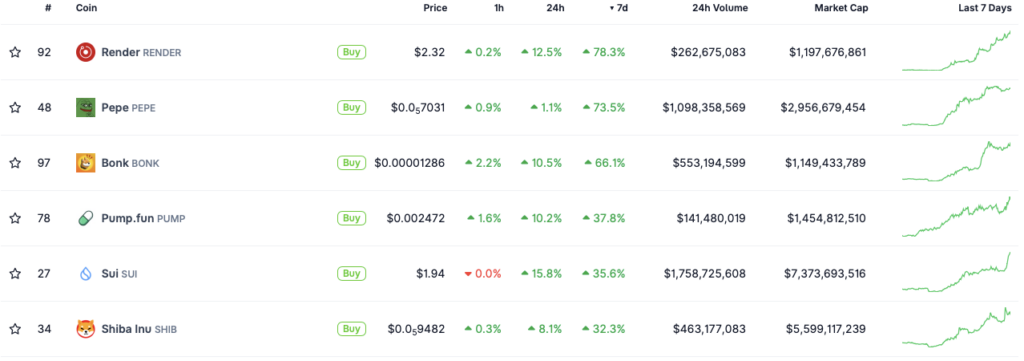

Memecoins Dominate Crypto Market: Are We In a Meme Season?

Memecoins aren't just back—they're running the show. While institutional players debate ETF flows and regulatory frameworks, a pack of joke-inspired tokens has quietly seized the narrative, liquidity, and social media feeds. Forget "fundamentals" for a second; the charts are screaming one thing: the crowd wants entertainment.

The Anatomy of a Meme Run

It starts with a viral post, a celebrity nod, or pure, unadulterated boredom. Liquidity floods into a handful of tokens with canine, feline, or absurdist themes. Trading volumes spike, overshadowing blue-chip altcoins. Social sentiment becomes a self-fulfilling prophecy, pushing prices to levels that would make any traditional analyst scoff. It's momentum trading stripped bare—no white papers required.

Beyond the Hype Cycle

This isn't 2021. The players are savvier, the tools sharper. Decentralized exchanges and automated market makers let anyone spin up a pool in minutes. Community-driven pumps are more coordinated, often leveraging influencer networks that bypass traditional marketing entirely. The memes are the marketing. And love it or hate it, it's pulling genuine capital away from more "serious" projects.

A Cynical Take for the Finance Bros

While hedge funds pay millions for quant models and market analysis, the most profitable trade of the quarter might just be a token named after a cartoon dog. It's a brutal reminder that in crypto, narrative often trumps net present value—at least for a while. The real genius? Convincing people that buying a meme is a revolutionary act against the financial system, all while the creators cash out into... you guessed it, traditional fiat.

So, are we in a meme season? The market cap doesn't lie. This is the season. Whether it ends with a bang or a whimper depends on how long the crowd stays amused—and how quickly the so-called smart money finally admits it's just chasing the same trend.

Source: CoinGecko

Source: CoinGecko

Is The Crypto Market Entering A Memecoin Season?

The memecoin rally comes amid a larger cryptocurrency market rally. Bitcoin (BTC) has climbed to the $93,000 price level after months of struggle, and is inching closer to reclaiming $94,000. The global crypto market cap has also risen 2.1% in the last 24 hours to $3.3 trillion.

There have been several bullish developments that may have propelled the cryptocurrency market. The Bank of America recently allowed its advisors to recommend crypto assets for their clients. Meanwhile, the Japanese Finance Minister Satsuki Katayama showered support for cryptocurrency assets to be integrated into traditional markets. Moreover, investors may be anticipating more economic stability after the US seized Venezuelan oil reserves after a military strike.

Despite the bullish developments, the surge of altcoins and memecoins could be a signal that the cryptocurrency market has bottomed. The market could move in either direction from here. The crypto sector is still recovering from its losses over the last few months. The memecoin surge could see a correction as investors book profits. Market participants are still keeping away from risky assets, and memecoins could see liquidations over the coming weeks.

However, if Bitcoin (BTC) maintains its upward momentum, the market-wide rally could continue. Cryptocurrencies are plagued by violent swings, and prices could pivot at any moment. Macroeconomic uncertainties may also introduce fresh volatility in the coming days.