Bitcoin December Outlook: Bullish Seasonal Patterns Signal Potential Rally

December's historical performance suggests Bitcoin could be gearing up for a year-end surge that leaves traditional finance shaking its head.

Seasonal Momentum Building

Historical data reveals December has consistently been one of Bitcoin's strongest performing months, with average returns outpacing most traditional assets. The cryptocurrency's tendency to rally during the final month of the year has become almost predictable—something Wall Street analysts still can't quite comprehend.

Institutional Inflows Accelerating

Major financial institutions continue allocating to Bitcoin despite the traditional holiday slowdown. While portfolio managers are busy with year-end bonuses and holiday parties, digital asset accumulation quietly continues behind the scenes.

Technical Setup Favors Bulls

Key resistance levels appear vulnerable as trading volume patterns align with previous December breakouts. The charts are painting a picture that technical analysts love—unless they're still trying to apply traditional valuation models to something that fundamentally rewrites the rules.

While traditional markets obsess over Santa Claus rallies, Bitcoin investors might just find their presents arriving early this year—proving once again that sometimes the best investment strategy involves ignoring conventional wisdom entirely.

Analysts’ Call For BTC

According to Ash Crypto, a leading BTC expert, BTC’s weekly candle has closed above the 4-year trend key level. The token is currently sitting at the macro long-term headline, a trend that has nagged the asset for 4 years now. As long as BTC manages to hold this line, the token will sail smoothly, hitting new highs eventually.

BITCOIN weekly candle closed above the 4-year Trend Key level

BTC is sitting right on the macro long-term trendline that’s held the market together for 4 years.

This level has acted as major resistance 3 times over the last 3 years, now flipping as strong support.

As long as… pic.twitter.com/Y6WuGu57Vk

Another leading analyst, Tara, took to X to share how BTC is slowly reclaiming its former glory path. Per Tara, BTC needs to break past the $86K and $94K lines to breeze through resistance and reclaim its former asset glory.

Hey guys!![]() #Bitcoin has reached our first resistance at $86.8k! The RSI is pretty strong and looking like it could want that higher resistance but I'm waiting for a break above the last high at $88.3k to really confirm- that level is now LTF resistance!

#Bitcoin has reached our first resistance at $86.8k! The RSI is pretty strong and looking like it could want that higher resistance but I'm waiting for a break above the last high at $88.3k to really confirm- that level is now LTF resistance!

Since #BTC is ABOVE… pic.twitter.com/BNL2rQcKFi

Technical Pattern for BTC

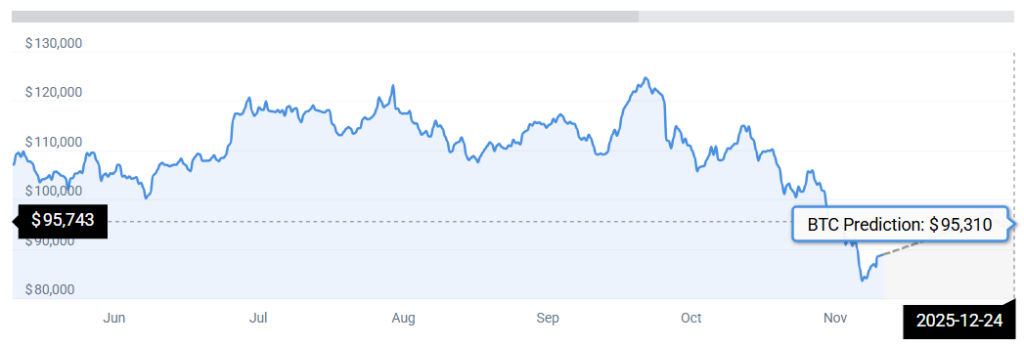

The latest Bitcoin price prediction for December by Coincodex adds that BTC is on a path to claim $95K by December 2025.