XRP Holders Get Brutal Reality Check - Shockwaves Rip Through Trader Community

A cold splash of water just hit the XRP market. Forget the hype—this is a straight-up recalibration of expectations, and traders are scrambling.

The Illusion vs. The Ledger

For years, a narrative fueled portfolios. The promise of institutional adoption, regulatory clarity, and parabolic price moves built a fortress of conviction. Then reality audited the books. The gap between community prophecy and on-chain activity isn't just a gap—it's a canyon. Trading volumes tell one story; the locked-in belief of holders tells another, far more stubborn one.

Market Mechanics Don't Care About Your Hopium

Liquidity shifts. Macro winds change. While holders diamond-hand their bags based on yesterday's news cycle, algorithmic traders feast on volatility and sentiment mismatches. It's a classic tale: the emotional capital of retail meets the cold, hard logic of market structure. One side views price as a scoreboard for their ideological victory; the other sees a series of entry and exit points. Guess which side typically pays for the other's lunch? (Hint: it's the one waiting for a 'sure thing' in an asset class that laughs at the concept.)

The Ripple Effect Is Real

This isn't contained to XRP die-hards. The shockwave tests the resilience of similar 'community-driven' assets. When one pillar of narrative-based valuation shows cracks, everyone starts nervously eyeing their own foundations. It forces a sector-wide question: are you investing in technology and utility, or just a particularly persuasive story?

The wake-up call is ringing. Whether it leads to a sober reassessment or just louder shouting remains the only real mystery left. After all, in crypto, the most reliable pattern is the market's ability to separate the faithful from their funds with a compelling story and a sharp correction.

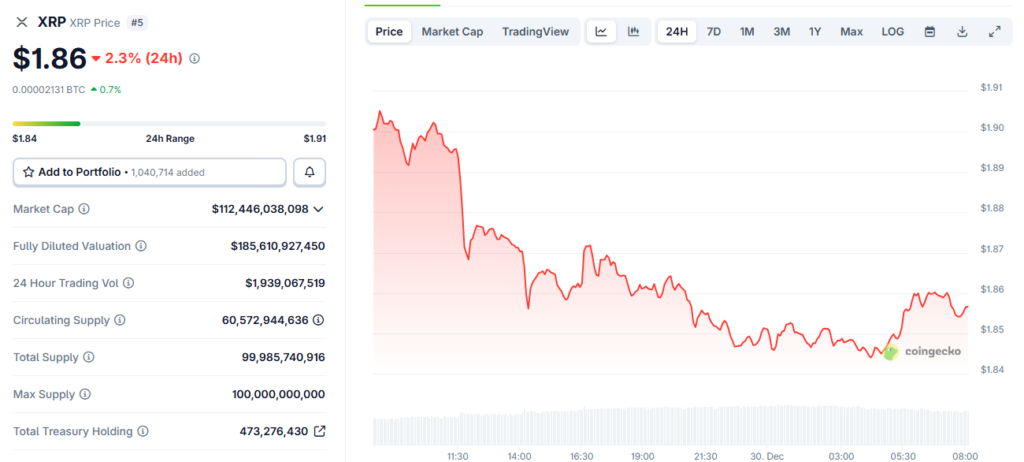

Source: CoinGecko

Source: CoinGecko

XRP Price Volatility And Crypto Market Risks Signal Trading Uncertainty

Poll Shows Reality Check For XRP Holders

Most people regard the unveiled Gemini poll numbers from Anderson as a turning point in terms of sentiment by XRP holders. The reality check arrived when about 70% of respondents reported they expect XRP won’t break the $2 mark by the time we enter further into the new year, and this indicates the market has increased its acceptance that an impressive breakout won’t materialize anytime soon. Investors who had been looking forward to an impressive late rally received this information as a wake-up call, and it shows that hopes have scaled back significantly over the past few weeks, as trading uncertainty around XRP has since taken control within the market.

Anderson indicated outside of XRP itself that turbulence in decentralized finance has been another element that has been informing sentiment in the recent past. Governance strains involving AAVE followed concerns over the role of founders in buying tokens in a crucial vote over the ownership of key brand assets, and these incidences highlight persistent fears over disconnect between development teams and token shareholders.

XRP Prediction 2026 Hinges On Liquidity

Anderson suggested that without new inflows or decisive positive news, conservative expectations are likely to shape trading behavior as we MOVE through the new year. Thin liquidity, he acknowledged, cuts both ways—while it can suppress momentum and contribute to price volatility for XRP, it also leaves room for sharper moves should buying pressure return unexpectedly. For the XRP holders reality check purposes, the poll serves as a signal that many participants are preparing themselves for stability rather than expansion in the immediate term.

The assessment from Anderson centers more on preparation rather than prediction, and it portrays a market that’s entering 2026 with caution as price volatility concerns, crypto market risks, and general trading uncertainty converge. The XRP prediction for 2026 outlook now appears to depend on factors that include sentiment shifts, liquidity conditions, and governance developments across the broader crypto market, and the XRP holders reality check data suggests restrained expectations will persist through at least the early part of this year.

Market Prepares For Cautious Start To 2026

What’s been interesting about this XRP holders reality check is how it contrasts with earlier optimism that was prevalent just weeks ago. The crypto market risks that Anderson highlighted—ranging from DeFi governance issues to stablecoin de-pegging events—have created an environment where XRP trading uncertainty seems to be the dominant theme. As XRP price volatility continues and liquidity remains thin during this period, the reality check for XRP holders might be exactly what the market needed to reset expectations heading into 2026.