XRP’s Wild Ride: 20% Rally Crashes 5% - What’s Next for the Rollercoaster Token?

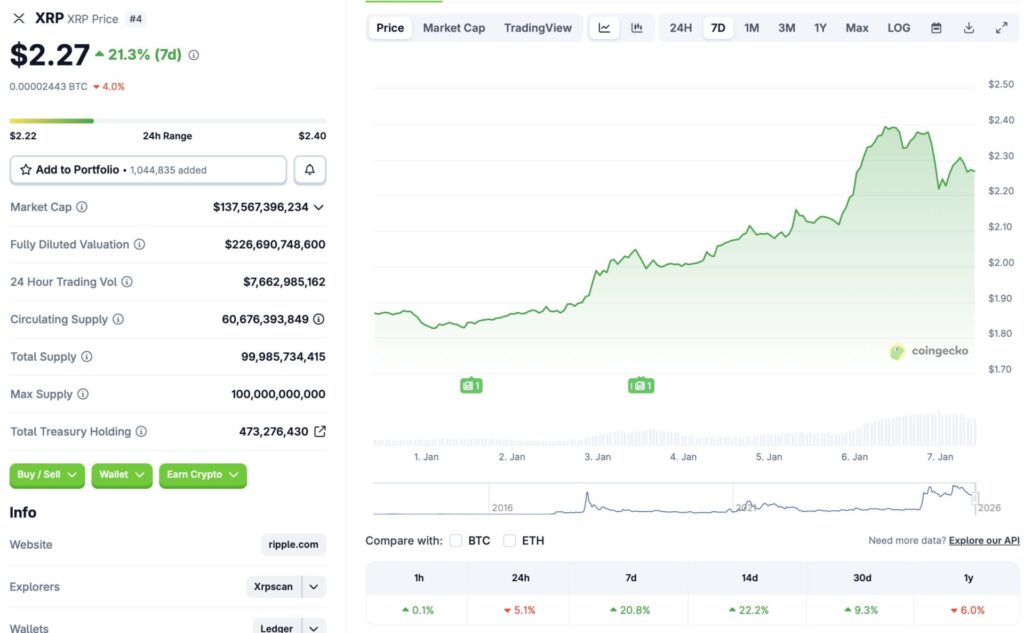

XRP just gave traders whiplash—a blistering 20% surge followed by a gut-punch 5% correction. Welcome to crypto's emotional pendulum.

The Rally That Fizzled

Markets cheered the double-digit climb—momentum built, charts turned green, and optimism briefly drowned out the usual skepticism. Then gravity kicked in. The 5% pullback wasn't a gentle dip; it was a reminder that in crypto, what goes up often comes down faster.

Reading the Tea Leaves

Is this a healthy consolidation or the start of something uglier? Technicals are flashing mixed signals. Support levels held—barely—but the volume tells a story of profit-taking and shaken nerves. Every trader's now asking the same question: buy the dip or brace for more pain?

The Bigger Picture

Forget the hourly charts. XRP's real battle isn't against resistance lines—it's against a market that treats even double-digit gains as mere preludes to the next 'correction.' It's the financial equivalent of building on sand, but hey—the view from the rollercoaster's peak is fantastic until you plummet.

So what's next? Either this is a classic shakeout before the next leg up, or another lesson in crypto's favorite pastime: turning rallies into regret. Place your bets—just don't act surprised when the house takes its cut.

Source: CoinGecko

Source: CoinGecko

Will XRP’s Price Continue TO Rally?

XRP had one of its best years in 2025. The SEC vs. Ripple lawsuit finally came to an end last year, pushing XRP to a new all-time high of $3.65. We also saw the launch of several spot ETFs towards the end of 2025. However, the year ended with a bearish market tone, with XRP struggling to go beyond the $1.90 mark. 2026 seems to have brought momentum for the crypto market.

XRP’s latest price rally came amid a larger crypto market resurgence. Bitcoin (BTC) climbed to the $93,000 mark yesterday, but has since dipped to the $92,000 level. However, XRP’s rally is likely due to increased ETF inflows. ETFs played a major role in the 2025 market cycle. Both Bitcoin (BTC) and Ethereum (ETH) climbed to new heights thanks to increased ETF inflows. A similar pattern could emerge in 2026 as well.

Despite the steep price spike on Jan. 6, XRP’s rally is showing signs of slowing down. The sharp correction could mean that investors are booking profits. This could be a signal that investors are still not fully confident in the crypto market. Macroeconomic worries have moved market participants to safe havens such as gold and silver.