Bitcoin's whale dominance crumbles as major holders execute their most significant distribution since 2022.

Whale Supply Collapse

Large holder supply plummeted to levels not seen in seven years—because nothing says 'confidence' like billionaires quietly exiting while retail gets hailed as 'the future of finance.' The selloff represents the largest coordinated whale departure in three years, suggesting institutional players might know something the Twitter influencers don't.

Market Impact Dynamics

This mass exodus creates immediate liquidity pressure while simultaneously removing major overhangs—classic Wall Street behavior dressed in crypto clothing. The movement signals potential volatility ahead as the market digests these substantial transfers.

Retail vs Whale Standoff

With whale dominance at multi-year lows, retail traders now face the ultimate test of conviction against professional money making calculated exits. Because when the so-called 'smart money' flees, it's either a brilliant contrarian opportunity or a warning sign that would make even traditional finance brokers blush.

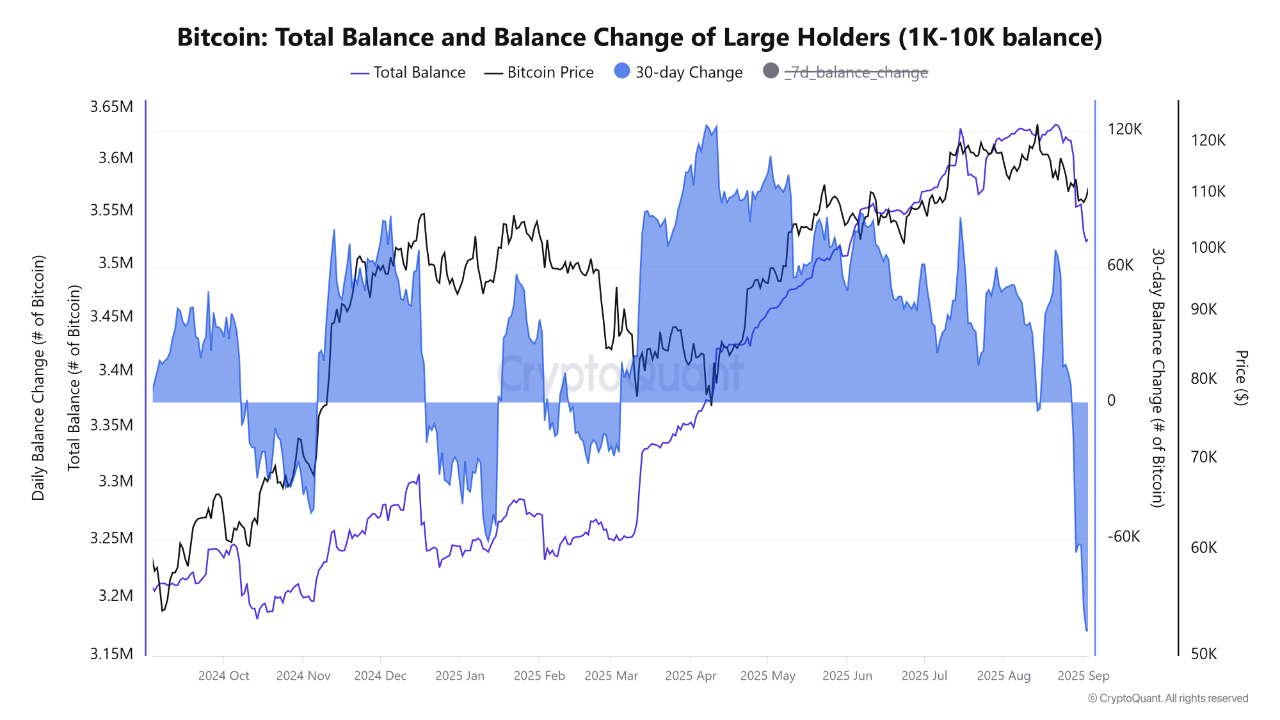

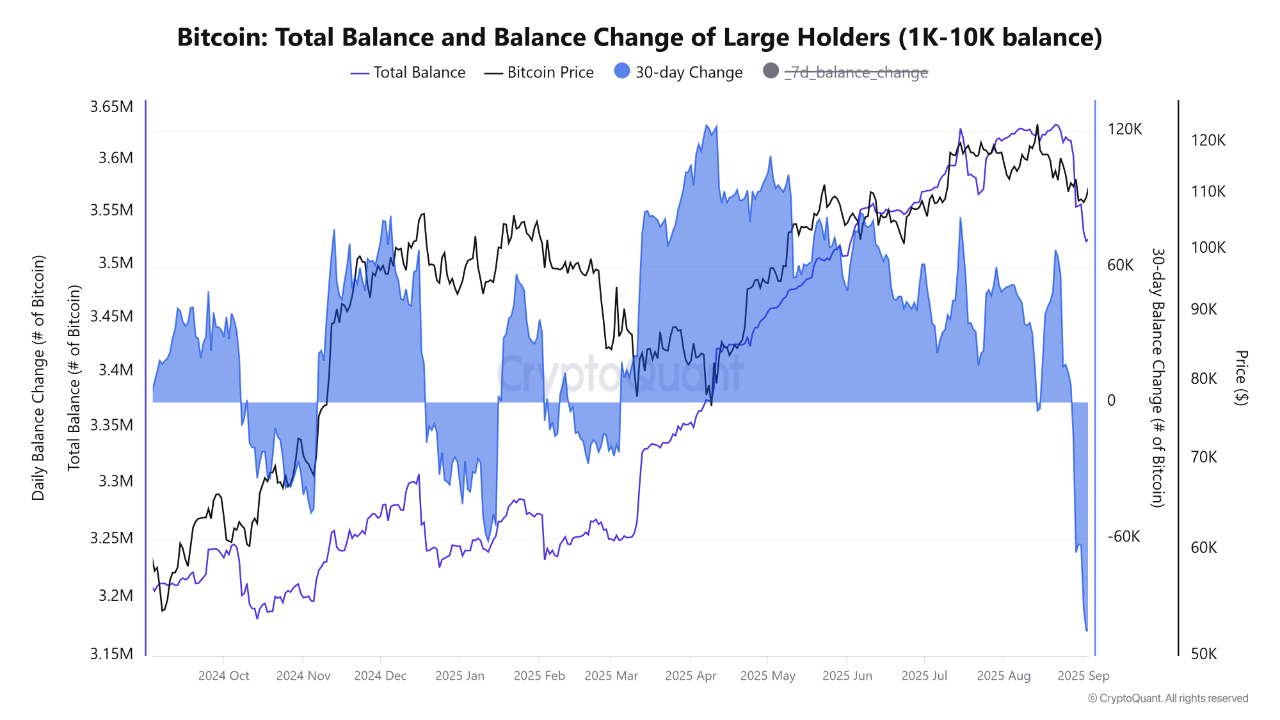

Bitcoin Whale Balance Change | CryptoQuant

Meanwhile, data from Glassnode shows whale supply has fallen to its lowest level in seven years. Notably, some traders see this as a sign of weakness, but others believe it points to a healthier spread of coins across the market, which strengthens Bitcoin's decentralization.

Bitcoin Supply Per Whale | Glassnode

Glassnode reported that the average

bitcoin balance per whale has been shrinking since November 2024. Specifically, entities holding between 100 BTC and 10,000 BTC now sit on an average of just 488 coins, a level not seen since December 2018.

Meanwhile, in a separate analysis, Glassnode described Bitcoin's current position as a consolidation phase. The premier crypto asset has been trading in a tight zone between $104,000 and $116,000 after a period of strong absorption by investors.

https://twitter.com/glassnode/status/1963510767397044596

