BNB vs Ethereum 2026: Which Crypto Will Deliver Maximum Returns?

Two titans clash—but only one can lead your portfolio to new heights.

Forget the tribal warfare. This isn't about which blockchain is 'better' in some abstract, philosophical sense. It's a cold, hard calculation of which digital asset will put more profit in your pocket by the end of 2026. The smart money is looking past the hype and sizing up the fundamentals.

The BNB Ecosystem Engine

BNB isn't just a token; it's the lifeblood of the world's largest crypto exchange. Every trade, every transaction fee, every new project launching on the BNB Chain burns a little more supply. It's a self-reinforcing economic flywheel that's proven brutally effective. While some chains chase decentralized purity, BNB chases utility—and utility drives demand. Its performance is tethered to the relentless growth of the Binance empire, a bet that's paid off handsomely for those who ignored the purists.

Ethereum's Scaling Crucible

Ethereum, the incumbent, faces its moment of truth. The merge was a historic feat of engineering, but the real test is adoption. Can Layer 2 scaling solutions finally deliver the cheap, fast transactions promised for years, or will congestion and fees push the next wave of users elsewhere? Its vast developer mindshare and established DeFi ecosystem are monumental advantages, but they come with the baggage of legacy—and legacy systems move slower. The network effect is powerful, but not invincible.

The Profitability Verdict

So, where does the alpha lie? BNB offers a streamlined bet on centralized efficiency and razor-focused product growth—a corporate rocket ship. Ethereum represents a bet on a sprawling, decentralized digital nation-state finding its second wind. One provides a clearer, more direct path to value accrual; the other offers unparalleled upside if its scaling vision fully materializes. Choose the ecosystem you believe will attract the most real economic activity, not the one with the most eloquent Twitter threads. After all, in this game, the only 'decentralization' that truly matters is the decentralization of wealth into your wallet.

Binance Coin vs. Ethereum: New Projections

BNB has lately been trading at $898, down significantly from its earlier high of $1100. The token, however, continues to leverage market momentum to stay ahead on the radar. Per a notable expert, crypto Patel, BNB could easily breach $10,000, with its chart pointing to an early surge by 2027.

$BNB Price Prediction by CryptoPatel: Could Reach $10,000 ?![]()

2021 Bull Run: +2100%![]()

2027 Projection: +1,000%-2000%![]()

Same Chart. Same Insane Green Candles Incoming.

Strong LT Supports: $500 / $200 ( Accumulation Zone)

Targets: $2K → $5K → $10K

$10,000 BNB is programmed.… pic.twitter.com/0kGAYntFHk

At the same time, ethereum is also projected to hit new highs, given the fact that the asset is sitting right in the center of tokenization narratives.

THE TRILLION DOLLAR SHIFT

Citi: asset tokenization could reach $5T by 2030.

Stocks. Funds. Real world assets.

All moving on chain, primarily on Ethereum.

This interview explains how it’s happening.

The opportunity isn’t priced in.

The infrastructure already is.$ETH pic.twitter.com/HyRvCqjWUa

The Ultimate Winner

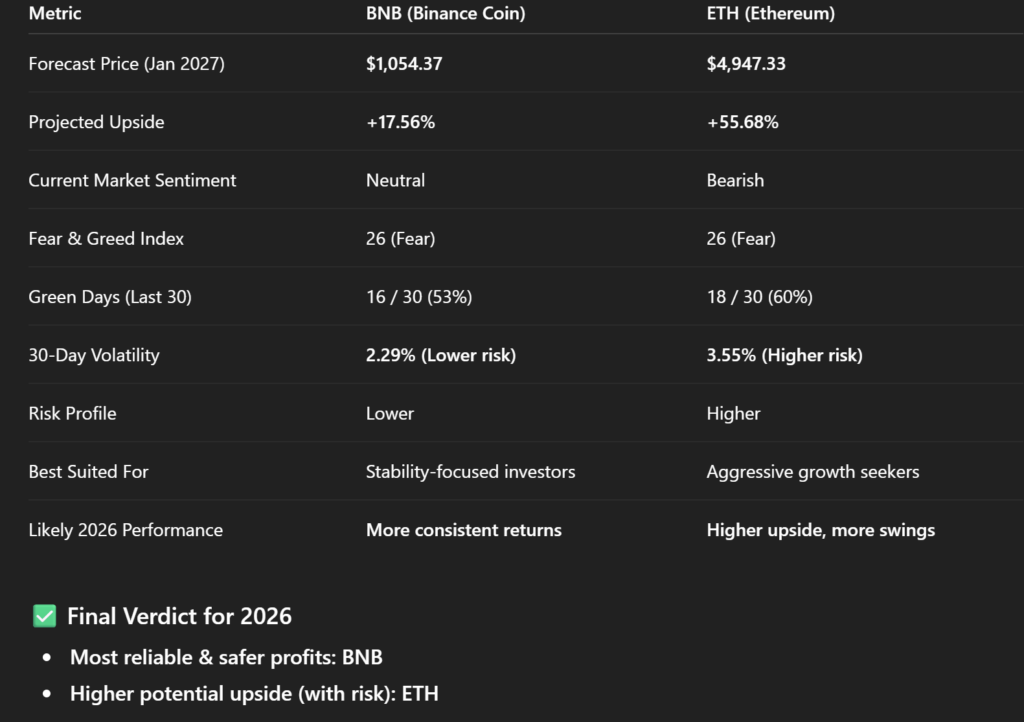

According to CoinCodex BNB Stats, Binance Coin may surge to sit at $1054 by 2027.

CC later adds how ETH, on the other hand, may surge around $4,947.33 by 2027.

ChatGPT, however, crowns BNB as the ultimate winner of 2026, stating how BNB is the more stable and consistent asset to explore this year.