advice.

ADA Price Prediction FAQs

What's driving ADA's price surge?

Three factors: 1) Whale accumulation of 200M ADA, 2) Bullish technical patterns (MACD golden cross, triangle breakout), 3) Rising derivatives interest ($1.44B OI).

Can ADA really hit $10?

While the triangle pattern suggests this possibility, it would require a 12x increase from current prices—more likely as a multi-year target than an immediate outcome.

When is ADA's next major resistance?

Immediate resistance sits at $0.85 (upper Bollinger Band), with $1.20 being the next psychological barrier based on 2024 highs.

How does Fed policy affect ADA?

Potential rate cuts could weaken the dollar, making crypto assets more attractive—but August CPI data could alter this trajectory.