Bitcoin Shatters Resistance Barrier: $95,000 Looms as the Next Major Challenge

Bitcoin just bulldozed through a critical price wall that had traders sweating for weeks. The move signals a major shift in market structure—and sets the stage for a run at the next psychological milestone.

The Path to Five Figures

Forget gradual climbs. This was a clean breakout, the kind that forces skeptics to check their charts twice. The momentum isn't just technical; it's fueled by a cocktail of institutional inflows and a narrative that traditional finance is finally, grudgingly, making room at the table. The old resistance level now flips to support—a classic bull market playbook move.

What's Fueling the Charge?

Look beyond the lines on a graph. Adoption metrics are ticking up, network activity remains robust, and the macro backdrop for hard assets hasn't vanished. It's a reminder that crypto markets move in cycles of accumulation and explosive recognition—we appear to be in the latter phase. Of course, a few Wall Street veterans are probably still trying to short it with their 'this time it's different' thesis.

The $95,000 Question

All eyes are now fixed on the next big number. Reaching it won't be a Sunday stroll—expect volatility, pullbacks, and the usual chorus of 'bubble' calls from commentators who missed the last ten rallies. The market's job is to inflict maximum pain on the most people, and right now, that pain is being felt by anyone sitting on the sidelines in cash. The climb continues, one skeptical hedge fund manager at a time.

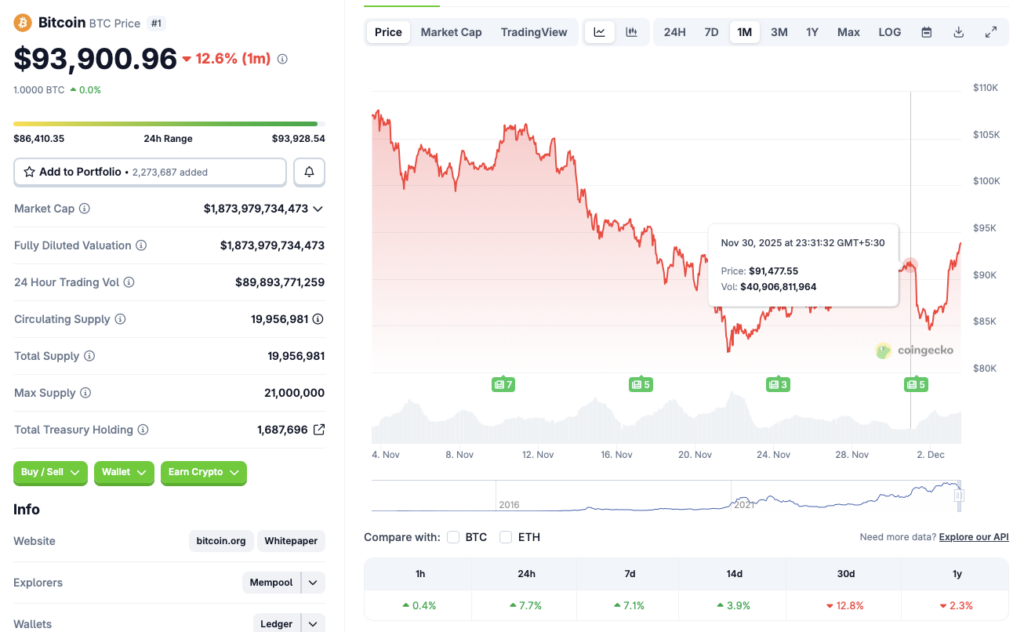

Source: CoinGecko

Source: CoinGecko

Can Bitcoin’s Rally Push It Past $95,000?

The recent market rebound could be due to the futures market showing improvements. Moreover, the high chances of another interest rate cut later this month may have boosted investor sentiment. bitcoin (BTC) and other risky assets could benefit from another rate cut.

Bitcoin’s (BTC) next challenge may arise around the $95,000 price point, a level last unsuccessfully tested in mid-November 2025. Breaking past $95,000 could push BTC beyond the $100,000 mark once again. The original crypto is currently down by 25.6% from its all-time high of $126,080, which it attained in October 2025. A rate cut could lead to BTC hitting a new all-time high.

Grayscale is also quite bullish on Bitcoin’s (BTC) performance over the coming months. The financial institution put out a report that said that BTC may follow a 5-year cycle, instead of the usual 4-year cycle. Grayscale anticipates BTC to hit a new all-time high sometime in 2026 before facing a dip.

ETF inflows are also expected to increase over the coming weeks, which may further fuel Bitcoin’s (BTC) price.

CoinCodex analysts anticipate Bitcoin (BTC) to dip to $91,000 and consolidate for the remainder of the year, before hitting the $100,000 mark in late January 2026.