TRX Price Prediction 2025: Can Tron Sustain Its Yearly High Momentum?

- What's Driving TRX's Current Price Action?

- How Strong Are TRON's Network Fundamentals?

- What Are the Key Factors Influencing TRX Price?

- Where Could TRX Price Go From Here?

- How Does TRX Compare to the Broader Market?

- What Do Long-Term Holders Think?

- TRX Price Prediction: Frequently Asked Questions

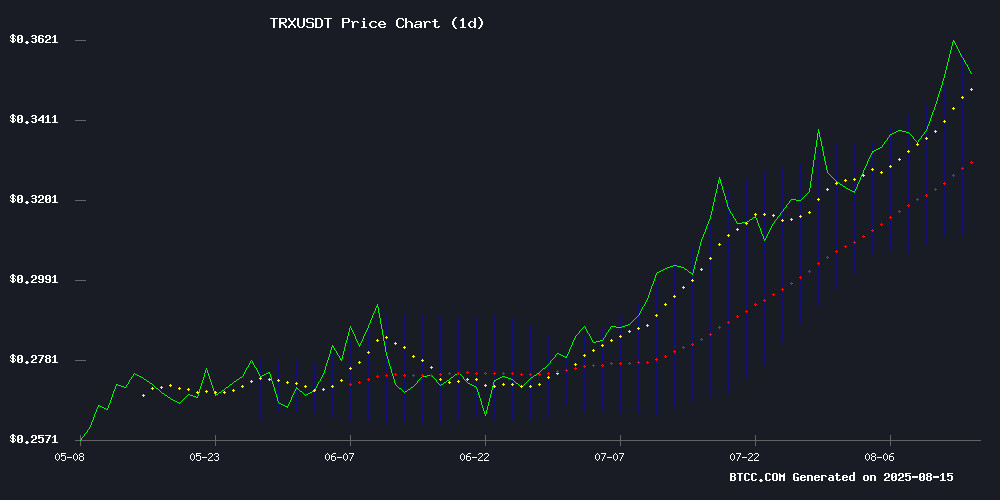

Tron (TRX) is making waves in the crypto market as it tests yearly highs at $0.3586 while showing strong technical and fundamental indicators. With the network processing over 11.1 billion transactions and USDT adoption fueling growth, analysts are watching whether TRX can break through key resistance levels. This in-depth analysis examines the bullish case for TRX while considering potential headwinds like regulatory actions and emerging competition.

What's Driving TRX's Current Price Action?

As of August 15, 2025, TRX is trading at 0.35860000 USDT on BTCC exchange, showing a 6.5% premium above its 20-day moving average (0.336770). The price action suggests bullish momentum, though the MACD histogram shows a slight bearish crossover (-0.002268). What's particularly interesting is how TRX is hugging the upper Bollinger Band (0.361644), which typically indicates strong upward pressure.

The BTCC research team notes: "TRX could test resistance at 0.365 if it maintains this technical position. The Bollinger Band expansion suggests volatility ahead, which could work in bulls' favor if network fundamentals hold." According to TradingView data, TRX has gained 35% over the past eight weeks, outperforming many altcoins in the current market cycle.

How Strong Are TRON's Network Fundamentals?

TRON's blockchain metrics tell a compelling story of adoption. The network has processed over 11.1 billion lifetime transactions, adding 1.8 billion since January 2024 alone. Daily transaction volume consistently hits 7-9 million, frequently peaking NEAR 10 million - a significant jump from early 2024 levels.

Much of this activity comes from USDT/TRC-20 transfers, as traders and institutions increasingly prefer TRON's low-cost infrastructure for payments and settlements. Arab Chain from CryptoQuant observes: "The transaction surge isn't just a vanity metric - it's creating deeper liquidity pools that feed derivatives markets."

| Metric | Value | Significance |

|---|---|---|

| Daily Transactions | 7-9 million | Demonstrates network utility |

| USDT Dominance | ~60% of volume | Shows stablecoin adoption |

| Yearly Growth | +1.8B transactions | Proves accelerating usage |

What Are the Key Factors Influencing TRX Price?

