Nvidia’s Market Cap Now Dwarfs Real Estate, Utilities & Materials Sectors Combined

The AI chipmaker's valuation has reached a staggering milestone—surpassing three cornerstone industries combined. What does this say about our tech-dominated future?

Nvidia's relentless rally defies traditional sector weightings, proving silicon now commands more economic power than bricks, power grids, and raw materials. Wall Street analysts scramble to justify valuations while quietly trimming positions.

One hedge fund manager quipped: 'At this rate, we'll soon value Nvidia in GDP equivalents rather than market cap.' The company now represents over 15% of the entire S&P 500's tech sector.

Meanwhile, legacy sector ETFs bleed assets as pension funds chase AI dreams. The great rotation isn't coming—it's already here, and it's wearing an RTX 6090.

Nvidia Continues to Shock the World

Per the latest report by the Kobeissi Letter, Nvidia is now the biggest in terms of size and valuation. The platform took to X to report a series of shocking facts about Nvidia, adding how the firm reflects 8.5% of the S&P 500 and is now larger than 6 of 11 indexes.

Moreover, KL was quick to emphasize how Nvidia is now bigger than real estate, materials, and utilities combined, taking the market by sweet surprise.

Shocking stat of the day:

Nvidia now reflects a record 8.5% of the S&P 500 and is now larger than 6 of the index's 11 sectors.

It is now larger than the Materials, Real Estate, and Utilities sectors combined.

With a market cap of ~$5.1 trillion, Nvidia also surpasses the… pic.twitter.com/xl9epUcXqa

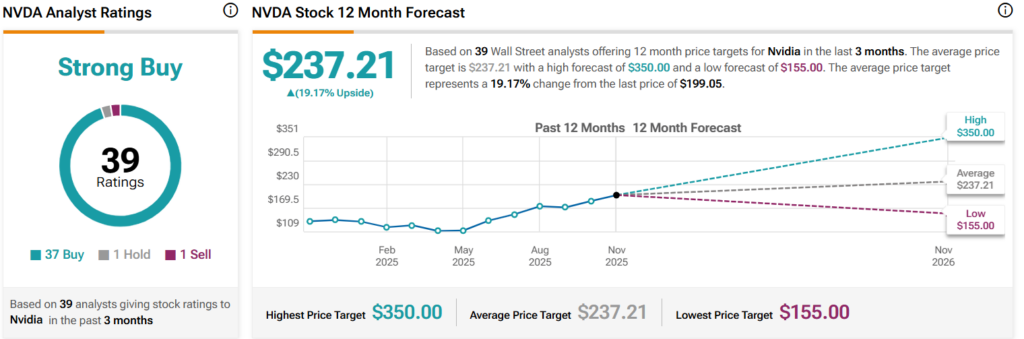

Next 12 Months Outlook

According to TipRanks NVDA stats, the firm’s stock is targeting $350, which it may be able to achieve within the next 12 months.