Bitcoin Mining Now Bolstering Russian Ruble, Central Bank Reports

Forget gold reserves—Russia's central bank is pointing to a new, digital-age asset strengthening the national currency.

The Crypto-Powered Pivot

In a move that flips the traditional sanctions-busting script, official analysis suggests Bitcoin mining operations are generating a tangible inflow of foreign currency. The mechanism is starkly simple: mint digital assets domestically using cheap power, sell them on international markets for dollars or euros, and bring that hard currency back home. It's a capital flow that bypasses traditional banking corridors entirely.

The Miner as Exporter

This reframes the crypto miner not as a mere energy consumer, but as a de facto export industry. Each solved block becomes a micro-export transaction, with the proceeds—often in currencies more stable than the ruble—feeding directly into the Russian financial system. It's a form of digital trade surplus, built on proof-of-work rather than barrels of oil.

A Provocative Hedge

The revelation highlights cryptocurrency's dual nature as both a speculative playground and a pragmatic financial tool for nations under economic pressure. While Wall Street debates ETFs, entire countries are quietly building monetary hedges with server racks and ASICs—proving that in global finance, the most cynical move is often the most practical one.

Russia Aiming to Become a Major Bitcoin Mining Superpower?

Bitcoin (BTC) has seen increasing interest among nations as the original crypto hit higher prices. The US has taken a strong position in the crypto landscape, especially after Donald Trump came to power earlier this year.

It is no surprise that Russia has also amped up its bitcoin (BTC) game over the last year. According to reports, the country produced 35,000 BTC this year at a low cost of roughly $39,000 per coin versus $92,000 market value.

Will The Asset Rebound From Its Price Crash?

Bitcoin (BTC) has faced a steep price crash in the latter part of 2025. The asset hit multiple peaks over this year, with its most recent high of $126,080 in October. However, since October, BTC’s price has taken a significant beating.

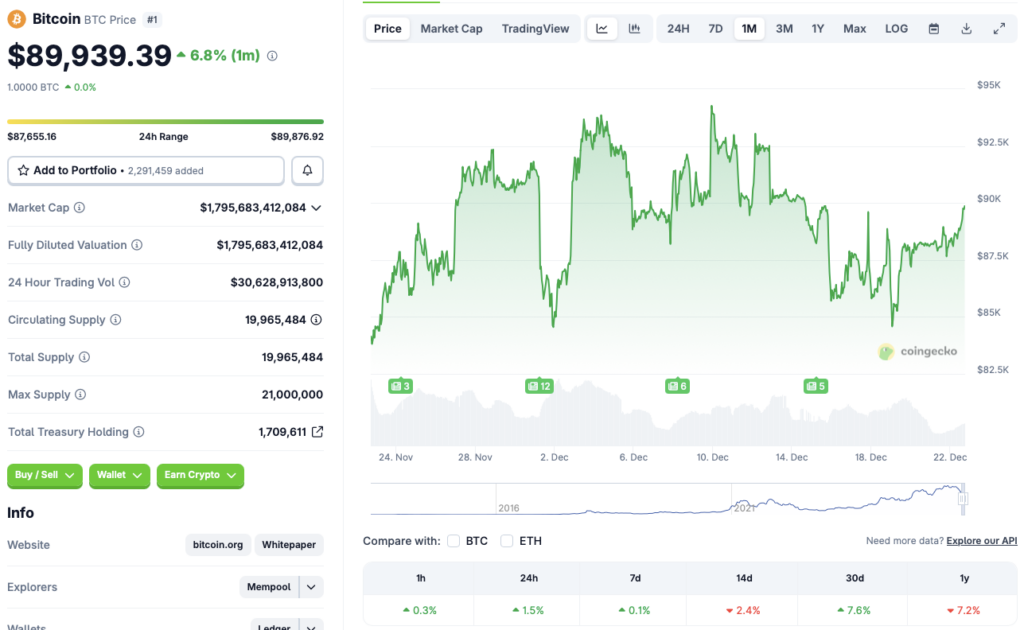

Bitcoin (BTC) is showing signs of a recovery, but the journey may take longer than many hope. According to CoinGecko’s Bitcoin data, BTC’s price has rallied 1.5% in the last 24 hours, 0.1% in the last week, and 7.6% over the previous month. However, the asset is still down by 2.4% in the 14-day charts and 7.2% since December 2024. BTC’s price has also fallen by more tha 26% from its all-time high.

Many anticipate Bitcoin (BTC) to enter a bullish phase in 2026. Grayscale and Bernstein, in particular, anticipate BTC to hit a new all-time high next year. Bernstein predicts BTC to finally breach the $150,000 mark in 2026, eventually hitting $200,000 in 2027.