From $310 to $3M: How an Early Ethereum ICO Investor Struck Crypto Gold

The ultimate crypto rags-to-riches play—turning pocket change into generational wealth. One investor’s $310 bet on Ethereum’s 2014 ICO ballooned to $3 million by 2025. No VC connections, no insider tips—just raw conviction in decentralized tech before it went mainstream.

The Unstoppable Ascent

While Wall Street scoffed at ‘magic internet money,’ Ethereum’s pioneers quietly built the foundation for DeFi, NFTs, and smart contracts. Early adopters who ignored the noise reaped life-changing returns—proving once again that the biggest financial revolutions start as punchlines.

A Modern-Day Alchemy

For context: That’s a 967,642% return—enough to turn every dollar into nearly $10,000. Try getting that from your financial advisor’s ‘diversified portfolio.’ The kicker? This isn’t even Ethereum’s all-time high performance—just another reminder that in crypto, patience beats timing the market every time.

The Cynic’s Corner

Meanwhile, traditional finance is still charging 2% fees for the privilege of underperforming Bitcoin. Some things never change.

From a $310 investment in the ICO, it is now worth $3.13M, a 10,097x return. pic.twitter.com/55uP8qTLvc — Cointelegraph (@Cointelegraph) November 17, 2025

Will The ICO Wallet Sell Its Ethereum Holdings?

Ethereum (ETH) experienced quite a bullish outbreak earlier this year. The asset climbed to an all-time high of $4,946.05 in August, hitting a new peak after nearly four years. The ICO wallet may sell the 200 ETH and book profits, given the bearish market environment.

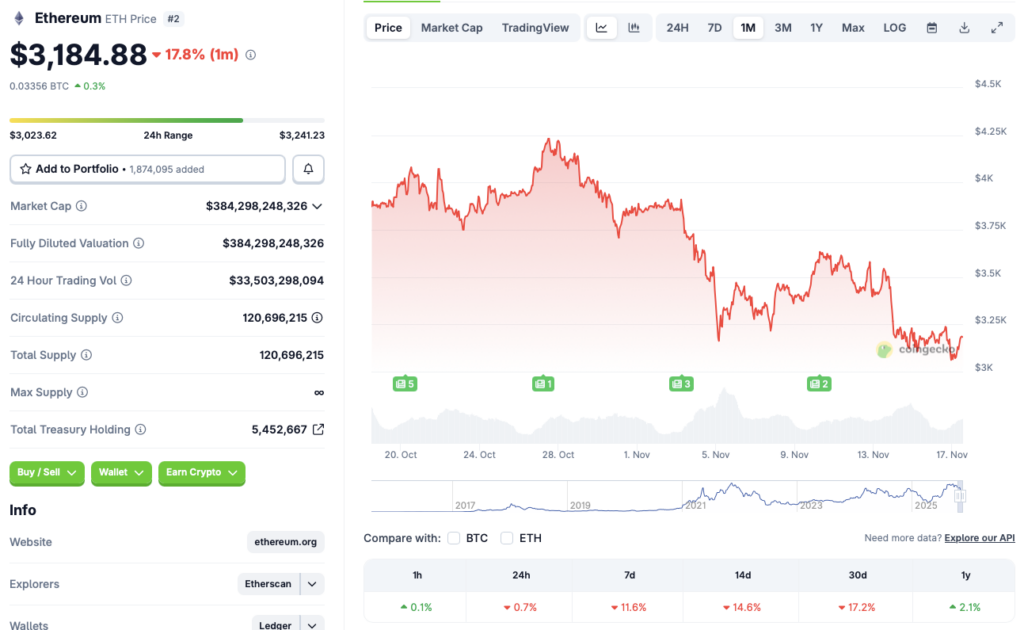

The crypto market has taken a beating over the last month. Ethereum (ETH) is also following the market downtrend. According to CoinGecko data, the second-largest crypto by market cap has fallen 0.7% in the last 24 hours, 11.6% in the last week, 14.6% in the 14-day charts, and 17.2% over the previous month.

Ethereum (ETH)’s current predicament could be due to a dip in ETF inflows. ETFs have played a major role in the current market cycle. Moreover, retail investors are likely moving away from risky assets, such as cryptocurrencies. The chances of another interest rate cut in 2025 have significantly diminished. The Federal Reserve’s cautionary outlook may have led to investors moving to SAFE havens, such as gold.

According to CoinCodex analysts, Ethereum (ETH) will break its current pattern over the coming week. The platform anticipates the asset to rally over the next few months, hitting a new all-time high of $5372.73 on Feb. 12, 2026. Hitting $5372.73 from current price levels will entail a rally of about 68.6%.