Chainlink ETF Approved by SEC: The Game-Changer You Can’t Afford to Miss

Wall Street just opened the floodgates to the oracle economy. The SEC's green light for a Chainlink ETF marks the first time a decentralized oracle network gets its own mainstream financial vehicle—forget waiting for institutions to figure out smart contracts, they're buying the data pipes instead.

The Nuts and Bolts

This isn't just another crypto fund. It's a pure-play bet on the infrastructure that feeds DeFi, insurance, and supply chains. The ETF tracks a basket of assets tied to Chainlink's oracle services, letting investors gain exposure to the network's usage fees and token economics without touching a digital wallet. Analysts call it a 'meta-bet' on blockchain utility over speculation.

Why It Cuts Through the Noise

Traditional finance has spent years tripping over blockchain's complexity. This move bypasses the tech learning curve entirely. Fund managers who couldn't explain a smart contract to save their lives can now allocate millions to the data that powers them. It's a classic Wall Street maneuver: commoditize the innovation, package it, and sell it with a tidy expense ratio.

The Ripple Effect

Expect a surge in institutional validation for other 'utility' tokens. If Chainlink's data feeds are ETF-worthy, what about the lending protocols or prediction markets they enable? The approval sets a precedent that could unlock a wave of niche crypto infrastructure funds. Suddenly, the narrative shifts from 'digital gold' to 'digital infrastructure.'

A Cynical Footnote

Let's be real—the same suits who once called crypto a scam are now selling it in a wrapper with a 0.95% management fee. The irony is thicker than a legacy bank's quarterly report. They've finally found a crypto product they love: one that generates steady, predictable fees for them.

The bottom line? The Chainlink ETF isn't just an investment product. It's a Trojan horse. It pulls decentralized infrastructure into the trillion-dollar traditional market, proving that in finance, the real revolution often gets sold by the very establishment it's supposed to disrupt.

The U.S. SEC has approved Bitwise’s spot Chainlink ETF for listing on NYSE, marking Chainlink’s first direct entry into U.S. equity markets.

The ETF is expected to launch this week, offering a 0% management fee for the first 3 months pic.twitter.com/cMU9rJYBc2 — Coin Bureau (@coinbureau) January 7, 2026

Will Chainlink Hit $50 After The ETF Launch?

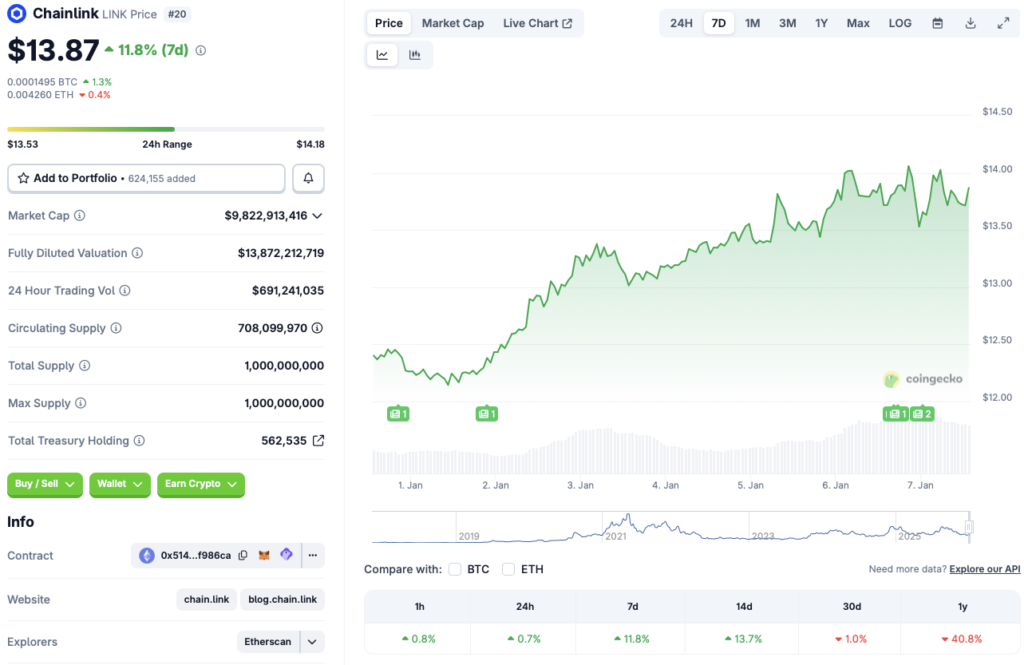

Chainlink (LINK) has seen quite a rebound over the last few days. According to CoinGecko data, LINK’s price has risen 0.7% in the last 24 hours, 11.8% in the last week, and 13.7% in the 14-day charts. However, LINK continues to struggle from last years market crash, dipping 1% over the last month and 40.8% since January 2026.

Bitwise’s Chainlink (LINK) ETF launch could change the game for the asset. ETFs played a vital role in the 2025 market cycle. Both Bitcoin (BTC) and ethereum (ETH) hit new all-time highs thanks to increased ETF inflows. Moreover, major financial institutions have once again amped up their buying for their crypto-based ETF products. LINK could follow a similar trajectory.

However, one should note that Bitcoin (BTC) was the only cryptocurrency that hit a new all-time high soon after its ETF launch in 2024. Ethereum (ETH) did not see much positive price action until a year after its ETF launches. Solana (SOL), XRP, etc., have also not hit new peaks after their ETF debuts. It is unclear if Chainlink (LINK) will reclaim its all-time high price level of $52.70 after its ETF debuts in the market. LINK is currently down by more than 73% from its peak.

Furthermore, market participants are currently following a risk-averse strategy. Chainlink’s (LINK) price may not see much action until the larger economy shows signs of improvements.