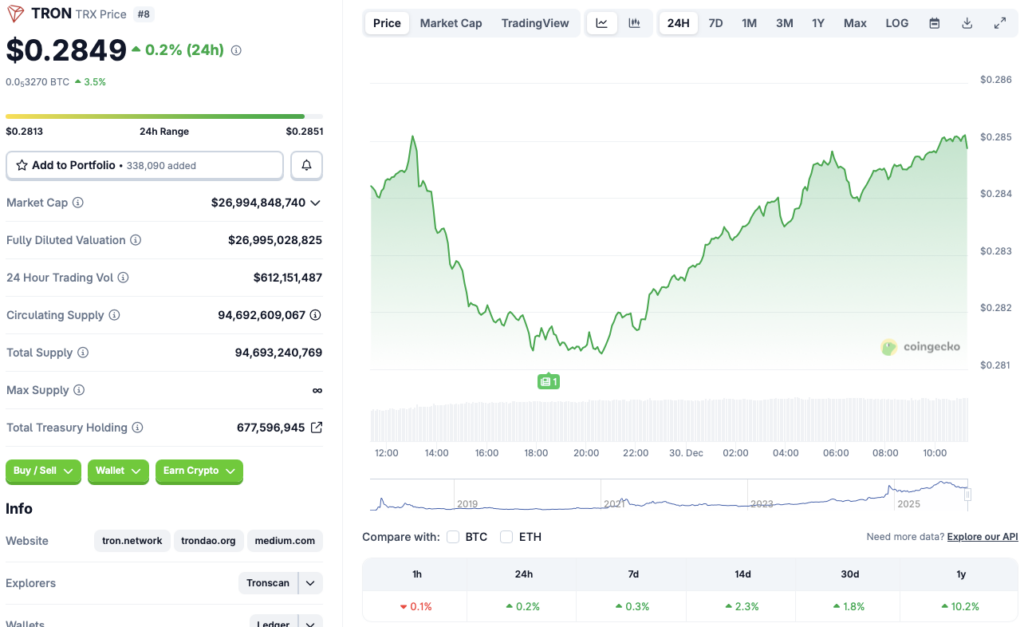

TRON Defies Market Trend: Turns Green Amid Crypto Crash

While red floods the crypto charts, one blockchain stands defiantly green.

The Lone Survivor

TRON's network isn't just holding its ground—it's gaining it. As major assets tumble, TRON's price action carves an independent path upward, a stark anomaly on a sea of red. This isn't mere stability; it's active defiance.

Decoding the Resilience

The surge points to factors beyond simple market sentiment. Look at network activity—consistent high throughput and stable gas fees suggest utility-driven demand, not speculative frenzy. Developer activity and dApp engagement metrics often tell a truer story than price charts ever could. In a sector obsessed with narratives, actual usage is the ultimate rebuttal.

What the Green Candle Signals

This divergence is a stress test for TRON's underlying value proposition. When liquidity gets pulled, assets tethered to real-world use cases and robust ecosystems tend to wobble less. It’s a classic flight to quality, or at least, a flight to perceived utility—proving once again that in crypto, the 'fundamentals' are whatever the market decides to price in that day.

One blockchain's gain amidst widespread pain offers a provocative lesson: in a crash, the narrative of decentralization gets tested, and sometimes, it's the chains with the strongest community and clearest use case that cut through the noise. Just don't tell the traditional finance guys—they're still trying to figure out if blockchain is a stock or a bond.

Source: CoinGecko

Source: CoinGecko

What’s Pushing TRON’s Price Rally? Will It Continue?

TRON’s latest price surge is likely due to founder Justin Sun’s recent investment of $18 million in the Nasdaq-listed Tron Inc. The investment was made via Black Anthem Limited to buy Tron Inc. shares at $1.38 per share. The investment money will be used to buy more TRX tokens for Tron Inc.’s treasury. The MOVE may have caused a surge in TRX’s price.

Despite the bullish turnaround, there is a high chance that TRON (TRX) will face a price correction over the coming days. Investors may book profits and move their funds to safe havens such as gold and silver. Given the condition of the larger crypto market, it is unlikely that TRX will sustain its current rally. Moreover, investors are keeping away from risky assets such as cryptocurrencies. Macroeconomic conditions may further pull money away from TRX.

Despite the larger market bearishness, CoinCodex analysts are quite optimistic about tron (TRX). The platform anticipates the asset to continue its upward trajectory, hitting $0.31 on Mar. 2. Hitting $0.31 from current price levels will entail a rally of about 10.7%.

The crypto market is currently in a cloud. It is unclear which direction the market may go. Bitcoin (BTC) seems to be consolidating around the $87,000 level, and other assets might follow its path. TRON (TRX) could pivot to either direction over the coming days.