Bitcoin’s 17th Birthday in 3 Days: Will History Spark a Bullish Rally?

Bitcoin's genesis block turns 17 in three days—and the crypto market holds its breath. Anniversaries have a funny way of moving digital asset prices, and this milestone is no exception. Past performance, of course, is not indicative of future results—a disclaimer Wall Street loves to ignore when it's convenient.

The Historical Echo

Seventeen years ago, Satoshi Nakamoto mined the first block and embedded a now-iconic headline about bank bailouts. Since then, Bitcoin has survived crashes, regulatory crackdowns, and endless obituaries. Each birthday has been a checkpoint, a moment for the community to reflect—and for traders to speculate.

Market Mechanics at Play

Narrative drives crypto. A major anniversary creates a powerful story, one that algorithms and retail investors can latch onto. It fuels social media chatter, spikes search volume, and often translates into short-term buying pressure. Whether it's genuine celebration or opportunistic trading hardly matters—the effect can be the same.

The Cynical Take

Let's be real: if traditional finance celebrated a stock's 'birthday' as a catalyst, analysts would scoff. But in crypto, where sentiment is king, these psychological markers carry weight. It's a market that runs on stories as much as code, where a round number can be as compelling as a fundamentals report.

What to Watch

The coming days will test whether sentiment alone can override macro pressures. Watch trading volume, social dominance metrics, and any whale wallet movements. A 'birthday rally' isn't guaranteed—but in a market built on belief, never underestimate the power of a good story.

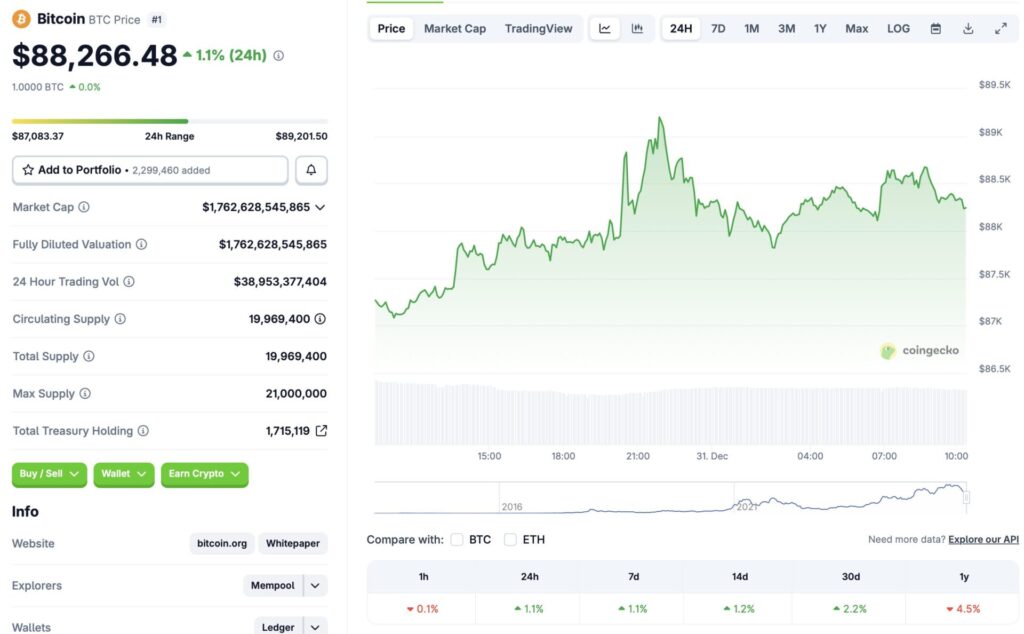

Source: CoinGecko

Source: CoinGecko

Will Bitcoin See A Birthday Rally?

2025 had a particularly bullish start to the year. President Trump assuming power led to a substantial rise in investor confidence in the crypto sector. Bitcoin (BTC) went on to hit an all-time high of $126,080 on Oct. 6. However, BTC climbing to a new all-time high was followed by a massive market correction. In fact the crypto market experienced its most significant liquidation event in history. BTC’s price continues to struggle after its October correction.

According to CoinGecko’s BTC data, bitcoin is showing signs of a trend reversal. BTC’s price has rallied 1.1% in the last 24 hours, 1.1% in the last week, 1.2% in the 14-day charts, and 2.2% over the previous month. BTC entering the green zone may be a sign that the asset is preparing for an upward push.

Bitcoin’s (BTC) latest upswing could be due to the new years approaching and its upcoming birthday. BTC made a similar MOVE on Dec. 29, briefly reclaiming the $90,000 price level. BTC is struggling to hold the $90,000 mark, and may make another attempt to breach it over the next few days. We could see a continued upward momentum due to BTC turning 17 years old.

However, the market is still quite fragile and macroeconomic uncertainties continue to present challenges. How the market behaves is yet to be seen.