BlackRock’s $100 Million Ethereum Bet Sends Price Soaring 10%

BlackRock just dropped a nine-figure bomb on Ethereum—and the market's reacting like it's 2021 all over again.

The Institutional Stamp of Approval

Forget the cautious whispers from traditional finance suits. When the world's largest asset manager makes a move, it's not a dip of the toe—it's a cannonball. This isn't just another fund allocation; it's a statement. A hundred million dollars says Ethereum's infrastructure is ready for prime time, that its smart contract ecosystem isn't just for degens, and that institutional capital is done waiting on the sidelines. Wall Street's slow, lumbering embrace of crypto just got a lot faster.

Why This Move Cuts Through the Noise

This purchase bypasses the usual speculative frenzy. It's cold, hard capital from a firm that manages more money than most countries' GDP. It validates the asset class for every pension fund and endowment still sitting on the fence. The immediate 10% price jump? That's just the market pricing in the floodgates opening. The real story is the signal it sends to every other institutional player still 'evaluating the regulatory landscape'—code for being late to the party.

The Ripple Effect Beyond the Charts

This isn't just about Ethereum's price. It's about the entire digital asset stack. Layer-2 networks, DeFi protocols, the staking economy—they all just got a credibility boost funded by BlackRock's balance sheet. It forces regulators to contend with the fact that the 'grown-ups' are now playing in the sandbox. Expect copycat moves from other asset managers who'd rather explain a 10% loss than explain to their board why they missed the boat entirely.

So, while the usual finance pundits will scramble to downplay it as a 'tiny allocation' relative to BlackRock's total AUM, the crypto world knows the truth: the dam has a crack. And once institutional FOMO meets a trillion-dollar balance sheet, you don't get a trickle—you get a tidal wave. Sometimes, the most bullish signal isn't a retail trader yelling 'to the moon,' but a fund manager quietly moving a decimal point.

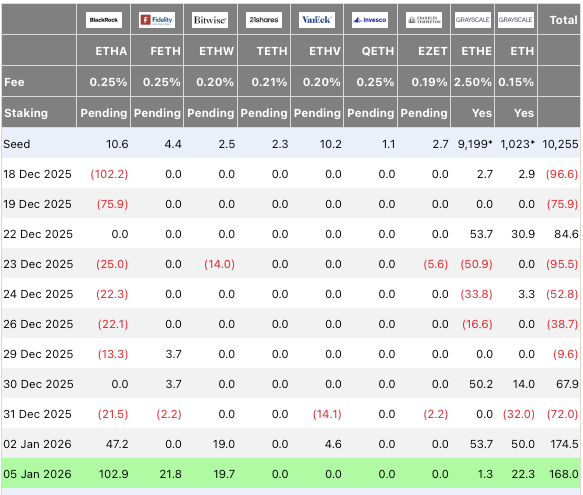

Source: Farside Investors

Source: Farside Investors

Ethereum Rallies Amid BlackRock’s Big Purchase

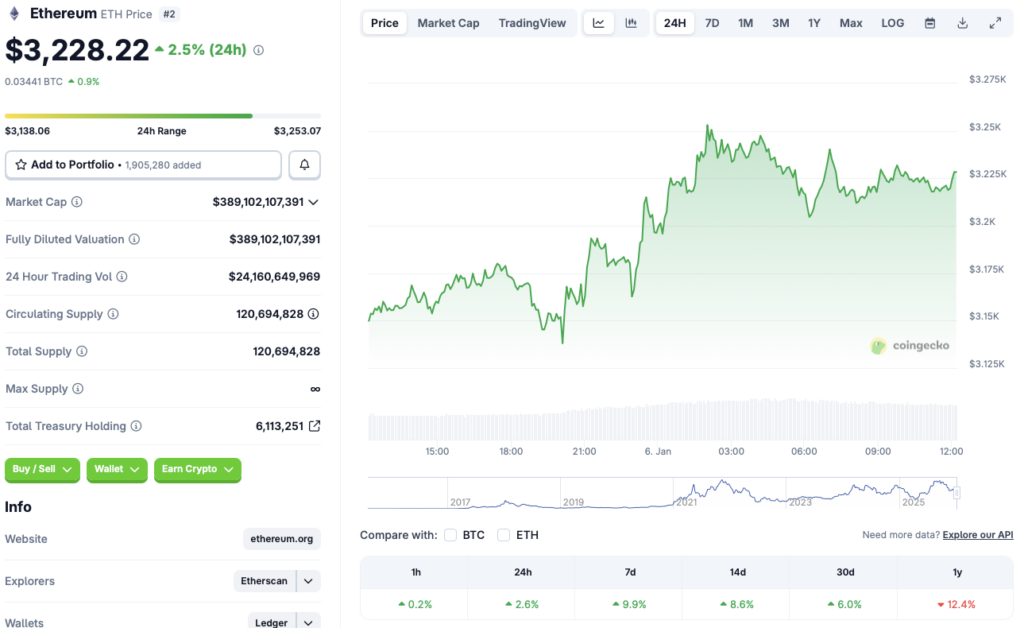

BlackRock’s big ETH purchase coincides with the asset registering big gains across nearly all time frames. According to CoinGecko data, Ethereum’s (ETH) price has rallied 2.6% in the last 24 hours, nearly 10% in the last week, 8.6% in the 14-day charts, and 6% over the previous month. However, despite the rebound, ETH’s price is still down by 12.4% since January 2025.

Ethereum’s (ETH) latest price rally could be due to increased ETF inflows, along with other bullish developments. The larger crypto market is also seeing significant price rallies, with Bitcoin (BTC) reclaiming the $93,000 price level. Ethereum’s (ETH) rally could be due to increased investor sentiment as we enter 2026. The rally have also stemmed from the Bank of America recently allowing advisors to recommend crypto assets to their clients.

Ethereum (ETH) may continue to rally over the coming weeks if market sentiment remains bullish. Many experts, such as Grayscale and Bernstein, anticipate Bitcoin (BTC) to climb to a new all-time high in 2026. BTC hitting a new peak could lead to Ethereum (ETH) seeing substantial growth.

However, macroeconomic conditions are still quite fragile. Fresh volatility could present new challenges to the crypto market. Ethereum’s (ETH) price could face a correction if market participants continue feeling the pressure. The risk-averse trend is still quite strong, pushing gold and silver to new heights over the last few months. The crypto market could suffer if the trend does not change.