XRP Defies Gravity at $1.90: Is a $3+ Surge Inevitable by 2026?

XRP isn't just holding the line—it's building a fortress at $1.90. The digital asset, long a lightning rod for regulatory drama, has settled into a stubborn consolidation that has traders and skeptics alike asking the same question: what's next?

The $3 Horizon: Speculation or Inevitability?

Forget incremental gains. The chatter on trading floors and crypto forums has shifted from 'if' to 'when' for the $3 benchmark. The 2026 timeline isn't pulled from thin air; it's a calculated projection based on current momentum, pending ecosystem developments, and the ever-present hope that the wider market will catch another bull wave. It's a target that transforms XRP from a payment token into a potential high-stakes bet.

Beyond the Price Tag: The Real Battlefield

The number on the screen tells only half the story. XRP's true value proposition—facilitating blisteringly fast, cross-border settlements—faces its own hurdles. Adoption by financial institutions remains a slow, grinding process, often outpaced by the hype cycle. Meanwhile, a chorus of traditional finance pundits still dismiss the entire sector as a casino, a cynical view that conveniently ignores the trillions in fees their own legacy systems extract annually.

The Verdict: Patience as a Strategy

Predicting crypto is a fool's errand, but identifying strong positions isn't. At $1.90, XRP demonstrates resilience. The path to $3 by 2026 is less about wild speculation and more about the gradual execution of a real-world utility play. It won't be a straight line up—expect volatility, regulatory noise, and the usual market theatrics. But for those watching the foundations being laid, not just the ticker, the steady hold at current levels is the most compelling headline of all.

Will XRP Reclaim $3 In 2026?

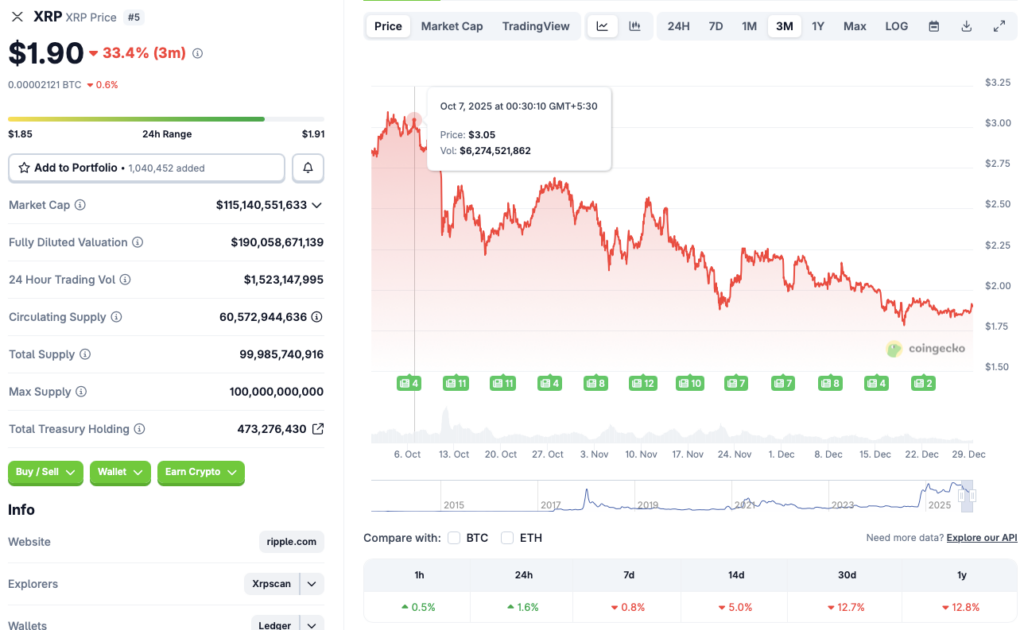

XRP last traded above the $3 mark in October of this year. October also saw Bitcoin (BTC) climbing to a new all-time high of $126,080. However, the crypto market faced substantial outflows following BTC’s ascent to a new peak.

According to CoinGecko data, XRP’s price has seen a 1.6% rally in the daily charts, but is down in the other time frames. The asset’s price has dipped 0.8% in the last week, 5% in the 14-day charts, 12.7% over the previous month, and 12.8% since December 2024.

XRP and the larger crypto market have fallen victim to macroeconomic uncertainties. The economic worries led to the most significant liquidation event in crypto history in October. Since then, the market has struggled to regain its lost momentum. XRP will likely follow the larger market trend over the coming weeks. If macroeconomic conditions improve, the crypto market could see increased inflows.

The cryptocurrency sector is already showing some signs of a reversal. Bitcoin (BTC) briefly reclaimed the $90,000 price level earlier today, Dec. 29, 2025. According to reports, the crypto market saw $80 billion in inflows within a period of seven hours today. The development could be a signal for a trend reversal. XRP’s price could benefit from the development.

However, the rebound could be a dead cat bounce, and XRP could face another correction over the coming days.