SOL Price Prediction 2025-2040: Expert Outlook & Key Market Drivers

- Where Is SOL Price Headed in 2025?

- Institutional Demand: The SOL ETF Phenomenon

- Technical Analysis: The Battle at Key Levels

- Long-Term SOL Price Projections: 2025-2040

- Frequently Asked Questions

Solana (SOL) stands at a crossroads in 2025, with institutional demand surging while technical indicators flash mixed signals. Our comprehensive analysis examines SOL's critical support levels, ETF inflows hitting record highs, and long-term price projections through 2040. The BTCC research team combines on-chain data, technical patterns, and institutional sentiment to provide a 360-degree view of Solana's potential trajectory.

Where Is SOL Price Headed in 2025?

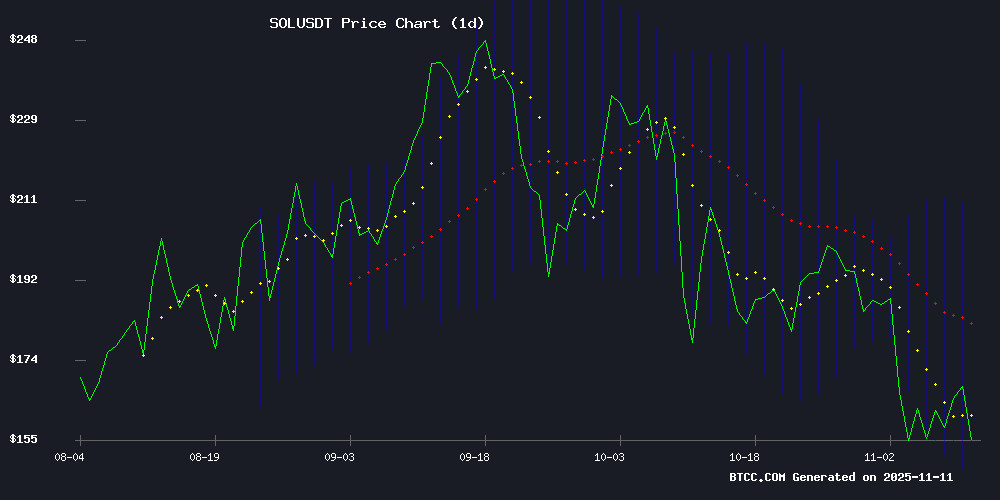

As of November 2025, SOL trades at $156.77 - below its 20-day moving average ($177.93) but showing bullish MACD crossover signals. The cryptocurrency finds itself at a make-or-break technical juncture:

"SOL needs to hold above $145 to avoid further downside," notes a BTCC market analyst. The lower Bollinger Band at $145.59 currently acts as critical support, while resistance looms at $177. This tight trading range reflects the market's uncertainty despite strong fundamentals.

Institutional Demand: The SOL ETF Phenomenon

Solana has become Wall Street's favorite altcoin, with ETF inflows shattering records:

- $323 million in spot ETF inflows over eight consecutive days

- $2.1 billion total inflows over nine weeks

- Major players like Rothschild Investment taking positions

The Volatility Shares SOLZ ETF alone attracted $132,720 from Rothschild's $1.5 billion portfolio. This institutional stamp of approval provides fundamental support that could outweigh short-term technical weakness.

Technical Analysis: The Battle at Key Levels

SOL's price action presents a fascinating divergence between indicators:

| Indicator | Reading | Implication |

|---|---|---|

| 20-day MA | $177.93 | Bearish (price below) |

| MACD | 5.63 (bullish crossover) | Potential upward momentum |

| Bollinger Bands | Testing lower band ($145.59) | Possible reversal point |

This technical tug-of-war creates what traders call a "compression zone" - the calm before a potential volatile move. The resolution of this pattern could set SOL's trajectory for months to come.

Long-Term SOL Price Projections: 2025-2040

Based on current adoption trends and technological developments, here's our outlook:

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2025 | $180-$220 | $250-$300 | $350+ |

| 2030 | $500-$700 | $800-$1,200 | $1,500+ |

| 2035 | $1,800-$2,500 | $3,000-$4,000 | $5,000+ |

| 2040 | $5,000-$7,000 | $8,000-$10,000 | $12,000+ |

Key drivers include:

- Institutional adoption through ETFs and traditional finance

- Solana's scalability advantages over competitors

- Developer activity and dApp ecosystem growth

- Broader cryptocurrency market trends

Frequently Asked Questions

What's driving SOL's institutional demand?

The combination of Solana's high throughput capabilities and new regulatory clarity around staking has made it particularly attractive to traditional finance players. ETFs provide a familiar vehicle for institutional exposure.

How reliable are long-term crypto price predictions?

While historical patterns and fundamental analysis can inform projections, cryptocurrency remains highly volatile. These forecasts should be viewed as potential scenarios rather than guarantees.

What's the most important SOL price level to watch?

The $145-$155 zone represents critical support. A sustained break below could signal further downside, while holding above may confirm institutional accumulation at these levels.

How does Solana compare to Ethereum in terms of adoption?

While ethereum maintains the larger developer community and TVL, Solana's transaction speed and lower costs have made it attractive for specific use cases like decentralized finance and NFTs.