Bank of America Sets Bold Amazon Stock Price Target for 2026 (AMZN)

Wall Street's crystal ball gets another polish.

Bank of America just slapped a fresh price target on Amazon, and it's a number that demands attention. Forget the timid whispers of incremental growth—this is a full-throated bet on the e-commerce and cloud juggernaut's next act.

The Analyst's Gambit

What's driving the optimism? It's the classic one-two punch: relentless retail dominance meets untapped cloud potential. While Main Street sees boxes on doorsteps, the Street sees a data center empire quietly printing money. The math, according to BofA, suggests the market still isn't pricing in the sheer scale of what's coming.

Beyond the Hype Cycle

This isn't about fleeting trends. The target hinges on execution—Amazon's notorious ability to squeeze efficiency from logistics and monetize its web services moat. Every percentage point of margin expansion in AWS is a direct rocket booster for the stock. It's a play on operational muscle, not magic.

Another quarter, another price target adjustment—because what's finance without a little forward-looking revisionism? The real story isn't the number itself, but the relentless pressure to keep growing that justifies it. In a market hungry for narratives, Amazon's is one of the few that's still being written.

Source: Google

Source: Google

Amazon Stock: Bank of America Gives Bullish Price Target

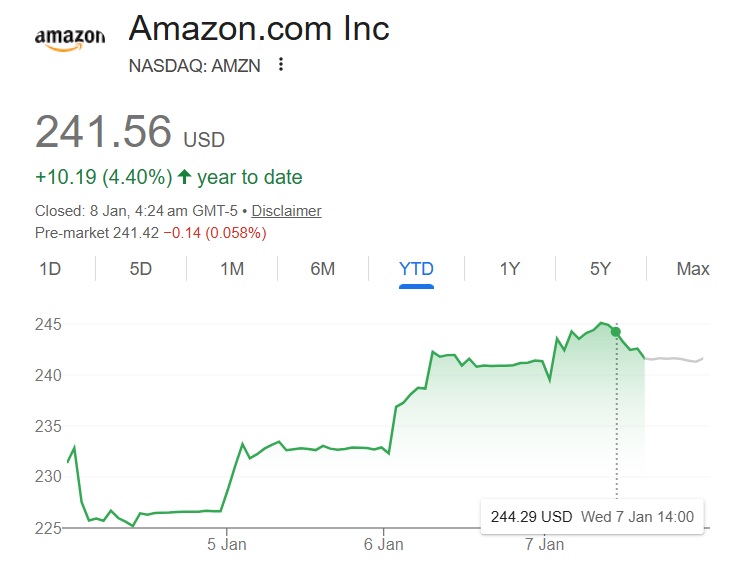

Bank of America Securities analyst Justin Post has given a buy rating for Amazon stock. He set a price target of $303 for AMZN, citing the company’s solid position in cloud computing and AI. He wrote that the giant is expanding AI services in most of the sectors that it operates, including workloads on Amazon Web Services (AWS).

If Bank of America’s price target of $303 turns accurate, an investment of $1,000 could turn into $1,260. That WOULD be an uptick and return on investment (ROI) of approximately 26%. That’s decent returns despite the market bracing for trade wars, tariffs, and the Venezuelan crisis.

The first target for AMZN was $240, and the equity breached it on Wednesday, closing at $241. It went nearly 0.30% higher, even after Dow Jones slumped by 466 points and the S&P 500 index slumped nearly 25 points. AMZN held on strong in the charts and barely dipped into the red this year. Therefore, Amazon stock is a must-watch equity this year, according to Bank of America.