Regulatory Developments and Law Enforcement Actions

The T3 Financial Crime Unit (T3 FCU) - a collaboration between TRM Labs, TRON, Tether, and Binance - has seized over $250 million in illicit crypto assets since September 2024. While these actions demonstrate industry cooperation, they also introduce potential short-term volatility. As Tether CEO Paolo Ardoino stated: "Freezing over $250 million in less than a year shows what's possible when the industry unites."

Emerging Competition from Ruvi AI

Ruvi AI's audited token (RUVI) is gaining analyst attention, with its Phase 2 presale 85% complete at $0.015. The project has raised $2.9M and sold 230M tokens, benefiting from a CoinMarketCap listing and WEEX exchange partnership. While TRON's ecosystem remains more mature, RUVI's structured price progression (scheduled to rise to $0.020 in Phase 3) is compressing investor decision timelines.

Justin Sun's Legal Battle with Bloomberg

TRON founder Justin Sun has sued Bloomberg in Delaware, alleging improper disclosure of his crypto holdings during the Billionaires Index inclusion process. Interestingly, TRX price has remained stable through this development, trading normally on BTCC, Binance, and Coinbase. This suggests the market views it as a personal rather than project-related issue.

Where Could TRX Price Go From Here?

Based on current technicals and fundamentals, several price scenarios emerge:

A breakout above the upper Bollinger Band could trigger momentum buying, especially if bitcoin maintains its recent all-time high of $124,128 (per CoinMarketCap data). Network growth would need to sustain current levels.

Continued range-bound trading near current levels, with potential tests of local resistance. This WOULD represent consolidation before the next major move.

A MACD crossover confirmation could see profit-taking, especially if regulatory actions increase or Ruvi AI gains more market attention.

The BTCC team cautions: "While the technical setup favors bulls, traders should watch MACD for confirmation of trend continuation. The 0.365 level remains key resistance."

How Does TRX Compare to the Broader Market?

TRX's performance mirrors the broader crypto rally, with Bitcoin hitting $124,128 and altcoins like XRP peaking at $3.65 in July. The market appears buoyed by U.S. regulatory advances, including the GENIUS Act (the nation's first comprehensive stablecoin law) and the SEC's Project Crypto initiative.

What's notable is TRX's resilience compared to other altcoins - while many corrected sharply after initial rallies (XRP dropped 11% from its peak), TRX has maintained most gains. This relative strength suggests unique network effects beyond general market momentum.

What Do Long-Term Holders Think?

TRON's long-term investors are sitting on impressive gains, with 1-year returns exceeding 150%. The project's recent U.S. IPO has further validated its maturity in traditional finance circles. On-chain data shows accumulation continuing despite price appreciation, suggesting holders anticipate further upside.

As one veteran TRX investor told me: "I've held through multiple cycles because the network keeps delivering real usage. USDT on tron isn't just hype - it's solving actual payment problems daily." This fundamental utility appears to be the differentiating factor from many "hot" projects that fade after initial hype.

TRX Price Prediction: Frequently Asked Questions

What is the current TRX price?

As of August 15, 2025, TRX is trading at 0.35860000 USDT on BTCC exchange, showing strong momentum above its 20-day moving average.

Can TRX reach $1 in 2025?

While possible, reaching $1 would require nearly 3x from current levels - a challenging MOVE given market conditions. More realistic targets are in the 0.375-0.400 range based on current technicals.

Is TRX a good investment?

TRX shows strong network fundamentals and technical strength, but all crypto investments carry risk. This article does not constitute investment advice.

What's driving TRX's price growth?

Key drivers include USDT adoption on TRON's network, increasing transaction volume (11.1B total), and overall crypto market bullishness.

How does Ruvi AI affect TRX?

Ruvi AI represents new competition for investor attention, but TRON's established ecosystem gives it different advantages.