The firm noted that both futures activity and ETF flows reflect weaker demand at the moment. It explained that a clear move above $116,000 could bring the uptrend back to life, but if the market breaks lower, prices could slide toward the $93,000 to $95,000 range.

Bitcoin Close to Cycle End?

Also, market analyst Crypto Birb recently discussed Bitcoin's current price position. He calculated that Bitcoin has run for 1,017 days since the November 2022 bottom.

According to him, past cycles peaked between 1,060 and 1,100 days, which points to a potential top forming between late October and mid-November this year. This is around fifty days from now.

Further, he highlighted the historical pattern following halvings. Notably, peaks usually happen 518 to 580 days after the event, and since the April 2024 halving occurred 503 days ago, Bitcoin is now between 77% and 86% through that window.

Bitcoin Price After Halvings |

crypto Birb

He said this puts the market inside the "hot zone," a stage when investors need to act with extra caution. Birb warned that every prior peak has led to a steep drop of 70% to 80% within the next 370 to 410 days, making a 2026 bear market almost certain.

He pointed out that Bitcoin recently pulled back to $109,800 from its August high of $124,100. According to him, local support sits between $107,700 and $108,700, while resistance lies near $113,000 to $114,100. He cautioned that a drop below support could invite stronger selling, but holding those levels would keep the structure intact.

Bitcoin Whale Balance Change | CryptoQuant

Meanwhile, data from Glassnode shows whale supply has fallen to its lowest level in seven years. Notably, some traders see this as a sign of weakness, but others believe it points to a healthier spread of coins across the market, which strengthens Bitcoin's decentralization.

Bitcoin Whale Balance Change | CryptoQuant

Meanwhile, data from Glassnode shows whale supply has fallen to its lowest level in seven years. Notably, some traders see this as a sign of weakness, but others believe it points to a healthier spread of coins across the market, which strengthens Bitcoin's decentralization.