Dogecoin ETF Skyrockets to Top Spot Amid 23% Surge: Bloomberg Analyst Breaks Down the Meme Coin Phenomenon

Forget the boring blue-chips—the hottest ticket on the trading floor right now is a joke that got serious. A Dogecoin exchange-traded fund has just bulldozed its way to the top of the performance charts, riding a blistering 23% rally that's left traditional assets eating its dust.

The Meme Goes Mainstream

Bloomberg analysts are scrambling to update their models as the Shiba Inu-themed cryptocurrency proves it's got more bite than bark. This isn't just retail frenzy anymore; institutional money is now chasing the same digital asset that started as a literal internet meme. The ETF structure gives wary fund managers a 'respectable' wrapper to hold the asset—like putting a tuxedo on a party animal.

Numbers Don't Lie (Even When the Asset Is Funny)

That 23% surge isn't a rounding error—it's a statement. It represents a massive capital rotation into what was once considered the casino section of the crypto market. The rally catapulted the Dogecoin ETF past every other contender, proving that in today's market, momentum often trumps fundamentals. After all, on Wall Street, the only sin is missing out on gains, no matter how absurd the source.

A Cynical Take on Serious Gains

Let's be real: the same finance pros who once dismissed Dogecoin as a 'joke' are now quietly allocating client funds to it through this shiny new ETF vehicle. Nothing sobers up skepticism like a double-digit percentage point return. It's the ultimate finance irony—using the industry's most structured product to bet on the market's least serious asset. The rally shows that when money talks, it doesn't care about pedigree.

The takeaway? Market narratives can shift faster than a Twitter trend. Today's fringe meme is tomorrow's top-performing ETF, leaving traditional analysts to explain to clients why they're underweight a digital currency featuring a dog. Sometimes, the market doesn't reward the smartest thesis—just the one that moves first.

Will Dogecoin ETF Inflows Push The Memecoin To $0.20?

ETFs played a vital role in the 2025 crypto market cycle. Bitcoin (BTC) and Ethereum (ETH) hit new all-time highs thanks to high ETF volume. 2025 also saw the launch of several crypto-based ETF products. XRP, Solana (SOL), Dogecoin (DOGE), etc., all saw ETF debuts last year. We could see positive price actions of all assets due to high ETF inflows. If the memecoin continues on its current trajectory, it could reclaim the $0.20 mark.

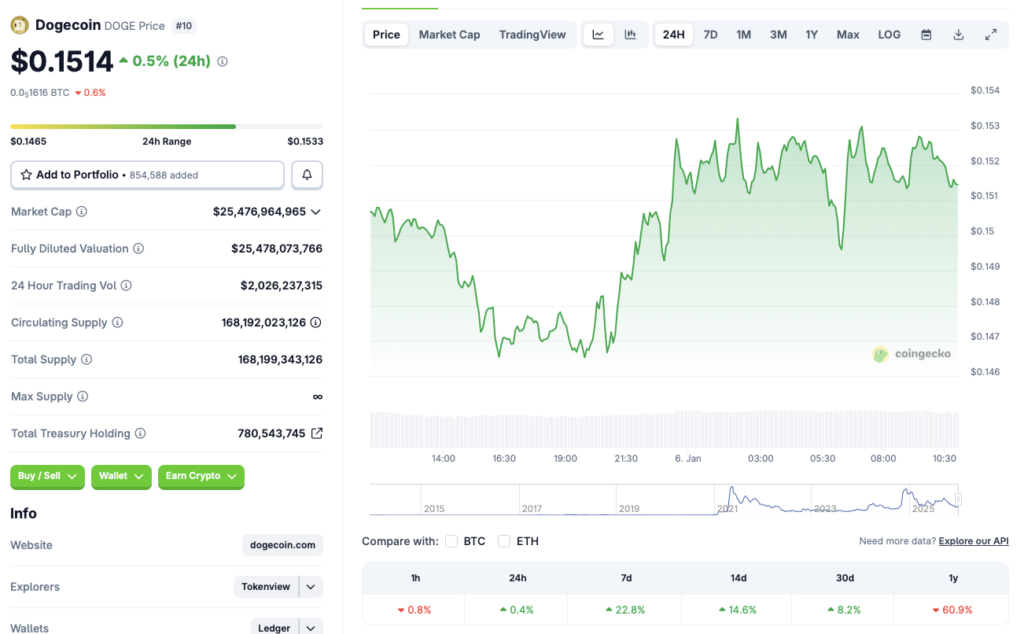

The crypto market seems to be recovering from its late-2025 losses. Dogecoin (DOGE) is also following the current market rebound. According to CoinGecko data, DOGE’s price has rallied 0.4% in the last 24 hours, 22.8% in the last week, 14.6% in the 14-day charts, and 8.2% over the previous month. Despite the recent turnaround, DOGE’s price is still down by a massive 60.9% since January 2025.

Dogecoin’s (DOGE) latest price upswing could be due to the ETF performance. The rally also comes amid other memecoins making big gains. Pepe (PEPE), Bonk (BONK), and shiba inu (SHIB) have registered some of the highest gains in the weekly charts today. DOGE’s rally could be a part of the larger memecoin resurgence.

According to CoinCodex analysts, Dogecoin (DOGE) will rally over the coming weeks, but will not hit the $0.20 mark. The platform anticipates the memecoin to hit $0.1923 on Jan. 29, 2026.